Next Generation Traveler Information System: A Five Year OutlookCHAPTER 3. TECHNOLOGY ROADMAP (2014-2020)The Technology Roadmap provides a snapshot of today's technology landscape, and projects likely evolution based on emerging technologies, as well as the lifecycles and adoption of existing and new solutions. Questions considered include:

This chapter includes:

3.1 OFFERINGS AND OFFERING TRENDS3.1.1 Today's OfferingsThe list of ways for travelers to get traveler information continues to grow, as dozens of permutations of new solutions, such as apps and social media, are added. Currently available platforms include:

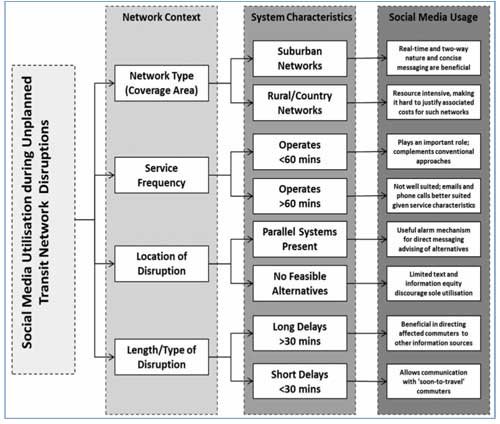

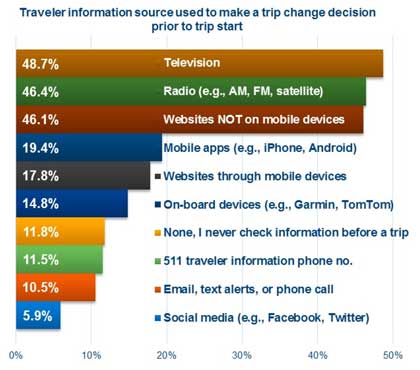

While growth in newer solutions has been explosive, studies show that the more traditional means of accessing information still receive substantial use. In particular, some studies show TV, radio, and non-mobile websites are still being used the majority of the time for pre-trip review (Robinson, Jacobs, Frankle, Serulle, & Pack, 2012). En route, the leading source of information remains radio, with DMS coming in second. Newer solutions such as mobile sites and apps are now running third for pre-trip and en route use according to several recent studies. It is reasonable to expect that growth of these tools will continue. However, it remains critical to carefully track both actual usage and the impact of that usage on behavior in order to determine the correct timing for phasing in traveler information solutions appropriate to both key user communities and overall transportation goals. Each type of social media has its pros and cons for different operational situations. For example, when communicating transit information to users, social media may be much more helpful for services which operate every hour (or less) than those which have lower service frequencies. One detailed example of considering the potential impact on user behavior is shown in Figure 12 below (Pender, 2014). In this example, transportation system characteristics (network context, system characteristics) are mapped to social media application.  Figure 12. Chart. Impact of Social Media in Multiple Operational Contexts (Pender, 2014)

3.1.2 Offering TrendsThe trend in new traveler information offerings follows the information need characteristics discussed above, as providers strive to provide functionality which supports anytime/anywhere availability, contextualized data, and machine-useable ambient data. A few recently announced examples include:

Figure 13. Photo. Google Maps "Faster Route" Feature (Google.com)

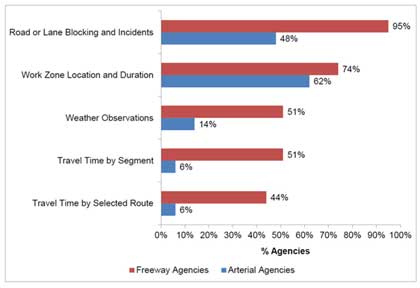

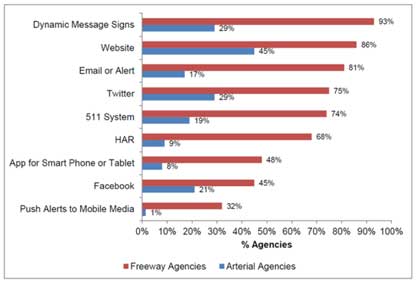

Google and the Google logo are registered trademarks of Google Inc., used with permission. 3.1.3 Offering Gap AnalysisWhen determining appropriate NGTIS offerings, it is helpful to generate a baseline by considering both the overall goals of the agencies involved and the specific needs of the major traveler segments to be served. A gap analysis involves comparing existing offering functionality with this baseline to identify unmet needs, i.e., gaps. For example, if provision of high quality traffic-responsive routing is required, then arterial data availability may become a key gap to address. As is shown in Figure 14 arterial agencies are less likely to disseminate various types of traveler information. This analysis will vary by locality, but there are some items which have been consistently identified as gaps and may serve as a useful starting point for these considerations:

Figure 14. Graph. Information Types Disseminated by Freeway and Arterial Agencies

