Freight Analysis Framework Inter-Regional Commodity Flow Forecast Study

Final Forecast Results Report

PDF Version, 1.8 MB

You may need the Adobe® Reader® to view the PDFs on this page.

Contact Information: Operations Feedback at FreightFeedback@dot.gov

U.S. Department of Transportation

Federal Highway Administration

Office of Operations

1200 New Jersey Avenue, SE

Washington, DC 20590

FHWA-HOP-16-043

May 2016

Notice

This document is disseminated under the sponsorship of the U.S. Department of Transportation in the interest of information exchange. The U.S. Government assumes no liability for the use of the information contained in this document. This report does not constitute a standard, specification, or regulation.

The US Government does not endorse products or manufacturers. Trademarks or manufacturers' names appear in this report only because they are considered essential to the objective of the document.

Quality Assurance Statement

The Federal Highway Administration (FHWA) provides high-quality information to serve Government, industry, and the public in a manner that promotes public understanding. Standards and policies are used to ensure and maximize the quality, objectivity, utility, and integrity of its information. FHWA periodically reviews quality issues and adjusts its programs and processes to ensure continuous quality improvement.

Technical Report Documentation Page

| Form DOT F 1700.7 (8-72) Reproduction of completed page authorized | |||

|

1. Report No. FHWA-HOP-16-043 |

2. Government Accession No. | 3. Recipient's Catalog No. | |

|

4. Title and Subtitle Freight Analysis Framework Inter-Regional Commodity Flow Forecast Study: Final Forecast Results Report |

5. Report Date May 2016 |

||

| 6. Performing Organization Code | |||

|

7. Author(s) Richard Fullenbaum, Christopher Grillo |

8. Performing Organization Report No. | ||

|

9. Performing Organizations Name And Address IHS Global, Inc. 24 Hartwell Avenue Lexington, Massachusetts 02421 |

10. Work Unit No. (TRAIS) | ||

|

11. Contract or Grant No. DTFH61-11-D-00011/5002 |

|||

|

12. Sponsoring Agency Name and Address Federal Highway Administration Office of Freight Management and Operations 1200 New Jersey Ave SE Washington, DC 20590 |

13. Type of Report and Period Covered Technical Report (August 2015 - May 2016) |

||

|

14. Sponsoring Agency Code HOP |

|||

| 15. Supplementary Notes | |||

|

16. Abstract This technical report accompanies the 2012 base-year Freight Analysis Framework Forecasts (FAF4) submitted to the FHWA Office of Freight Management and Operations. The technical report outlines the data and methodology employed to develop freight forecasts using the 2012 base-year FAF data for 2013, 2014, 2015, 2016, and long-term forecasts in five-year increments from 2020 to 2045. This report also analyzes the resulting FAF4 forecasts, summarizing the observed trends and the outlook for domestic, imported, and exported goods movement for the United States. Included are detailed breakdowns by major commodity class and, for international trade, by key trade region. Three scenarios driven by different macroeconomic assumptions are analyzed and presented. |

|||

|

17. Key Words FAF, Freight Flows, Commodity Flows, Inter-regional Freight, Goods Movement, Multimodal Transportation, Intermodal Transportation |

18. Distribution Statement No restrictions |

||

| 19. Security Classif. (of this report) | 20. Security Classif. (of this page) |

21. No. of Pages 80 |

22. Price |

SI* (MODERN METRIC) CONVERSION FACTORS

| SYMBOL | WHEN YOU KNOW | MULTIPLY BY | TO FIND | SYMBOL |

|---|---|---|---|---|

| LENGTH | ||||

| in | inches | 25.4 | millimeters | mm |

| ft | feet | 0.305 | meters | m |

| yd | yards | 0.914 | meters | m |

| mi | miles | 1.61 | kilometers | km |

| AREA | ||||

| in2 | square inches | 645.2 | square millimeters | mm2 |

| ft2 | square feet | 0.093 | square meters | m2 |

| yd2 | square yard | 0.836 | square meters | m2 |

| ac | acres | 0.405 | hectares | ha |

| mi2 | square miles | 2.59 | square kilometers | km2 |

| VOLUME | ||||

| fl oz | fluid ounces | 29.57 | milliliters | mL |

| gal | gallons | 3.785 | liters | L |

| ft3 | cubic feet | 0.028 | cubic meters | m3 |

| yd3 | cubic yards | 0.765 | cubic meters | m3 |

| NOTE: volumes greater than 1000 L shall be shown in m3 | ||||

| MASS | ||||

| oz | ounces | 28.35 | grams | g |

| lb | pounds | 0.454 | kilograms | kg |

| T | short tons (2000 lb) | 0.907 | megagrams (or "metric ton") | Mg (or "t") |

| TEMPERATURE (exact degrees) | ||||

| F | Fahrenheit | 5 (F-32)/9 or (F-32)/1.8 |

Celsius | oC |

| ILLUMINATION | ||||

| fc | foot-candles | 10.76 | lux | lx |

| fl | foot-Lamberts | 3.426 | candela/m2 | cd/m2 |

| FORCE and PRESSURE or STRESS | ||||

| lbf | poundforce | 4.45 | newtons | N |

| lbf/in2 | poundforce per square inch | 6.89 | kilopascals | kPa |

| SYMBOL | WHEN YOU KNOW | MULTIPLY BY | TO FIND | SYMBOL |

|---|---|---|---|---|

| LENGTH | ||||

| mm | millimeters | 0.039 | inches | in |

| m | meters | 3.28 | feet | ft |

| m | meters | 1.09 | yards | yd |

| km | kilometers | 0.621 | miles | mi |

| AREA | ||||

| mm2 | square millimeters | 0.0016 | square inches | in2 |

| m2 | square meters | 10.764 | square feet | ft2 |

| m2 | square meters | 1.195 | square yards | yd2 |

| ha | hectares | 2.47 | acres | ac |

| km2 | square kilometers | 0.386 | square miles | mi2 |

| VOLUME | ||||

| mL | milliliters | 0.034 | fluid ounces | fl oz |

| L | liters | 0.264 | gallons | gal |

| m3 | cubic meters | 35.314 | cubic feet | ft3 |

| m3 | cubic meters | 1.307 | cubic yards | yd3 |

| MASS | ||||

| g | grams | 0.035 | ounces | oz |

| kg | kilograms | 2.202 | pounds | lb |

| Mg (or "t") | megagrams (or "metric ton") | 1.103 | short tons (2000 lb) | T |

| TEMPERATURE (exact degrees) | ||||

| oC | Celsius | 1.8C+32 | Fahrenheit | oF |

| ILLUMINATION | ||||

| lx | lux | 0.0929 | foot-candles | fc |

| cd/m2 | candela/m2 | 0.2919 | foot-Lamberts | fl |

| FORCE and PRESSURE or STRESS | ||||

| N | newtons | 0.225 | poundforce | lbf |

| kPa | kilopascals | 0.145 | poundforce per square inch | lbf/in2 |

Table of Contents

- Introduction

- Key Assumptions

- Forecast Results

- Forecast Methodology

- Underlying Forecast Drivers: Data Sources

- Appendix

List of Figures

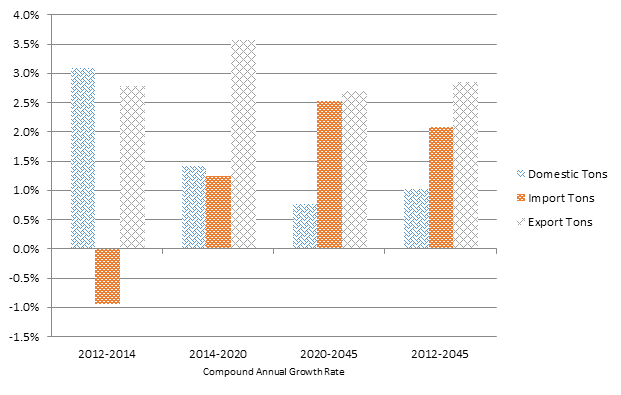

- Figure 1. Graph. Compound Annual Growth Rates for Domestic, Import, and Export Tonnage Forecasts for Selected Time Periods

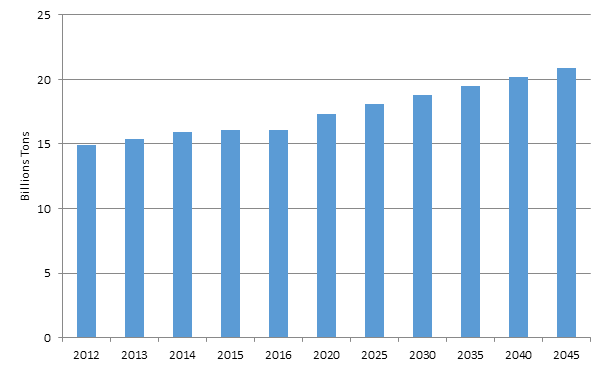

- Figure 2. Graph. Total Domestic Freight Flows, 2012 — 2045

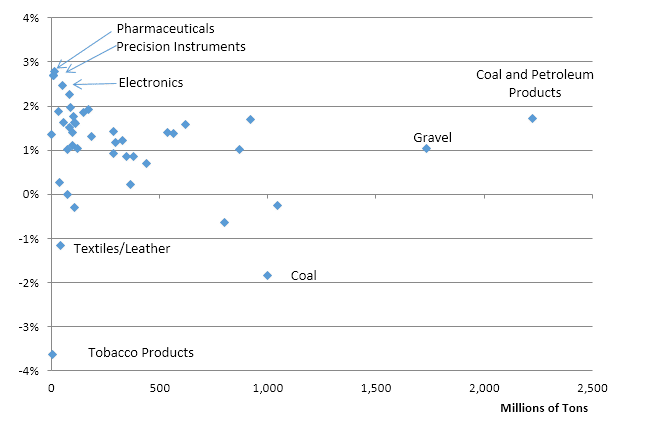

- Figure 3. Graph. Compound Annual Growth Rates (2012 — 2045) by Commodity and Tonnage

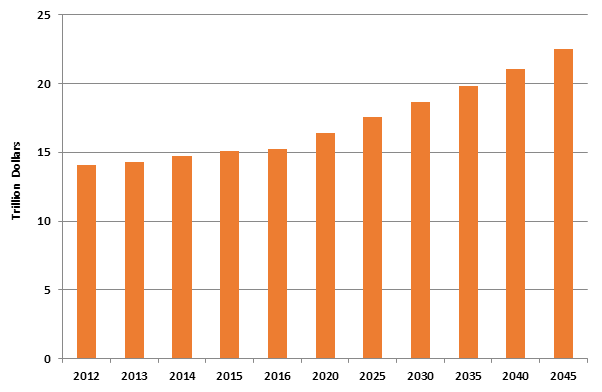

- Figure 4. Graph. Total Real Values of Domestic Freight Flows, 2012 — 2045

- Figure 5. Graph. Total Export Flows, 2012 — 2045

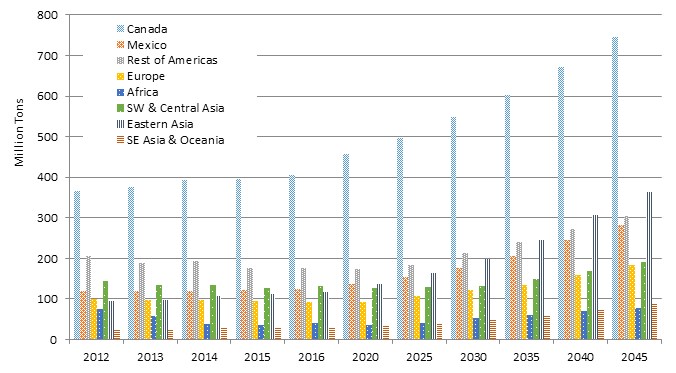

- Figure 6. Graph. U.S. Exports by Destination Region, 2012 — 2045

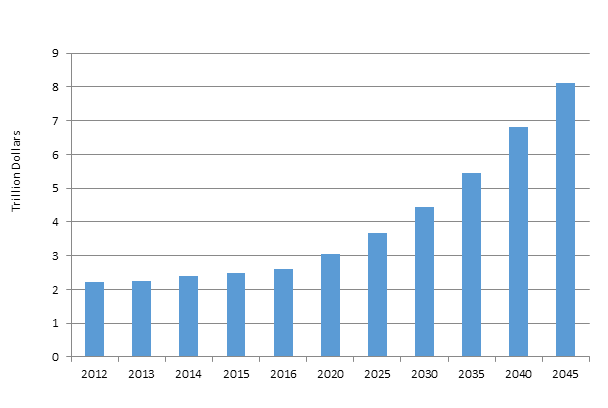

- Figure 7. Graph. Real Values of Total Export Freight Flows, 2012 — 2045

- Figure 8. Graph. Total Import Freight Flows, 2012 — 2045

- Figure 9. Graph. U.S. Imports by Region of Origin, 2012 — 2045

- Figure 10. Graph. Real Value of Import Freight Flows, 2012 — 2045

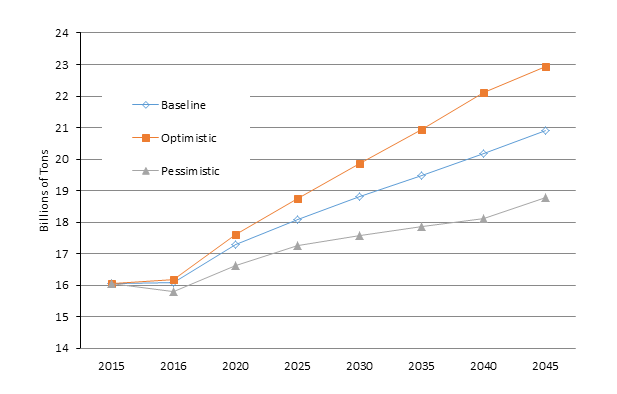

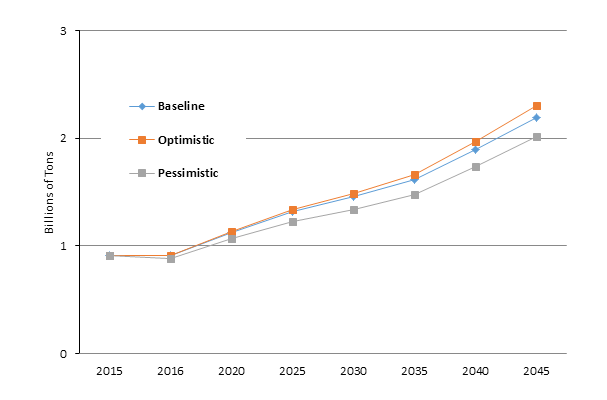

- Figure 11. Graph Domestic Tonnages — Baseline, Optimistic, and Pessimistic Scenarios, 2015 — 2045

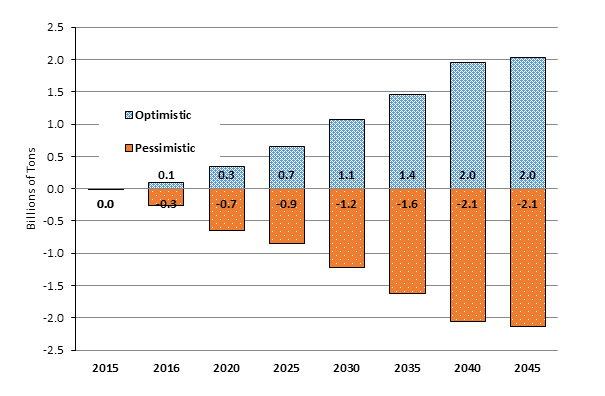

- Figure 12. Graph. Domestic Optimistic and Pessimistic Scenario Variations from the Baseline Scenario, 2015 — 2045

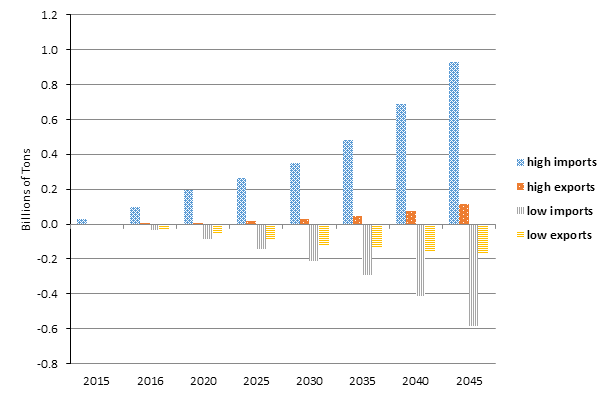

- Figure 13. Graph. Export Tonnages — Baseline, Optimistic, and Pessimistic Scenarios, 2015 — 2045

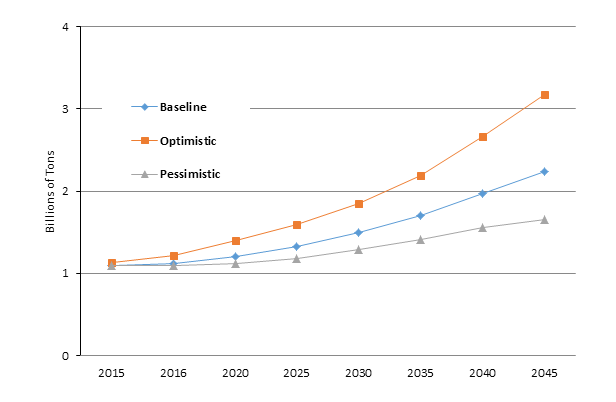

- Figure 14. Graph. Import Tonnages — Baseline, Optimistic, and Pessimistic Scenarios, 2015 — 2045

- Figure 15. Graph. Variations in Import and Export Tonnage from Baseline, Optimistic, and Pessimistic Scenarios, 2015 — 2045

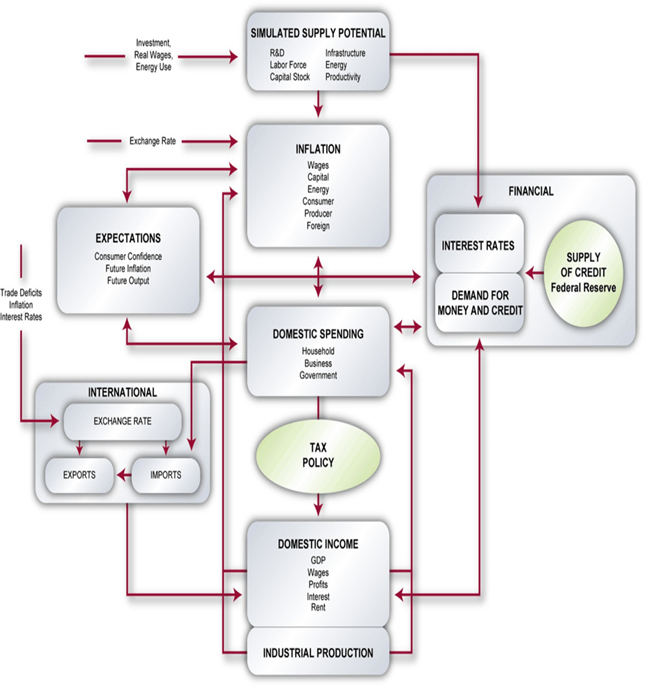

- Figure 16. Chart. Overview of the IHS Model of the U.S. Economy

List of Tables

- Table 1. U.S. Macroeconomic Forecast Historical and Forecasted Indicators to 2020

- Table 2. Long-Term U.S. Macroeconomic Forecasted Indicators to 2045

- Table 3. U.S. Macroeconomic Snapshot — January 2016

- Table 4. Top Five Domestic Commodity Classes, 2012 and 2045

- Table 5. U.S. Exports by Destination Region, 2012 and 2045

- Table 6. U.S. Imports by Region of Origin, 2012 and 2045

- Table 7. Growth in Domestic Tonnage under Baseline, Optimistic, and Pessimistic Scenarios, 2012 — 2045

- Table 8. Growth in Exported Tonnage under Baseline, Optimistic, and Pessimistic Scenarios, 2012 — 2045

- Table 9. Growth in Imported Tonnage under Baseline, Optimistic, and Pessimistic Scenarios, 2012 — 2045

- Table 10. WTS Import/Export Drivers by Standard Classification for Transported Goods Code

1 Introduction

The United States (U.S.) Department of Transportation (DOT) Federal Highway Administration (FHWA) administers the Freight Analysis Framework (FAF) to periodically survey goods movement to, from, and within the US, and to use that data to develop long-term forecasts for commodity flows between domestic and international origin-destination pairs. The FHWA, with the help of the Bureau of Transportation Statistics (BTS), develops detailed base-year freight flow data every five years through the Commodity Flow Survey (CFS). The most up-to-date data was released in early 2016, with 2012 as the base year. The FHWA then works with public and private entities to apply macroeconomic data and industry research in order to forecast this base-year data as inter-regional freight flows, domestic and international, through 2045.

The Final Forecast Results Report describes the assumptions, methodology and approach, and final results in the development of the 2012 base-year Freight Analysis Framework Inter-Regional Commodity Flow Forecast Study. For brevity, the study and forecasts will be referred to throughout this document as "FAF4", as this version represents the fourth generation of FAF1. The report covers forecasts derived from Version 4.1 or the FAF4 base-year database (FAF4.1). The forecasts are developed using data and assumptions provided by third-parties which, by themselves, do not necessarily represent the views of the FHWA or the U.S. Federal Government.

In keeping with the structure of the FAF4 base-year database, the FAF4 Forecasts are provided for 132 mutually-exclusive regions that fully partition the 50 States and the District of Columbia. Moreover, exports from and imports to these 132 regions are forecasted with respect to 8 international regions. The flow forecasts are further disaggregated by 7 domestic and 8 international modes of transportation and by 43 domestic and 42 international commodity classes. The result is a detailed database of forecasted domestic and international freight flows into and out of each CFS-defined region2.

This document is organized into four major sections. The Key Assumptions section summarizes the macroeconomic trends and factors affecting U.S. domestic and international commodity flows. The Forecast Results section summarizes the resulting FAF4 Final Forecasts for the Baseline, Optimistic, and Pessimistic scenarios. The Forecast Methodology section describes the processes by which macroeconomic and industry forecasts are applied to the FAF4 2012 base-year data set to produce the FAF4 Forecasts. The Underlying Forecast Drivers: Data Sources section then describes in greater detail the primary products and services used to develop the macroeconomic drivers of the FAF4 Forecasts.

2 Key Assumptions

This section of the report describes the key macroeconomic assumptions underpinning the Freight Analysis Framework (FAF) Fourth Generation (FAF4) Forecasts. As a preface to the overview of the FAF4 Forecasts, it is important to review the assumptions that drive the long-term economic forecasts because they directly influence the results. The Forecast Methodology section of this document later describes in detail the processes by which the long-term macroeconomics assumptions are combined with the FAF 2012 base-year database, resulting in the FAF4 Forecasts.