(Gordon & Trombly, 2014) 3.2 TECHNOLOGY AND DEPLOYMENT TRENDSBuilding, operating, and enhancing an NGTIS requires an increasingly complex suite of technologies, including:

Each of these areas is currently quite dynamic, with new solutions emerging and costs dropping at an unprecedented rate. This section will take a look at highlights for each area. 3.2.1 Collection TechnologiesData collection has historically been based on static sensors placed at or in the roadside, such as loop detectors, cameras, toll tag readers, and more recently, Bluetooth readers which register passing cellphones. Significant deployments of these technologies are in operation, and further ones are planned. At the same time, there is a new emphasis on mobile sensors which can be rapidly and broadly deployed. These solutions include:

These mobile solutions are particularly appealing because they have no right-of-way restrictions, and may not require that traffic collectors deploy much physical infrastructure beyond the back-end processing needed to handle the data. In fact, these solutions have done so well that some industry commenters have started to consider a future in which mobile sensors become the exclusive source of traffic data. It is unclear that such a change is feasible at this stage, but the possibility is certainly one that should be monitored closely over time using consistent metrics such as quality, reliability, and cost. A summary view of traffic data collection technologies is shown below in Figure 15. As a result of the addition of new probe capabilities, more traffic and traveler data streams are becoming widely available. Basic issues, like cross-source location referencing and overall data security, have not gone away, but the number of real-time data points to be managed on a daily basis has soared into the billions. Particularly in the case of probe data, this significantly increases the complexity of managing this information.  Figure 15. Illustration. Traffic Data Collection Technologies (INRIX.com)

Detailed state of the practice summaries of arterial and rural solutions can be found in Travel Time on Arterials and Rural Highways: State-of-the-Practice Synthesis on Arterial Data Collection Technology (Singer, Robinson, Krueger, Atkinson, & Myers, 2013). 3.2.1.1 Data Quality StandardsThe Real-Time System Management Information Program (RTSMIP) provides a baseline for traffic quality levels, as shown in Table 2 below. There is ongoing work to provide consensus standards for measuring this quality. The American Society for Testing and Materials (ASTM) in particular has a number of activities in this area:

Older standards in this space include ASTM's series of E-standards and Federal Geographic Data Committee (FGDC) International Organization for Standardization (ISO) and Department of Defense (DOD) guidelines:

3.2.1.2 Data Quality ImprovementsPublic and private sector data managers are continuously working to improve data quality. One recent example is the focus on sub-TMC granularity. At a January 2015 conference, three major traffic data vendors reported that they are now able to offer sub-TMC link level data. This is a relatively new offering, and discussions are underway about access and effective operational use of this information. (Hamedi, 2015) 3.2.2 Aggregation and Analysis TechnologiesThe largest trend in data aggregation is the rapidly increasing ability to fuse and analyze data sets for improved NGTIS end product functionality. One area which illustrates this trend particularly well is predictive traffic. Travel time prediction has been a major focus of advanced traveler information systems in recent years. Travelers can use travel time if accurately predicted to make informed decision both pre-trip and en route. Predicted travel time information can also be used as inputs to optimize network capacity and reduce bottlenecks using various active transportation and demand management (ATDM) strategies. Several travel time prediction techniques have been developed. These techniques can be categorized into two approaches: (a) regression-based methods and (b) machine learning methods. The travel time data can come from various sources including toll tags, fixed sensors, and Bluetooth probes. Research also captures the effect of weather on the predicted travel time using toll tag readings as a data source (Faouzi, Billot, & Bouzebda, 2010). Specific examples include:

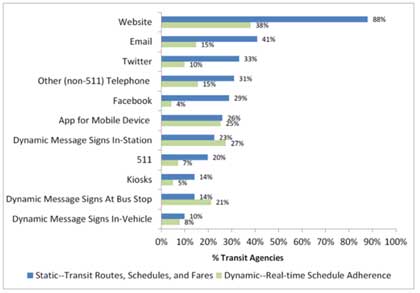

3.2.3 Delivery TechnologiesDelivery technologies span a wide range of solution types and technologies. Deployment of many of these solutions has reached very high levels among freeway agencies, with transit agencies focusing primarily on web-based solutions (Figure 16 and Figure 17).  Figure 16. Graph. Media Used by Transit Agencies (Gordon & Trombly, 2014)

Figure 17. Graph. Traveler Information Distribution Methods –

Freeway and Arterial Agencies (Gordon & Trombly, 2014) In order to properly assess delivery options, it is helpful to organize current and emerging technologies into three categories – communications channels, hardware platforms, and presentation software – as shown in Table 3. Table 3 also highlights the relative momentum of key technologies. Further detail about these technologies is provided in the subsections below.