The FAF4 Forecasts are driven by the most up-to-date macroeconomic assumptions on the short- and long-term trends of the United States (U.S.) economy at the time of the FAF4 Forecasts development (January 2016) as the basis for inter-regional domestic and international freight flows tonnage and value forecasts. These assumptions about the national economy form the basis of national-level forecasts of output, consumption, and trade, by industry for the various FAF regions, which are ultimately applied to the FAF4 base-year database to drive the FAF4 Forecasts.

Because the macroeconomic assumptions are provided by a third-party, the views summarized in this section do not necessarily reflect the views of the Federal Highway Administration (FHWA) or the Federal Government. Rather, the data and models derived from these assumptions are procured to enhance Government-published data. The FAF4 base-year database is compiled and published by the FHWA, using information collected from freight transportation operators as part of the most recent five-year Commodity Flow Survey (CFS) and from other information sources. The process of combining third-party and Federal Government data results in forecasts for years 2013, 2014, 2015, and 2016 and long-term forecasts in five-year increments from 2020 to 2045.

This section describes a baseline macroeconomic scenario for the U.S. economy, as well as two alternative cases. These scenarios guide the development of various macroeconomics and industry forecasting data applied in this study. These macroeconomic inputs drive, respectively, the Baseline, Optimistic, and Pessimistic FAF4 Forecasts summarized in this FAF4 Final Forecast Results Report.

2.1 Baseline U.S. Economy Outlook3

The IHS January 2016 U.S. Economy Macroeconomic Outlook suggests that the U.S. economic fundamentals remain solid, despite weak top-line growth in the third and fourth quarters of 2015. The Outlook, which summarizes U.S. macroeconomic forecasts to 2020, highlights the following recent and expected future trends:

- Real Gross Domestic Product (GDP) growth in the third quarter of 2015 (2.0 percent) was about half the rate of second-quarter growth (3.9 percent).

- Almost all of the slower growth can be attributed to an (expected) inventory correction. Real final sales by domestic purchasers, GDP less inventories and exports, grew by 2.9 percent.

- Household spending growth remained robust, with real consumer expenditures up 3.0 percent in the third quarter of 2015, and residential investment increased 8.2 percent. Estimates suggest slightly lower growth in consumer expenditures (2.4 percent) and residential investment (6.3 percent) in the fourth quarter of 2015.

- In an indication of strong fundamentals, real final sales of domestic product (GDP less private inventory change) rose 3.0 percent in the third quarter of 2015.

- Real growth fell to 1.2 percent in the fourth quarter of 2015 but, with the inventory cycle beginning to ease, is expected to rebound to 3.0 percent in the first quarter of 2016.

- Calendar-year growth is forecasted to rise from 2.4 percent in 2015 to 2.7 percent in 2016.

- In another sign of strength, after two weak months, the job market showed strength in December of 2015, with gains of 292,000. This brings the three-month average to 284,000.

- The $1.1 trillion omnibus spending bill and the reauthorization of Federal transportation programs will have a small but positive impact on growth in 2016, while also significantly reducing policy uncertainty.

- The Federal Reserve elected to increase the Federal Funds Rate in December of 2015. The Federal Reserve based this decision on its analysis of intervening data, particularly the improved employment situation.

The slower GDP growth experienced in the second half of Calendar Year 2015, which fell from an annualized 3.9 percent in the second quarter to 2.0 percent in the third quarter and 1.2 percent (estimated) in the fourth quarter, is attributable to three negative influences: the strong dollar, the collapse in oil sector investment, and the recent inventory cycle. The worst of the oil sector's capital spending drop is over and the inventory correction is winding down, meanwhile lower energy costs are helping U.S. manufacturers facing headwinds on exports due to the strong dollar. Therefore, some of the headwinds contributing to the recent deceleration of growth appear to be subsiding.

At the same time, there are a number of positive signs for U.S. economic growth. Robust service-sector growth and employment growth (unemployment has fallen to 5 percent) combined with lower gasoline prices, decreasing consumer debt, and increasing incomes and real wages will continue to boost consumer confidence and spending. While some sectors such as business fixed investment and construction slowed in the second half of 2015, this is partly due to rebalancing after extraordinarily high growth in these sectors in the first half of the year. These sectors will accelerate again in 2016, with strong November housing starts data already pointing towards improved construction sector growth. A return of modest growth in government spending (especially State and local government spending and transportation spending resulting from the reauthorization of Federal transportation programs) and government employment combined with Federal budgetary policy and continued low Federal Government interest rates will help support an acceleration of growth to 2.7 percent in 2016.

In the medium term, U.S. GDP growth will accelerate, peaking in 2017 at 2.9 percent and tapering off slightly by 2020 to 2.4 percent. The key assumptions include a return in oil and gas industry capital investment (whose decline has disproportionately affected growth in extraction regions of the US), a tightening of U.S. monetary policy, and the eventual appreciation of other currencies premised on continued strength in real disposable income growth, further growth in auto sales, increasing household real estate wealth, and modest consumer price inflation. Employment will continue to grow but at a slower relative pace, as companies try to strike a balance between adding payroll and increasing productivity.

In terms of trade, imports will outpace exports for the next two years, constraining growth. This is due to appreciation of the U.S. dollar as well as a likely increase in petroleum imports, as the recent shrinking of U.S. petroleum imports (in favor of domestic production) reaches a near-term natural limit. Export growth rates will begin to exceed import growth rates again beginning in 2018 when GDP in many foreign countries begins to grow, pulling up foreign currencies and making U.S. manufacturing more cost competitive.

The following table forecasted key macroeconomic drivers of the U.S. economy through 2020.

| 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|

| Source: IHS | |||||||||

| Gross Domestic Product Growth (percent change) |

2.2 | 1.5 | 2.4 | 2.4 | 2.7 | 2.9 | 2.6 | 2.4 | 2.4 |

| Industrial Production (percent change) |

2.8 | 1.9 | 3.7 | 1.3 | 0.6 | 3.0 | 2.9 | 2.6 | 2.8 |

| Non-residential Fixed Investment (percent change) |

9.0 | 3.0 | 6.2 | 3.4 | 5.0 | 5.0 | 4.7 | 3.9 | 3.9 |

| Light Vehicle Sales (million units) |

14.44 | 15.53 | 16.44 | 17.39 | 17.76 | 18.19 | 18.07 | 17.70 | 17.28 |

| Housing Starts (million units) |

0.784 | 0.928 | 1.001 | 1.109 | 1.265 | 1.419 | 1.509 | 1.559 | 1.597 |

| Productivity (percent change) |

0.2 | 0.4 | 0.4 | 0.5 | 1.4 | 1.7 | 1.9 | 2.0 | 1.9 |

With regard to the long term, beyond 2020 it is assumed that the U.S. economy exists in an environment free of exogenous shocks. Economic output will converge towards its potential level, with all resources fully utilized. As a result, the growth rates of output, real incomes, real expenditures, and the general standard of living of the population are determined by the growth rate of potential GDP. The long-range outlook is dominated by supply factors, such as population growth and demographics, labor force participation rates, average weekly hours worked, national saving and capital stock accumulation, and productivity growth. The following table summarizes long-term assumptions about the U.S. economy.

| 2025 | 2030 | 2035 | 2040 | 2045 | |

|---|---|---|---|---|---|

| Source: IHS | |||||

| Gross Domestic Product Growth (percent change) |

2.1 | 2.2 | 2.2 | 2.1 | 2.1 |

| Industrial Production (percent change) |

1.8 | 1.9 | 1.9 | 1.8 | 1.6 |

| Non-residential Fixed Investment (percent change) |

3.3 | 2.5 | 2.8 | 2.7 | 2.5 |

| Light Vehicle Sales (million units) |

17.13 | 17.93 | 18.25 | 18.78 | 19.68 |

| Housing Starts (million units) |

1.569 | 1.515 | 1.510 | 1.499 | 1.544 |

| Productivity (percent change) |

1.8 | 1.8 | 1.8 | 1.7 | 1.7 |

Alternative scenarios have also been developed for the FAF4 Forecasts by applying optimistic and pessimistic scenarios for the U.S. economy. The following table summarizes some of the underlying assumptions of the baseline scenario described in the previous paragraphs as well as the optimistic and pessimistic scenarios driving the FAF4 Forecasts, focusing on early years in the forecasting process.

In long-term out years, growth assumption factors remain higher for the optimistic case and lower for the pessimistic case. The differences among long-term growth rates across the scenarios are; however, more narrow than in early year, and generally deviating less than 0.5 percent from the baseline. The IHS Outlook assigns a 65 percent probability that the baseline case will occur, 20 percent to pessimistic case, and 15 percent to the optimistic case.

| Baseline (65 percent) | Pessimistic (20 percent) | Optimistic (15 percent) | |

|---|---|---|---|

| Source: IHS | |||

| Gross Domestic Product Growth | Moderate growth, 2.7 percent in 2016 and 2.9 percent in 2017 | Growth slumps to 0.9 percent in 2016 with a recession in the second and third quarters | Stronger rebound as improved wages and payroll employment feed a housing recovery, up 3.4 percent in 2016 and 3.9 percent in 2017 |

| Consumer Spending | Moderately strong, up 3.0 percent in 2016 and 3.2 percent in 2017 | Slows sharply, up 1.9 percent in each of 2016 and 2017 | Economy leader as incomes rise, up 2.9 percent in 2016 and 3.9 percent in 2017 |

| Business Fixed Investment | Solid, up 5.0 percent in 2016 and 2017 | Stalls, up 1.8 percent in 2016 and 0.7 percent in 2017 | Stronger, up 6.0 percent in 2016 and 7.4 percent in 2017 |

| Housing | Gradual improvement, with more than 1.3 million starts by the end of 2016 | Construction stagnates, and starts decline to 1.1 million in 2016 | Pace of building rises, with nearly 1.5 million starts by late 2016 |

| Exports | Modest, with 2.3 percent growth in 2016 and a 5.4 percent jump in 2017 | Strong dollar and global weakness damage exports, down 1.1 percent in 2016 and recovering to 2.8 percent in 2016 | Strong, up 5.4 percent in 2016 and 7.6 percent in 2017 |

| Fiscal Policy* | Bipartisan agreements fund existing obligations without interruption | Political paralysis prevents any meaningful fiscal action during the current and future administrations | Budget gap narrows as policymakers slow the pace of spending growth, while taking in more revenue |

| Monetary Policy* | The Federal Reserve hikes the Federal Funds Rate four times in 2016, ending the year at 1.5 percent | The Federal Reserve abstains from additional rate increases until 2018; thereafter, the funds rate remains elevated in the face of inflationary pressure | Interest rates rise above 2 percent in 2016 and settle just beneath the 4 percent range in the longer term |

| Credit Conditions* | Gradually easing | Lending standards remain high | Rapidly easing |

| Productivity Growth | Modest, averaging 1.6 percent during 2016—25 | Stagnates and fails to improve rapidly, averaging 1.2 percent during 2016—25 | Takes off in 2016, averaging 1.9 percent during 2016—25 |

| Consumer Confidence | Peaks in late 2016 and remains roughly stable | Plunges through mid-2017 and begins a slow recovery thereafter at depressed levels | Rebounds strongly through mid-2018 and then retreats, leveling off higher than in the baseline |

| Oil Prices (Dollars/barrel) | Brent crude oil price averages $48 in 2016 and $58 in 2017 | Brent crude oil price averages $43 during 2016 and rebounds to $57 in 2017, exceeding the baseline thereafter as supply tightens | Brent crude oil price rises to $64 by the end of 2016 but trends below the baseline thereafter |

| Stock Markets* | The S&P 500 maintains steady growth, averaging 3.0 percent in 2016 and 3.2 percent between 2017-25 | S&P 500 contracts sharply in mid-2016 on a wave of global weakness and equities are devalued, regaining early-2015 levels only by 2018 | The S&P 500 grows at a brisk pace of 6.8 percent in 2016 and averages 3.7 percent between 2017 and 2025 |

| Inflation (Consumer Price Index) | Headline Consumer Price Index inflation picks up in 2016 as lower oil prices begin to reverse; core inflation hits 1.9 percent in 2016 and 2.0 percent 2017 | Weak demand keeps inflation below 2.0 percent until 2017 but an inflationary environment takes hold and inflation exceeds the baseline starting in late 2017 | Core prices exceed the baseline through 2017 but then rejoin it in 2020 |

| Foreign Growth | In 2016, Eurozone growth will proceed around 1.7 percent and China’s will slow to 6.3 percent | Developing markets suffer a slowdown and Europe undergoes contraction; global growth stagnates | Global growth picks up, with developed economies and emerging markets experiencing strong accelerations |

| U.S. Dollar | The inflation-adjusted dollar appreciates 6.4 percent against the broad index of trading partners’ currencies in 2016 and begins declining in the third quarter | Appreciates faster than the baseline through early 2016, then depreciates at a faster pace thereafter | World-leading growth causes appreciation against other currencies from late 2016 through mid-2018 |

3 Forecast Results

This section summarizes the Freight Analysis Framework (FAF) Fourth Generation (FAF4) Forecasts. The content summarizes the Baseline Forecast and the relative growth trajectories of the Optimistic and Pessimistic forecasts for domestic, import, and export freight flows. In addition, imports and exports for historical forecast years (2013 and 2014) are calibrated to actual provisional data available through various Federal Government sources, where available. This ensures that 2013 and 2014 international tonnage and value flow forecasts match actual data, to the extent feasible.

The forecasts are driven by macroeconomic data derived from a national model for which FAF-zone-level data is fully integrated. In some cases modifications are applied to the inputs and processes for certain origin-destination-commodity combinations where the overarching methodology and process produces unrealistic growth rates. This is primarily due to situations where FAF-zone-level industry employment and/or output growth rates are poor indicators of traffic growth (e.g., the "headquarters effect") or where major shifts in production and consumption patterns are expected to occur. These issues and the subsequent adjustments are described in detail in the Forecast Methodology section.

3.1 Baseline Scenario

The FAF4 Forecasts Baseline Scenario has three parts: domestic, imports, and exports. The total tonnage compound average annual growth rate (CAGR) is 1.2 percent from 2012 to 2045. Growth will be highest through 2014, reflecting the United States (U.S.) economy's rebound from the Great Recession as well as manufacturing and exports growth during the historical forecast years of 2012-2014. Growth in tonnage will slow from 2015-2020 to 1.7 percent, reflecting the strong but modest economic growth forecasted for the short- and medium-term described in Section 2 of this report.

Over the final 25 years of the forecast period, freight growth rates moderate further to 1.0 percent, reflecting a longer-term structural analysis of the U.S. economy. Between 2020 and 2045, imports and especially exports grow more rapidly, at 2.5 percent and 2.7 percent, respectively. However, domestic flows fall to 0.8 percent, partially reflecting lower long-term growth in U.S. domestic output as well as changing energy consumption patterns. Total tonnage increases from 17.0 billion tons in 2012 to 25.3 billion tons in 2045.

Figure 1. Graph. Compound Annual Growth Rates for Domestic, Import, and Export Tonnage Forecasts for Selected Time Periods

3.1.1 Domestic Freight Flows

In the Baseline Scenario, total domestic freight flow tonnage grows by 6.0 billion tons over the forecast period of 2012 to 2045, an increase of just over 40 percent, or a 1.0 percent CAGR. However, that 33-year view masks some key short-term trends. Specifically, the early years of the forecast period exhibit much higher growth due to recovery from the nadir of the Great Recession. Moreover it reflects a generally stronger outlook earlier in the forecast period, as recent trends favor more modest but historically robust growth from 2014-2020 of about 1.4 percent. This more modest but still relatively strong growth in domestic tonnage reflects the mostly favorable, albeit diminishing, macroeconomic tailwinds through 2020, as described in Section 2 of this report. After 2020, the rate of growth is expected to slow to a steady 0.8 percent CAGR partially reflecting a lower overall U.S. economic growth potential. However, another major factor weighing down long-term growth rates is the changing pattern of energy consumption and production in the US, which will be described in greater detail later in this sub-section.

Figure 2. Graph. Total Domestic Freight Flows, 2012 — 2045

The five Standard Classification of Transported Goods (SCTG) classes with the highest domestic traffic in the FAF4 base-year database are Coal and Petroleum Products (SCTG 19, including natural gas, natural gas liquids, petroleum coke, and related commodities), Gravel and Crushed Stone (12), Gasoline (17), Coal (15), and Nonmetallic Mineral Products (31). These five commodity classes represent about 46 percent of the total purely domestic tonnage moved in 2012. By 2045, however, several major shifts occur. Most notably, coal continues its significant decline, falling to 12th in the rankings. This reflects the continued shift in U.S. domestic power generation to natural gas (driving SCTG 19; still the largest domestic commodity class in 2045) and, to a lesser extent, renewables. Gravel and Crushed Stone remains the second largest domestic commodity class, averaging 1.0 percent growth from 2012 to 2045. This is the result of new construction and ongoing maintenance and repair of an aging U.S. infrastructure network, all of which is linked in part to economic growth.

Cereal Grains (SCTG 02) and Other Foodstuffs (SCTG 07) enter the top five rankings by 2045. Growth in Cereal Grains generally reflects the expected long-term growth in production and consumption of food in the US, and is a rough proxy for population growth in an advanced economy. The Other Foodstuffs commodity class growth suggests increased demand for manufactured food products, reflecting population and income growth. Adding domestic Cereal Grains and Other Foodstuffs flows to the 2012 top five domestic commodity classes represents 56 percent of the total tonnage in the base year.

| Standard Classification for Transported Goods Class and Number | Tonnage and Rank, 2012 | Tonnage and Rank, 2045 | Compound Annual Growth Rate, 2012-2045 |

|---|---|---|---|

| Coal and Petroleum Products (19) | 2.22 billion tons, 1 | 3.89 billion tons, 1 | 1.7 percent |

| Gravel and Crushed Stone (12) | 1.74 billion tons, 2 | 2.43 billion tons, 2 | 1.0 percent |

| Gasoline (17) | 1.04 billion tons, 3 | 961 million tons, 6 | -0.2 percent |

| Coal (15) | 997 million tons, 4 | 540 million tons, 12 | -1.8 percent |

| Nonmetallic Mineral Products (31) | 920 million tons, 5 | 1.60 billion tons, 3 | 1.7 percent |

| Cereal Grains (02) | 871 million tons, 6 | 1.21 billion tons, 4 | 1.0 percent |

| Other Foodstuffs (07) | 620 million tons, 8 | 1.04 billion tons, 5 | 1.6 percent |

Several declining commodity classes are related to the energy sector. Nuance is important in interpreting these results. In addition to general macroeconomic conditions, industry-specific factors contribute significantly to the forecasts. First, coal, which is primarily used for the generation of electricity, is in a structural decline as represented by an average forecasted decline of 1.8 percent over the forecast period. The discovery and economic extraction of domestic natural gas combined with lower capital costs for new gas-fired power plants is significantly altering the long-term U.S. energy consumption profile. Development of renewable-powered generation and compliance with environmental regulations will also contribute to declining shares of coal-fired power generation. Meanwhile, the growth in domestic energy products used primarily for motor vehicle fuel such as gasoline and diesel (the former is a component of SCTG 17, while the latter is a component of SCTG 18) peaks around 2020 as fuel efficiency standards and changing transportation patterns drive 2045 consumption below 2012 levels.

Domestic Crude Petroleum (SCTG 16) flows grow throughout most of the forecast period, before falling below base-year 2012 levels by 2045. Despite declining domestic growth for gasoline and diesel beginning in the 2020s, U.S. refineries will increase consumption of low-cost, domestically produced crude petroleum. The increased production of petroleum products at U.S. refineries will be reflected strongly in SCTG 17 and SCTG 18 export growth. This dynamic will be described in the exports forecast summary following this sub-section. Nonetheless, the forecasted peaking of domestic unconventional shale oil plays will contribute to long-term declines in domestic crude oil production and domestic refinery consumption.

While most domestic energy SCTG classes decline over the long term, one grows rapidly. Two of the larger components of the Coal and Petroleum Products class are natural gas and natural gas liquids. The SCTG 19 flows are forecasted to rise through 2045 by 1.7 percent, compounded annually. As previously described, natural gas will displace coal demand for domestic power generation, while natural gas liquids will supply a rejuvenated chemicals manufacturing base. The impact on domestic chemicals, especially Fertilizers (SCTG 22) and Plastics and Rubber (SCTG 24), will be described later in this sub-section. It is important to note that natural gas and natural gas liquids will probably grow by more than 1.7 percent; however, the overall SCTG 19 growth rate will be weighed down by slowing domestic petroleum coke consumption.

It is also important to note that there is uncertainty in the magnitude in shifts of long-term trade and supply chains resulting from the growth of U.S. unconventional energy extraction. The industry forecasts used in this study for energy-related products are roughly consistent with U.S. Energy Information Administration (EIA) forecasts for SCTGs 16-18. The forecasts differ somewhat for SCTG 15 and SCTG 19; however, as the data sources employed in this study assume a more rapid decline in coal consumptions and a more rapid increase in natural gas consumption for domestic power generation.

Figure 3 plots 2012 tonnage to CAGRs over the forecast interval. The chart shows that the fastest growing domestically moved commodities over the forecast interval also generally make up some of the smaller commodity groups tonnage-wise. The clustering in the upper left hand corner illustrates the trend in high growth rates for small-tonnage, high-value commodities.

This growth in small-tonnage, high-value commodities illustrates the transition of the U.S. manufacturing base towards producing lighter, higher-value goods requiring more technically advanced processes. The fastest growing commodity groups from 2012-2045, Pharmaceuticals (SCGT 21, 2.8 percent), Precision Instruments (SCTG 38, 2.7 percent), and Transport Equipment (SCTG 37, 2.7 percent), are among the five smallest commodity classes in terms of tonnage. Electronics (SCTG 35) is larger in terms of tonnage and includes many now-commoditized products (that is, products that are not differentiable by quality or producer but are largely homogeneous), but this advanced technology class still registers a 2.5 percent CAGR.

Figure 3 also illustrates several outliers. Tobacco Products (SCTG 09) flows decline rapidly due to changing U.S. consumption patterns. Meanwhile, Textiles and Leather (SCTG 30) declines due to trends towards imports of apparel. High-tonnage Gravel and Crushed Stone grows with increased construction demand, especially for infrastructure maintenance. Meanwhile, the chart captures the aforementioned displacement of Coal by Coal and Petroleum Products (i.e., natural gas), and the growth of natural gas liquids.

Figure 3. Graph. Compound Annual Growth Rates (2012 — 2045) by Commodity and Tonnage

The "re-shoring" of automotive manufacturing in the US, both in the Great Lakes region but especially in the Southeast, has been driving up domestic production for the U.S. market in recent years. This is reflected in the Motorized Vehicles (SCTG 36) domestic commodity flow growth rates, averaging about 5.3 percent compounded annually from 2012 to 2015. While domestic production and consumption of Motorized Vehicles should remain positive in the future, the high-growth phase has likely peaked. Positive but lower growth rates are forecasted in the future.