3.2.3.1 Communications ChannelsLooking at national trends, FM radio, TV, and landline telephone use are all declining overall, in favor of mobile device options. However, usage of these traditional media for traveler information is still quite strong, as shown in the section 3.1.1 titled "Today's Offerings" earlier in this chapter. HAR is a more challenging area. Some studies show a user base of between 15-20 percent, but there is little recent data (Robinson, Jacobs, Frankle, Serulle, & Pack, 2012). Anecdotal reports trend towards a belief that HAR usage is steadily declining (CTC & Associates LLC, 2011). It seems reasonable to project a continued downward trend for this technology overall. HAR is, however, a reliable emergency backup to mobile networks for certain geographic regions and traveler populations, and as such, should be carefully considered as an option in the overall NGTIS communication mix. In May 2015, for example, the Tennessee DOT reported removing HAR in urban areas, and relocating it to rural areas where clear benefits can be identified, such as areas with high crash rates, winter weather issues, etc. 3.2.3.2 Hardware PlatformsKey hardware platforms for the dissemination of traveler information include:

3.2.3.3 Presentation SoftwareFrom the traveler's perspective, the software used to present the information is what matters, as it controls the user experience and hopefully ensures safe en route operation. This software can reside in various places – on the vehicle, on mobile devices – and operate either individually or as part of a social network. Within the vehicle, an increasing range of traveler information applications are now packaged as part of in-vehicle infotainment systems, or available through smartphone integration. Private sector traffic providers have now taken their place on the dashboard, as evidenced by announcements such as the INRIX / Audi offering first shown at CES 2015 (INRIX, 2015). On the mobile side, the majority of state DOTs now support mobile platforms (80 percent). In addition, many offer mobile applications with a primary focus on traffic and traveler information (55 percent). These apps may also provide safety messages (15 percent), project updates and notifications (23 percent), and general DOT information (34 percent). A significant percentage of these apps are developed by DOT staff (more than 1-in-4) (Brown, 2014). These public sector offerings are joined by a broad array of private sector apps and mobile websites. A summary of some widely-used traveler information applications is provided in Table 4. As can be seen from this sample set, the private sector is actively investing in traveler information offerings which draw on the latest data and data collection approaches to provide a comprehensive set of capabilities.

Key:

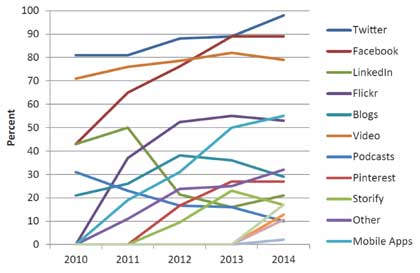

Social media has been the recipient of enormous hype. State agencies have quickly added this tool to their arsenal of traveler information delivery tools (see Figure 18), and anecdotal evidence shows that the interactive, measurable nature of this technology is yielding benefits (Brown, 2014). However, it is difficult to tell exactly how highly to place social media in the overall traveler information solution set, as there is little usage data showing how much of the overall user base interacts with traveler information in this way. Total costs are also an area for further research, as initial capital outlay is quite low but operational staffing demands must also be managed over time (AASHTO, 2014).  Figure 18. Graph. State DOT Social Media Adoption (AASHTO, 2014)

As new solutions become available, the overall traveler information delivery mix must be re-evaluated. What platforms are best for sharing specific types of data? Which new solutions should be deployed? Which older ones have run their course? This is a particularly critical question for older web- and IVR-based solutions. These have often been packaged under the overall brand of 511, although there is no consistent standard for what is included in a 511 offering, making it difficult to clearly assess them. For the purposes of this report, we note the following highlights:

Figure 19. Graph. Pre-Trip Information Usage (Robinson, Jacobs, Frankle, Serulle, & Pack, 2012)

Given this general direction and the quickly growing use of alternatives, it appears that 511/IVR is a technology which is starting to shift into the later phases of its lifecycle. Like all technology transitions, the exact timing is uncertain and decisions about changes will need to be made on a case-by-case basis in response to the needs of key traveler populations. This makes it critical to closely both track performance and determine quantifiable milestones for making any needed changes (e.g., phasing out 511/IVR in favor of solutions which have become more effective). A tracking framework might include the items shown in Figure 20:

Figure 20. Chart. 511/IVR Tracking Framework (SCG)

This framework will help public agencies conduct a cost/benefit analysis of this technology and allow its projected lifecycle to be mapped. 3.2.4 International TrendsThis section considers highlights of recent trends and activities related to NGTIS occurring around the world. 3.2.4.1 Global Case StudiesThere are a variety of global activities which can serve as valuable sources of lessons learned for U.S. agencies. The following is a list of selected programs to consider, sorted by key traveler information topic:

3.2.4.2 European Commission HighlightsIn December 2012, the European Commission funded a study regarding the provision of European Union-wide Real Time Traveler Information (RTTI) services. As this study is focused on very similar topics as this report, a summary is included here to demonstrate the global nature of the trends which are occurring in this space. Observations and findings for European Union traveler information services from this report that have implications for the U.S. market include (van de Ven & Wedlock, July 2014):

1 This rating reflects user reviews of the applications, as gathered by app stores providing these apps. | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

United States Department of Transportation - Federal Highway Administration |

||