The forecasts suggest some mid-sized commodity groups among the fastest growing, especially in chemicals-related industries. Specifically, Fertilizers (1.3 percent, 19th largest commodity group by tonnage in 2012), Plastics and Rubber (1.9 percent, 20th), and Chemical Products (1.8 percent, 26th) register higher-than-average growth rates for domestic cargo flows from 2012 and 2045. Growth in these chemicals-related commodity classes (as well as Pharmaceuticals) relates to the resurgence of chemicals manufacturing in the US. As detailed previously, abundant petrochemical feedstocks from domestic unconventional oil and gas extraction has contributed to the massive current and planned expansion of chemicals manufacturing in the US. These new plants are concentrated on the U.S. Gulf Coast, but there may also be investment in states in the Marcellus and Utica shale play areas of the Appalachian Mountains (mainly Pennsylvania and West Virginia, but also possibly in Ohio, Kentucky, and New York). The US will switch from being a major importer to being a major exporter of numerous widely-traded petrochemical commodities, such as methanol.

The trend in real value of domestic freight follows the trend of tonnage growth. The following figure illustrates the growth in domestic commodity flow values, in real terms. The real value measure excludes the impact of inflation. From 2012 to 2014, real value grows by about $694 million (2.4 percent CAGR) from $14.1 trillion to $14.8 trillion, and then grows by another $1.7 trillion to $16.4 trillion by 2020 (1.8 percent CAGR). Over the entire period of this forecast, value grows from $14.1 trillion in 2012 to $22.5 trillion in 2045, representing a CAGR of 1.4 percent.

Figure 4. Graph. Total Real Values of Domestic Freight Flows, 2012 — 2045

According to this forecast, the growth rate of domestic freight real value (1.4 percent CAGR) exceeds the growth rate of tonnage (1.0 percent CAGR), indicating that the mix of domestically moved tonnage evolves over time toward higher-value commodities.

3.1.2 Export Freight Flows

In general, demand for U.S. exports is influenced by the relative values of the currency of the US and its trading partners, as well as the levels of demand for U.S.-produced goods from each trading partner. Since at least the Great Recession, a weak U.S. dollar has supported export growth generally in balance with, or greater than, imports. A weak dollar effectively makes goods produced in the US relatively cheaper for foreign consumers to buy. In addition, certain regions of the world weathered the recession of 2007-2009 better than others, particularly in developing economies, thus their demand growth for imports did not diminish as much as in the US.

The recent strengthening of U.S. growth compared to slower growth in Europe and many developing economies, combined with other factors such as monetary policy, has led to an appreciation of the U.S. dollar relative to other global currencies. This, in turn, will push import growth above export grown in the short term. The macroeconomic forecasts described in Section 2 suggest that this trend will persist until about 2018, when economic growth outside of the US accelerates, the dollar depreciates, and U.S. exports again rise faster than imports.

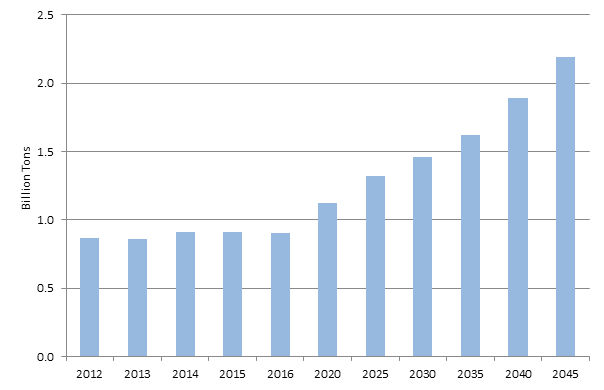

With exchange rates as the driving force, U.S. export tonnage is forecasted to grow at 2.8 percent from 2012-2014, as well as by about 2.9 percent over the entire forecast period. The following figure illustrates the export flow forecasts over the FAF4 Forecast period.

Figure 5. Graph. Total Export Flows, 2012 — 2045

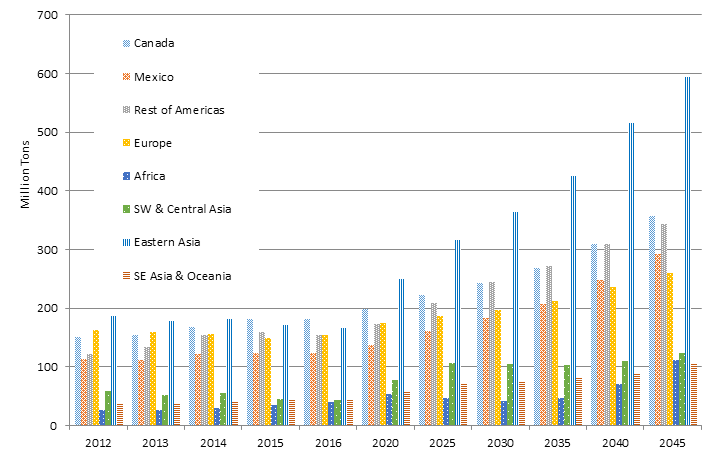

Eastern Asia is the leading destination for U.S. exports, and trade will grow rapidly along this lane over the forecast period (3.6 percent CAGR). The region includes major trading partners: China, Japan, and South Korea. Greater integration, possibly through enhanced free-trade deals, as well as the continued growth in China and other major Eastern Asia consumer economies will help buttress this long-term trend.

The next two largest destinations are North American Free Trade Agreement (NAFTA) trade partners, Canada and Mexico. Canada is and will remain the second largest recipient of U.S. exports, growing at 2.6 percent compounded annually over the forecast period. Mexico will overtake Europe as the fourth largest destination, growing at 2.9 percent compounded annually over the forecast period. These growth rates reflect a general trend in cross-border trade between the US, Canada, and Mexico, and greater integration of the major North American economies.

Figure 6. Graph. U.S. Exports by Destination Region, 2012 — 2045

Export growth to other regions will vary from 1.4 percent to 4.5 percent. Trade to Europe, currently the second largest recipient of U.S. exports, will grow the slowest to 2045. Headwinds on long-term economic growth in Europe result in lower consumer demand and, hence, lower demand for U.S. exports. Meanwhile, growth in Africa economies will propel compound annual growth in U.S. exports to the region by 4.5 percent through 2045.

| Region Code | Destination Region | Export Tons, 2012, millions | Export Tons, 2045, millions | Compound Annual Growth Rate, 2012-2045 |

|---|---|---|---|---|

| 801 | Canada | 151 | 357 | 2.6 percent |

| 802 | Mexico | 114 | 293 | 2.9 percent |

| 803 | Rest of Americas | 123 | 344 | 3.2 percent |

| 804 | Europe | 163 | 260 | 1.4 percent |

| 805 | Africa | 26 | 113 | 4.5 percent |

| 806 | SW & Central Asia | 60 | 123 | 2.2 percent |

| 807 | Eastern Asia | 188 | 595 | 3.6 percent |

| 808 | SE Asia & Oceania | 39 | 105 | 3.1 percent |

| Total | 864 | 2,190 | 2.9 percent |

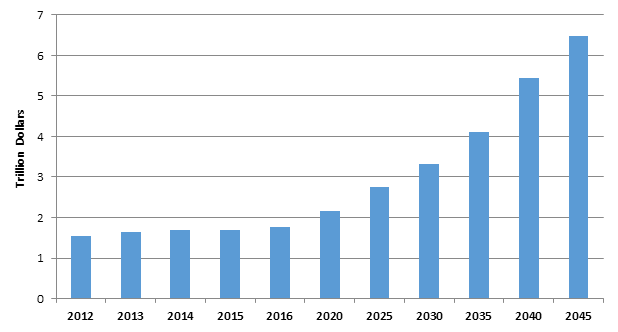

As in the case of domestic freight flow forecasts, the real value of U.S. exports will outpace tonnage growth. The following table illustrates export value growth from $1.5 trillion in 2012 to $6.5 trillion by 2045, a CAGR of 4.1 percent, as compared to a 2.9 percent CAGR in tonnage.

Figure 7. Graph. Real Values of Total Export Freight Flows, 2012 — 2045

3.1.3 Import Freight Flows

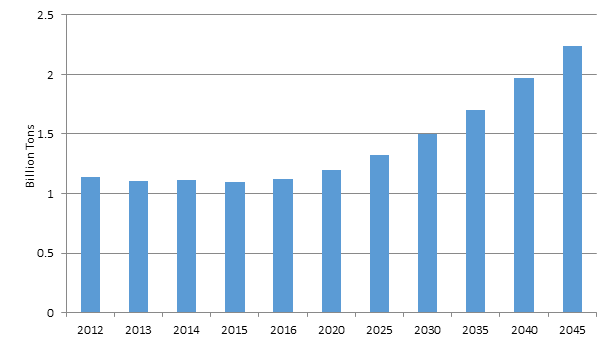

Demand for imports is also affected by the relative strength of the dollar versus other currencies, plus the overall U.S. demand for commodities. However, a weak dollar lessens the demand for imports, as imports become more expensive relative to domestically produced goods. Therefore, the overall trend in imports diverges from that of exports. The relatively weak dollar helps explain why imports are forecasted to grow slower than exports between 2012 and 2014; imports are forecasted to decline by a 0.9 percent CAGR over this period, while exports grow at a 2.8 percent CAGR. This trend is also partially a function of import substitution of petroleum products. Imports then grow rapidly with an appreciating dollar between 2014 and 2018, before a diminishing growth rate takes hold, relative to exports. The following figure illustrates the trends in U.S. import growth from 1.1 billion tons in 2012 to 2.2 billion tons in 2045 (2.1 percent CAGR).

Figure 8. Graph. Total Import Freight Flows, 2012 — 2045

Canada and Mexico are, again, major trading partners for the US, with Canada being the largest origin for U.S. imports. Imports from Mexico; however, are growing faster (a 2.6 percent CAGR from Mexico versus a 2.2 percent CAGR from Canada from 2012-2045) partly due to the increase in Mexico-produced automobile and other manufacturing for export to the U.S. market. In particular, Japanese and European automobile manufacturers continue to heavily invest in new plants in Mexico.

Figure 9. Graph. U.S. Imports by Region of Origin, 2012 — 2045

Nevertheless, Eastern Asia and Southeastern Asia & Oceania remain the fastest growing origins for U.S. imports (4.1 percent CAGR and 4.0 percent CAGR, respectively, over the FAF4 Forecast period). The forecasts suggest the continuing of a long-term trend in rapid manufacturing growth in China, South Korea, Japan, and elsewhere in Eastern Asia for export. Eastern Asia, already a major origin for U.S. imports, will become the second most important origin for U.S. imports by 2045. Southeastern Asia & Oceania starts from a smaller base but grows nearly as fast as Eastern Asia, as manufacturing growth spreads to lower-cost emerging economies such as Vietnam.

| Region Code | Region of Origin | Import Tons, 2012, millions | Import Tons, 2045, millions | Compound Annual Growth Rate, 2012-2045 |

|---|---|---|---|---|

| 801 | Canada | 368 | 746 | 2.2 percent |

| 802 | Mexico | 119 | 283 | 2.6 percent |

| 803 | Rest of Americas | 205 | 304 | 1.2 percent |

| 804 | Europe | 101 | 184 | 1.8 percent |

| 805 | Africa | 77 | 79 | 0.1 percent |

| 806 | SW & Central Asia | 44 | 191 | 0.9 percent |

| 807 | Eastern Asia | 97 | 363 | 4.1 percent |

| 808 | SE Asia & Oceania | 25 | 91 | 4.0 percent |

| Total | 1,136 | 2,241 | 2.1 percent |

The real value of U.S. imports will significantly outpace tonnage growth. Total import value is forecasted to grow from $2.2 trillion in 2012 to $8.1 trillion by 2045, a CAGR of 4.0 percent. This is driven by imports of high-value goods, including electronics and other technology from Eastern Asia and Southeastern Asia & Oceania. The following figure summarizes the trends in import freight flow value growth.

Figure 10. Graph. Real Value of Import Freight Flows, 2012 — 2045

3.2 Optimistic and Pessimistic Alternative Scenarios

The Optimistic and Pessimistic scenario FAF4 forecast data are based on the alternative macroeconomic scenarios described in the Key Assumptions section of this report. The key alternative macroeconomic variables are described in Table 3. These macroeconomic assumptions for the alternative cases are then filtered through regional employment and economic output models, which in turn drive the alternative forecasts of inter-regional freight flows. The process is described in greater detail in the Forecast Methodology section of this document.

The same methodology used to create the Baseline Scenario FAF4 Forecast was followed to create the Optimistic and Pessimistic scenarios forecasts. For the FAF4 Optimistic and Pessimistic forecasts, the appropriate input files were changed to reflect the different levels of employment and output growth captured in the alternative macroeconomic cases.

As previously noted, inputs and processes were adjusted for some commodity classes and origin-destination pairs to more closely calibrate Baseline Scenario flow forecasts with Federal Government data and other third-party macroeconomic and industry growth models. In these cases, the Optimistic and Pessimistic scenarios are adjusted proportionally.

3.2.1 Domestic Optimistic and Pessimistic Scenario Tonnage

The following figures summarize the Optimistic and Pessimistic scenarios compared to the Baseline Scenario. Years 2012-2014 are deemed to be "historical forecast" years; consequently, the deviation from the Baseline Scenario begins in 2015.

Figure 11. Graph Domestic Tonnages — Baseline, Optimistic, and Pessimistic Scenarios, 2015 — 2045

Figure 12. Graph. Domestic Optimistic and Pessimistic Scenario Variations from the Baseline Scenario, 2015 — 2045

In the Optimistic Scenario, total domestic tonnage is expected to grow by 1.3 percent on average per year from 2012 to 2045 as opposed to a 1.0 percent CAGR in the Baseline Scenario. This yields 22.9 billion tons of domestic commodity flow in 2045, 2.0 billion tons higher than in the Baseline Scenario. In the Pessimistic Scenario, total domestic tonnage is projected to grow by 0.7 percent on average per year from 2012 to 2045, resulting in 18.8 billion tons of domestic commodity flow in 2045, 2.1 billion tons less than the Baseline Scenario forecast.

3.2.2 Exports and Imports Optimistic and Pessimistic Scenario Tonnage

In the Optimistic Scenario, total export tonnage is expected to grow by 3.0 percent on average per year from 2012 to 2045 as opposed to a 2.9 percent CAGR in the Baseline Scenario. As a result, export tonnage is estimated to reach 2.3 billion tons in 2045, about 118 million tons higher than in the Baseline Scenario forecast. In the Pessimistic Scenario, total export tonnage is projected to grow by 2.6 percent on average per year from 2012 to 2045, resulting in 2.0 billion tons of exports in 2045, about 169 million tons less than in the Baseline Scenario forecast.

Figure 13. Graph. Export Tonnages — Baseline, Optimistic, and Pessimistic Scenarios, 2015 — 2045

In the Optimistic Scenario, total import tonnage is expected to grow by 3.2 percent on average per year from 2012 to 2045 as opposed to a 2.1 percent CAGR in the Baseline Scenario. Consequently, import tonnage is forecasted to reach 3.2 billion tons in 2045, approximately 932 million tons higher than in the Baseline Scenario forecast. In the Pessimistic Scenario, total import tonnage is projected to grow by 1.1 percent on average per year from 2012 to 2045, resulting in 1.7 billion tons of imports in 2045, about 586 million tons less than in the Baseline Scenario forecast.

Figure 14. Graph. Import Tonnages — Baseline, Optimistic, and Pessimistic Scenarios, 2015 — 2045

The previous charts illustrate that the Optimistic and Pessimistic scenarios are asymmetrical around the Baseline Scenario forecast. This is due to the fact that the assumptions driving the Optimistic Scenario promote overall consumption and a stronger dollar, thus the higher demand for imports and domestically-produced goods, which limits the amount that can be exported. In the Pessimistic Scenario, reduced demand from lower manufacturing and a weaker dollar eases the need for imports, while significantly reducing the attractiveness and availability of goods for export. Therefore, the impacts of a changing macroeconomic scenario on imports and exports are not necessarily equal.

Figure 15. Graph. Variations in Import and Export Tonnage from Baseline, Optimistic, and Pessimistic Scenarios, 2015 — 2045

The three tables that follow summarize the tonnage forecasts across all scenarios by SCTG commodity class from 2012 to 2045. The tables summarize domestic, exported, and imported flows, respectively. In no instance does the Optimistic Scenario or the Pessimistic Scenario result in the changing of the long-term directionality of the growth rate. The dynamics described in the Baseline Scenario summary sub-section are consistent across scenarios. For example, low-tonnage, high-value commodities such as Pharmaceuticals, Precision Instruments, and Transportation Equipment retain their relative rankings in terms of fastest growth over the study time horizon regardless of scenario. The only difference is that the application of optimistic or pessimistic macroeconomic assumptions affects the relative magnitude of growth rates across all SCTG commodity classes.

| Class | Description | 2012 tons (millions) | 2045 tons (millions) | Compound Annual Growth Rate 2012-2045 (percent) |

||||

|---|---|---|---|---|---|---|---|---|

| Source: IHS | ||||||||

| 01 | Live animals/fish | 98.7 | 141.9 | 155.4 | 127.4 | 1.1 | 1.4 | 0.8 |

| 02 | Cereal grains | 870.9 | 1212.1 | 1329.6 | 1086.7 | 1.0 | 1.3 | 0.7 |

| 03 | Other agriculture products | 438.9 | 552.2 | 606.2 | 495.2 | 0.7 | 1.0 | 0.4 |

| 04 | Animal feed | 286.5 | 456.2 | 500.3 | 408.6 | 1.4 | 1.7 | 1.1 |

| 05 | Meat/seafood | 84.9 | 138.9 | 152.3 | 124.3 | 1.5 | 1.8 | 1.2 |

| 06 | Milled grain products | 112.1 | 189.7 | 208.0 | 169.6 | 1.6 | 1.9 | 1.3 |

| 07 | Other foodstuffs | 619.9 | 1041.5 | 1142.7 | 929.8 | 1.6 | 1.9 | 1.2 |

| 08 | Alcoholic beverages | 99.4 | 157.3 | 172.8 | 140.5 | 1.4 | 1.7 | 1.1 |

| 09 | Tobacco products | 3.0 | 0.9 | 1.0 | 0.8 | -3.6 | -3.4 | -4.0 |

| 10 | Building stone | 30.8 | 56.9 | 62.3 | 50.8 | 1.9 | 2.2 | 1.5 |

| 11 | Natural sands | 538.0 | 848.8 | 930.6 | 761.3 | 1.4 | 1.7 | 1.1 |

| 12 | Gravel | 1735.6 | 2434.8 | 2670.2 | 2175.1 | 1.0 | 1.3 | 0.7 |

| 13 | Nonmetallic minerals | 148.1 | 272.3 | 298.8 | 243.1 | 1.9 | 2.1 | 1.5 |

| 14 | Metallic ores | 75.8 | 75.9 | 83.3 | 67.8 | 0.0 | 0.3 | -0.3 |

| 15 | Coal | 996.7 | 539.6 | 593.8 | 497.9 | -1.8 | -1.6 | -2.1 |

| 16 | Crude petroleum | 365.1 | 393.6 | 430.5 | 361.0 | 0.2 | 0.5 | 0.0 |

| 17 | Gasoline | 1043.4 | 960.9 | 1050.6 | 861.6 | -0.2 | 0.0 | -0.6 |

| 18 | Fuel oils | 801.6 | 650.3 | 709.3 | 586.5 | -0.6 | -0.4 | -0.9 |

| 19 | Coal & petroleum prods. | 2223.3 | 3893.1 | 4263.9 | 3508.8 | 1.7 | 2.0 | 1.4 |

| 20 | Basic chemicals | 328.7 | 491.4 | 537.8 | 444.9 | 1.2 | 1.5 | 0.9 |

| 21 | Pharmaceuticals | 16.1 | 40.0 | 43.9 | 35.7 | 2.8 | 3.1 | 2.4 |

| 22 | Fertilizers | 183.3 | 280.8 | 308.0 | 251.7 | 1.3 | 1.6 | 1.0 |

| 23 | Chemical products | 102.0 | 181.4 | 198.8 | 162.1 | 1.8 | 2.0 | 1.4 |

| 24 | Plastics/rubber | 173.6 | 324.8 | 354.9 | 292.4 | 1.9 | 2.2 | 1.6 |

| 25 | Logs | 285.8 | 388.6 | 425.7 | 347.5 | 0.9 | 1.2 | 0.6 |

| 26 | Wood products | 348.8 | 463.1 | 508.0 | 414.0 | 0.9 | 1.1 | 0.5 |

| 27 | Newsprint/paper | 106.5 | 96.7 | 127.2 | 86.3 | -0.3 | 0.5 | -0.6 |

| 28 | Paper articles | 74.8 | 104.7 | 114.9 | 93.4 | 1.0 | 1.3 | 0.7 |

| 29 | Printed products | 37.7 | 41.2 | 45.2 | 36.7 | 0.3 | 0.5 | -0.1 |

| 30 | Textiles/leather | 40.3 | 27.5 | 30.2 | 24.5 | -1.2 | -0.9 | -1.5 |

| 31 | Nonmetal mineral products | 919.6 | 1603.9 | 1758.2 | 1432.9 | 1.7 | 2.0 | 1.4 |

| 32 | Base metals | 296.4 | 435.5 | 477.5 | 388.8 | 1.2 | 1.5 | 0.8 |

| 33 | Articles-base metal | 108.4 | 184.3 | 202.1 | 165.2 | 1.6 | 1.9 | 1.3 |

| 34 | Machinery | 82.9 | 173.7 | 190.4 | 155.6 | 2.3 | 2.6 | 1.9 |

| 35 | Electronics | 50.9 | 113.7 | 124.7 | 101.6 | 2.5 | 2.8 | 2.1 |

| 36 | Motorized vehicles | 119.8 | 168.8 | 185.2 | 150.9 | 1.0 | 1.3 | 0.7 |

| 37 | Transport equipment | 7.7 | 18.6 | 20.4 | 16.8 | 2.7 | 3.0 | 2.4 |

| 38 | Precision instruments | 7.5 | 18.1 | 19.9 | 16.2 | 2.7 | 3.0 | 2.3 |

| 39 | Furniture | 57.3 | 97.4 | 106.9 | 87.0 | 1.6 | 1.9 | 1.3 |

| 40 | Miscellaneous manufacturing | 86.5 | 164.7 | 180.5 | 146.8 | 2.0 | 2.3 | 1.6 |

| 41 | Waste/scrap | 563.0 | 883.6 | 969.6 | 788.3 | 1.4 | 1.7 | 1.0 |

| 43 | Mixed freight | 380.9 | 592.6 | 650.3 | 529.9 | 1.3 | 1.6 | 1.0 |

| 99 | Unknown | 1.3 | 2.0 | 2.2 | 1.8 | 1.3 | 1.6 | 1.0 |

| Class | Description | 2012 tons (millions) | 2045 tons (millions) | Compound Annual Growth Rate 2012-2045 (percent) |

||||

|---|---|---|---|---|---|---|---|---|

| Source: IHS | ||||||||

| Base | High | Low | Base | High | Low | |||

| 01 | Live animals/fish | 0.3 | 0.3 | 0.3 | 0.3 | 0.0 | 0.0 | -0.1 |

| 02 | Cereal grains | 67.1 | 188.1 | 190.9 | 183.8 | 3.2 | 3.2 | 3.1 |

| 03 | Other agriculture products | 61.9 | 204.6 | 210.5 | 198.0 | 3.7 | 3.8 | 3.6 |

| 04 | Animal feed | 26.5 | 56.4 | 57.2 | 55.1 | 2.3 | 2.4 | 2.2 |

| 05 | Meat/seafood | 9.4 | 29.0 | 29.4 | 28.3 | 3.5 | 3.5 | 3.4 |

| 06 | Milled grain products | 3.6 | 9.7 | 9.9 | 9.5 | 3.1 | 3.1 | 3.0 |

| 07 | Other foodstuffs | 21.3 | 78.7 | 79.9 | 76.9 | 4.0 | 4.1 | 4.0 |

| 08 | Alcoholic beverages | 2.1 | 10.3 | 10.4 | 10.1 | 4.9 | 4.9 | 4.8 |

| 09 | Tobacco products | 0.1 | 0.1 | 0.1 | 0.0 | -1.3 | 0.2 | -3.0 |

| 10 | Building stone | 0.3 | 0.6 | 0.6 | 0.6 | 2.0 | 2.1 | 1.8 |

| 11 | Natural sands | 8.9 | 11.7 | 11.7 | 10.9 | 0.8 | 0.8 | 0.6 |

| 12 | Gravel | 2.5 | 3.4 | 3.4 | 3.2 | 0.9 | 0.9 | 0.7 |

| 13 | Nonmetallic minerals | 12.9 | 24.9 | 25.0 | 23.2 | 2.0 | 2.0 | 1.8 |

| 14 | Metallic ores | 26.1 | 60.2 | 60.4 | 55.9 | 2.6 | 2.6 | 2.3 |

| 15 | Coal | 165.5 | 160.8 | 161.3 | 149.3 | -0.1 | -0.1 | -0.3 |

| 16 | Crude petroleum | 3.7 | 23.5 | 23.5 | 21.8 | 5.7 | 5.8 | 5.5 |

| 17 | Gasoline | 33.7 | 63.8 | 64.1 | 59.3 | 2.0 | 2.0 | 1.7 |

| 18 | Fuel oils | 116.8 | 248.5 | 249.5 | 230.9 | 2.3 | 2.3 | 2.1 |

| 19 | Coal & petroleum prods. | 30.2 | 149.2 | 149.7 | 138.6 | 5.0 | 5.0 | 4.7 |

| 20 | Basic chemicals | 42.7 | 128.6 | 129.1 | 119.5 | 3.4 | 3.4 | 3.2 |

| 21 | Pharmaceuticals | 0.8 | 4.1 | 6.8 | 2.3 | 5.2 | 6.8 | 3.3 |

| 22 | Fertilizers | 13.6 | 22.9 | 23.0 | 21.3 | 1.6 | 1.6 | 1.4 |

| 23 | Chemical products | 10.2 | 47.5 | 55.2 | 39.7 | 4.8 | 5.2 | 4.2 |

| 24 | Plastics/rubber | 25.1 | 92.1 | 92.9 | 85.0 | 4.0 | 4.0 | 3.8 |

| 25 | Logs | 10.1 | 33.8 | 33.9 | 31.4 | 3.7 | 3.7 | 3.5 |

| 26 | Wood products | 10.3 | 32.0 | 36.8 | 26.9 | 3.5 | 3.9 | 2.9 |

| 27 | Newsprint/paper | 22.5 | 55.6 | 55.8 | 51.7 | 2.8 | 2.8 | 2.6 |

| 28 | Paper articles | 2.0 | 6.7 | 9.4 | 4.7 | 3.7 | 4.8 | 2.6 |

| 29 | Printed products | 1.3 | 3.6 | 5.9 | 2.0 | 3.2 | 4.7 | 1.4 |

| 30 | Textiles/leather | 5.9 | 18.0 | 29.4 | 9.9 | 3.5 | 5.0 | 1.6 |

| 31 | Nonmetal mineral products | 9.3 | 36.5 | 38.0 | 33.0 | 4.2 | 4.4 | 3.9 |

| 32 | Base metals | 15.3 | 32.2 | 32.3 | 29.9 | 2.3 | 2.3 | 2.1 |

| 33 | Articles-base metal | 9.3 | 29.7 | 41.2 | 27.3 | 3.6 | 4.6 | 3.3 |

| 34 | Machinery | 13.8 | 51.1 | 69.5 | 46.8 | 4.1 | 5.0 | 3.8 |

| 35 | Electronics | 4.2 | 20.1 | 29.7 | 15.9 | 4.9 | 6.1 | 4.1 |

| 36 | Motorized vehicles | 14.8 | 31.0 | 35.1 | 24.6 | 2.3 | 2.7 | 1.6 |

| 37 | Transport equipment | 2.8 | 11.1 | 13.1 | 9.1 | 4.2 | 4.8 | 3.6 |

| 38 | Precision instruments | 0.9 | 7.7 | 12.1 | 4.9 | 6.6 | 8.1 | 5.2 |

| 39 | Furniture | 2.3 | 11.8 | 18.9 | 6.9 | 5.1 | 6.6 | 3.4 |

| 40 | Miscellaneous manufacturing | 1.8 | 11.1 | 15.9 | 9.7 | 5.7 | 6.8 | 5.3 |

| 41 | Waste/scrap | 51.1 | 172.5 | 175.5 | 158.8 | 3.8 | 3.8 | 3.5 |

| 43 | Mixed freight | 1.4 | 5.9 | 9.6 | 3.2 | 4.4 | 6.0 | 2.6 |

| Class | Description | 2012 tons (millions) | 2045 tons (millions) | Compound Annual Growth Rate 2012-2045 (percent) |

||||

|---|---|---|---|---|---|---|---|---|

| Source: IHS | ||||||||

| Base | High | Low | Base | High | Low | |||

| 01 | Live animals/fish | 1.1 | 2.7 | 2.8 | 2.4 | 2.7 | 2.9 | 2.4 |

| 02 | Cereal grains | 8.0 | 18.1 | 19.5 | 16.6 | 2.5 | 2.7 | 2.2 |

| 03 | Other agriculture products | 23.9 | 124.4 | 136.1 | 112.7 | 5.1 | 5.4 | 4.8 |

| 04 | Animal feed | 5.9 | 14.4 | 17.7 | 13.0 | 2.7 | 3.4 | 2.4 |

| 05 | Meat/seafood | 4.6 | 12.5 | 14.5 | 11.1 | 3.1 | 3.5 | 2.7 |

| 06 | Milled grain products | 4.1 | 14.1 | 15.1 | 12.9 | 3.8 | 4.0 | 3.5 |

| 07 | Other foodstuffs | 24.4 | 91.8 | 98.6 | 84.2 | 4.1 | 4.3 | 3.8 |

| 08 | Alcoholic beverages | 9.5 | 56.8 | 61.0 | 52.1 | 5.6 | 5.8 | 5.3 |

| 09 | Tobacco products | 0.1 | 0.1 | 0.1 | 0.0 | 0.0 | 0.8 | -2.2 |

| 10 | Building stone | 0.2 | 1.1 | 1.4 | 1.0 | 5.5 | 6.3 | 5.1 |

| 11 | Natural sands | 2.6 | 3.2 | 4.1 | 2.8 | 0.6 | 1.4 | 0.3 |

| 12 | Gravel | 15.8 | 25.3 | 32.6 | 22.6 | 1.4 | 2.2 | 1.1 |

| 13 | Nonmetallic minerals | 30.5 | 58.7 | 75.4 | 52.4 | 2.0 | 2.8 | 1.7 |

| 14 | Metallic ores | 21.5 | 30.1 | 38.7 | 26.9 | 1.0 | 1.8 | 0.7 |

| 15 | Coal | 7.7 | 34.4 | 44.2 | 30.7 | 4.6 | 5.4 | 4.3 |

| 16 | Crude petroleum | 480.7 | 465.8 | 904.0 | 281.7 | -0.1 | 1.9 | -1.6 |

| 17 | Gasoline | 43.4 | 18.6 | 36.1 | 11.2 | -2.5 | -0.6 | -4.0 |

| 18 | Fuel oils | 67.5 | 53.8 | 104.4 | 32.5 | -0.7 | 1.3 | -2.2 |

| 19 | Coal & petroleum prods. | 59.6 | 135.4 | 174.1 | 120.9 | 2.5 | 3.3 | 2.2 |

| 20 | Basic chemicals | 30.9 | 112.9 | 145.2 | 100.8 | 4.0 | 4.8 | 3.6 |

| 21 | Pharmaceuticals | 2.3 | 12.9 | 16.8 | 6.3 | 5.3 | 6.2 | 3.1 |

| 22 | Fertilizers | 29.4 | 42.2 | 67.8 | 31.7 | 1.1 | 2.6 | 0.2 |

| 23 | Chemical products | 5.9 | 34.1 | 44.0 | 25.4 | 5.4 | 6.3 | 4.5 |

| 24 | Plastics/rubber | 21.6 | 88.1 | 119.9 | 46.2 | 4.3 | 5.3 | 2.3 |

| 25 | Logs | 1.2 | 4.0 | 5.2 | 3.6 | 3.8 | 4.6 | 3.5 |

| 26 | Wood products | 18.0 | 63.2 | 81.7 | 38.9 | 3.9 | 4.7 | 2.4 |

| 27 | Newsprint/paper | 15.5 | 33.5 | 43.1 | 29.9 | 2.4 | 3.1 | 2.0 |

| 28 | Paper articles | 2.0 | 5.6 | 7.3 | 3.2 | 3.2 | 4.0 | 1.4 |

| 29 | Printed products | 1.2 | 2.8 | 3.6 | 1.4 | 2.5 | 3.3 | 0.3 |

| 30 | Textiles/leather | 14.3 | 52.5 | 68.1 | 25.7 | 4.0 | 4.9 | 1.8 |

| 31 | Nonmetal mineral products | 22.5 | 100.1 | 128.7 | 88.4 | 4.6 | 5.4 | 4.2 |

| 32 | Base metals | 36.3 | 82.6 | 102.1 | 74.2 | 2.5 | 3.2 | 2.2 |

| 33 | Articles-base metal | 21.8 | 55.5 | 57.4 | 45.5 | 2.9 | 3.0 | 2.3 |

| 34 | Machinery | 24.4 | 100.8 | 112.3 | 79.3 | 4.4 | 4.7 | 3.6 |

| 35 | Electronics | 15.0 | 68.4 | 82.8 | 45.1 | 4.7 | 5.3 | 3.4 |

| 36 | Motorized vehicles | 28.9 | 68.8 | 111.8 | 32.6 | 2.7 | 4.2 | 0.4 |

| 37 | Transport equipment | 1.0 | 5.6 | 7.6 | 3.5 | 5.2 | 6.2 | 3.8 |

| 38 | Precision instruments | 1.6 | 10.1 | 11.5 | 7.0 | 5.8 | 6.2 | 4.6 |

| 39 | Furniture | 11.4 | 78.4 | 101.7 | 38.4 | 6.0 | 6.9 | 3.8 |

| 40 | Miscellaneous manufacturing | 5.9 | 25.5 | 33.0 | 17.0 | 4.6 | 5.4 | 3.3 |

| 41 | Waste/scrap | 10.7 | 19.8 | 25.4 | 17.6 | 1.9 | 2.7 | 1.5 |

| 43 | Mixed freight | 2.6 | 12.4 | 16.1 | 6.1 | 4.8 | 5.6 | 2.6 |

4 Forecast Methodology

The foundation of the approach to the Freight Analysis Framework (FAF) Fourth Generation (FAF4) Forecasts is the consistency across the forward-looking outlook of macroeconomic, regional, inter-industry, and intra-state forecast models. The economic forecasting models used in this study are built and maintained with a common framework and perspective that provides a comprehensiveness, consistency, and level of detail that are unique for freight transportation forecasting. Most importantly, this means that the detailed freight flow forecasts are derived in a manner consistent with the path of the economy at the national, regional, and sub-state levels.

This section provides a general overview of the forecasting methodology. The following sub-sections will provide a more detailed examination of the steps taken in producing the domestic and international forecasts. Throughout the methodology discussion, third-party tools and databases are referenced. The primary tools and databases used in the FAF4 forecasting process are also described in detail in the Underlying Forecast Drivers: Data Sources section of this document.

The initial calibration in the forecasting process involves two distinct steps. The first is to construct the desired level of geography in the IHS Business Market Insights (BMI) and the Business Transactions Matrix (BTM) forecast databases relative to the 2012 FAF4 base-year database. The creation of the FAF4 regions in these two models is a process of aggregation, grouping the county-level data into the FAF4 regional market definitions, and summing the values.

The second step during this initial stage entails the development of the crosswalk between the North American Industry Classification System (NAICS) industry sector classifications and the two-digit-level Standard Classification of Transported Goods (SCTG) commodity classifications. This is done through a review of existing commodity classification concordance files, which detail the relationships between different combinations of NAICS, SCTG, and Standard Transportation Commodity Classification (STCC) codes at various levels of detail. The crosswalk between industry and commodity classifications is important because it provides the bridge from the value and weight of the physical commodities and products shipped through the transportation system to the industry activity measured by economists on an industry establishment level (typically using the value of output or purchases and/or the associated employment).

The mapping of six-digit NAICS codes to corresponding SCTG codes began with the FAF Third Generation (FAF3) Forecasts concordance table. The FAF3 mapping was then updated so that the concordance table reflects new additions and changes to the code definitions. The Commodity Flow Survey (CFS) microdata file, which also contains NAICS-SCTG relationships, was also employed as a reference where an accurate six-digit NAICS-SCTG mapping could not be determined.

In addition, for international movements, a crosswalk was developed linking SCTG to codes used in the IHS World Trade Service (WTS) model. WTS codes are related to the International Standard Industrial Classification of All Economic Activities (ISIC) system. This crosswalk provides the bridging between the WTS international trade forecasts and the international and cross-border movements in the FAF4 database. A detailed mapping was also completed to match ISIC to the WTS codes, the latter of which have already been updated for concordance with STGC two-digit-level codes (the WTS to SCTG crosswalk appears in the Appendix).

The development of the baseline commodity tonnage forecasts is multi stage. For domestic forecasts, these steps include:

- Establish national control totals by commodity using the Industrial Production Index of the IHS Model of the U.S. Economy (U.S. Macro Model);

- For each commodity, apply specific shipment growth to each CFS region destination from each origin region using the BMI;

- Apply specific purchasing and consumption growth by CFS region and commodity using the BTM;

- Summarize and compare the results from steps 2 and 3 with the national controls in Step 1; and

- Adjust the resulting freight flows so that the volumes correspond with the national control levels:

- For each CFS region and commodity, ratably adjust shipments to match purchases.

- For each commodity, adjust so that national control totals are satisfied.

For international forecasts, these steps include:

- Using the BTM and the BMI data, respectively, grow imports and exports by FAF region for all commodities by Federal Highway Administration (FHWA)-defined United States (U.S.) Gateway and World Region, and applying WTS forecasts;

- Establish national import and export control numbers for each commodity by FHWA-defined U.S. Gateway and World Region using the WTS;

- Ratably adjust the import and export forecasts in Step 1 with national controls for each in Step 2; and

- Adjust 2013 and 2014 international forecasts to be consistent with provisional Federal Government trade data.

The following sub-sections provide greater detail on the domestic and international freight forecasting methodologies, reconciling short-term forecasts (2013 and 2014) with actual provisional data, the conversion of value forecasts to real dollars, the development of alternative scenarios, and descriptions of various case-by-case adjustments to calculating forecasts in certain cases.

4.1 Domestic Freight Forecast Methodology

The first step in creating the forecast of the FAF4 database is to extract the county-level employment and the U.S. dollar value of output information, by 6-digit NAICS code, from the BMI database. The BMI database covers each of the forecast years from 2012 to 2040. BMI is extended to 2045 for the purposes of this project. The BMI database is described in detail in the Underlying Forecast Drivers: Data Sources section of this report.

The employment data from the BMI is then matched to the SCTG categories, and aggregated to the 2-digit SCTG level to conform to the FAF4 2012 base-year database. The concordance table identifying the relationships between NAICS and SCTG coding systems is used in this processing. Extensive cross-referencing is required to ensure that all detailed NAICS industry categories in the BMI are assigned to a SCTG commodity class code, and also that all SCTG commodity class codes in the FAF4 data are assigned to a NAICS industry sector classification.

Concurrent with the extension of the BMI output and employment forecasts to 2045, county-level data is aggregated to match the geographic market region definitions used in the 2012 FAF4 base-year database. The counties are mapped to the FAF4 geographic regions using the definitional assignments provided by the FHWA. The output and employment data are then converted to growth rates. The results are cross-checked and verified against the growth rates for the individual constituent counties.

The independent forecast variables include data from the BTM database, which are described in detail in the Underlying Forecast Drivers: Data Sources section of this report. The BTM Input/Output (I/O) tables require a similar methodology for translation of the NAICS industry classification codes to SCTG commodity category codes, and the county-level geography to the FAF4 geographic market regions. Again, minor adjustments to the NAICS-to-SCTG relationships are necessary to insure that all SCTG categories are assigned to NAICS industry categories, for example:

- NAICS 212322 → 25 percent to SCTG 11 & 75 percent to SCTG 12

- NAICS 211111 → 45 percent to SCTG 16 & 55 percent to SCTG 19

- NAICS 324110 → 26 percent to SCTG 17, 25 percent to SCTG 18 & 50 percent to SCTG 19

The total domestic shipment volumes are then projected out through the forecast horizon using the forecast information from the BMI, converted to annual growth rates. The result is a table that shows, for each of the forecast years, the shipment tonnage for each CFS region-to-region SCTG commodity flow.

The BTM I/O data is then integrated with the 2012 base-year FAF4 database, so that for each origin region-SCTG commodity combination there is a complete set of purchased (consumed) goods associated with SCTG commodity volumes. The base-year purchase volumes are then forecasted for each year of the forecast period using the forecasted growth rates in the BTM.

At this point, a national-level freight forecast, based on the most recent U.S. economic data from the U.S. Macro Model, is employed to establish aggregate-level benchmark freight volumes for each SCTG commodity class. The total 2012 base-year FAF4 freight flows, by SCTG commodity, are then initially forecasted using the national-level forecasts of output and consumption.

Once these national-level benchmark values are established, the last step is to reconcile and rebalance the original BMI-based region-to-region shipment forecast and the BTM-based region-to-region purchases forecast. This iterative process yields the detailed CFS-market-to-CFS market commodity flow volumes, which are adjusted to and constrained by the national benchmarks established using the U.S. Macro Model.

Lastly, annual growth rates are reviewed against various Federal Government and third-party industrial production and transportation flow benchmarks to validate the forecasts. As will be described later in this section, several adjustments were applied to flows at various dimensions (e.g. the SCTG level, origin-destination level, etc.) where the overall forecasting process produced results substantially different from the appropriate Federal Government and/or third-party benchmarks.

4.2 International Freight Forecast Methodology

The procedure for forecasting the international components of the FAF4 data is similar in nature to that which is used for the domestic traffic, but some adjustments are required due to the different underlying growth drivers for international business transactions and the additional gateway or port market definitional dimension that must be incorporated. The process of producing the international forecasts treats the import and export portions of the international data separately, as the treatment of suppliers and consumers is asymmetrical with respect to the level of detail available on each end of the transaction (i.e., much more detail is available on the U.S. end of the shipment).

In addition, for the forecast years of 2013 and 2014, actual provisional import and export data is currently available. It is important for the forecasts to correctly reflect existing data as best as possible. To that end, the international freight forecasts use additional inputs from the U.S. Census and from other relevant Federal Government sources to produce international flows consistent with trade data for those two years. The latest "forecast" year of 2014 is used as the driver of the international forecast so that movements appearing in the 2014 data will continue in the forecast whether or not they appear in the FAF4 2012 base-year database. The specific process used to make assignments in 2013 and 2014 international data is detailed later in this report.

The base-year FAF4 data set is maintained throughout the processing in separate files for domestic, import, and export freight flows. Unlike the domestic data, the international records also contain the gateway or port market identifying where flows enter or exit the US. The originating foreign geographic market for imports and the foreign destination geographic market for exports is identified by the foreign region in the base-year 2012 FAF4 database and in the forecasts (as well as for the adjusted forecasts for new flows appearing in provisional actual data for 2013 and 2014).

Individual commodity growth rates of U.S. imports and U.S. exports, taken from the WTS model, are then applied to the FAF4 base-year international data set to obtain forecast flows by the gateway/foreign geographic regional market/SCTG commodity class combination. The processes and methodologies underlying WTS are described in the Underlying Forecast Drivers: Data Sources section of this report.

To apply the WTS to the FAF4 2012 base-year database, the commodity classifications of the WTS have been translated to SCTG commodity classes. The relationships between the WTS and the SCTG commodity codes are listed in the Appendix of this document. In addition, the geographic country and regional market areas used in the WTS are translated to match those used in FAF4.

With the necessary commodity class and geographic regional market mappings complete, export volume growth is then forecasted by regional market and commodity using BMI export data and WTS foreign import purchases data. For U.S. international import volume growth, also by geographic regional market and SCTG commodity class, the shipment-level import freight flow forecast are calculated as a function of the WTS import forecast and the demand for purchases forecasted in the BTM.

Consistent with the domestic forecasts, national-level constraints by SCTG commodity class are applied in an iterative process. Import shipment-level forecasts are controlled by purchases, and export purchases are controlled by shipments. Once the national-level constraint derived using the WTS is applied, a similar process is completed for each port/SCTG commodity class pair. The resulting file yields total tonnage for each forecast year for each regional market-gateway/region-SCTG commodity class combination.

After employing quality controls, including any adjustments determined through the validation process, the output includes international forecasts formatted with annual growth changes for each SCTG commodity class, gateway and SCTG commmodity class, and foreign geographic region market and SCTG commodity class.

4.3 Development of 2013 and 2014 International Flows

In order to produce forecasts consistent with known values, additional processing is employed to 2013 and 2014 forecast years for international movements. FAF4 forecast years 2013 and 2014 should be consistent with dollar value and tonnage data derived from Customs and trade data information, where available, that are published by various Federal Government agencies5 along the following measures:

- External geography

- U.S. port aggregated to the corresponding FAF district

- Commodity

- Ultimate U.S. internal origin or destination

Movements that occur in the base-year 2012 FAF4 database are adjusted to match the known 2013 and 2014 totals in the FAF4 forecast years. Those 2014 totals are then used as the base for the outer-year forecasts.