Hennepin County - MN

FAST FACTS ABOUT: Hennepin County - MN

Types of TDM: Modal Shift, Location Shift

Keywords: Transit subsidy, Pre-Tax benefits, Legislation

Employer Demographics: Hennepin County, Minnesota,

has 130 offices and facilities dispersed throughout the county with

differing levels of transit service at each site. About 10,000 County

employees are located in downtown Minneapolis and are well served by

transit.

Results: Estimated 60% drive alone, 15% carpool, 2%

vanpool, 15% bus, 3% telework, 5% flextime

Cost: $559,000 bus subsidy + $14,000 vanpool, parking

and administration costs = $573,000 - $109,000 FICA Savings = Total

Cost: $464,000.

Staff: Minimal staff time and staff costs once program

was set up.

Contact: Mike Bastyr, Sr. Human Resources Representative,

612-348-4640

Local and Federal Legislation and Policy Impacts

Since 1960 the City of Minneapolis’s growth management policies

concentrated office and retail use in a downtown core and limited parking

to areas just outside the core. These policies have resulted in high

bus service and ridership in the downtown core, where most of Hennepin

County’s employees work.

Like many other US cities, Minneapolis is recently experiencing a resurgence

in downtown growth and development. As Minneapolis’s downtown

core continues to grow, city and county officials have become concerned

about increasing congestion and decreasing air quality.

In 1999 Minneapolis expanded the smart growth policy in their City Comprehensive

Plan to include more emphasis on transit. Per the plan, “Minneapolis

will follow a policy of ‘Transit First’ in order to build

a more balanced transportation system than the current one.”

In addition to the local “Transit First” policy, federal

legislation passed in 1999 encouraged employers throughout the United

States to reevaluate their transportation benefits programs. Internal

Revenue Code Section 132 (f), allows employees to exclude certain transportation

fringe benefits from gross income. In 1998, these pre-tax fringe benefits

were limited to $65.00/month for transit or vanpool and $175.00/month

for qualified parking. In 2000, the benefit limits were increased to

$100/month for transit or vanpool and $195.00/month for qualified parking.

The convergence of local policy and federal

legislation provided the impetus for Hennepin County to reevaluate its

20-year old bus pass program.

The convergence of local policy and federal legislation provided the

impetus for Hennepin County to reevaluate its 20-year old transportation

program. During the 1980’s and 1990’s Hennepin County’s

transportation program consisted of a pay-roll deducted bus pass. Convenience

and a 5% discount from the local transit authority, MetroTransit, motivated

employee bus pass purchases. In 1999, spurred by new federal transportation

benefit regulations, Hennepin County introduced a pre-tax employee transportation

program that covered bus and parking costs (in 2000).

Pre-Tax and Creative Use of Savings

Hennepin County’s pre-tax transit pass program, available to all

13,000 employees, immediately increased transit usage by 400-500 employees

spread throughout the County’s dispersed offices.

Soon after Hennepin County’s introduction of the pre-tax transit

program, MetroTransit, introduced a metro pass. Although employees voiced

interest in the metro pass, the cost was too high for Hennepin County.

Instead, in 2000, the County enhanced the transit pass program by providing

a 40% discount on transit pass purchases. The combined subsidy and pre-tax

status of the transit pass reduced costs for the employee. Transit purchases

increased to over 1,900 by January 2003.

As an employer, the pre-tax bus and parking program saved the County money on FICA payments. The County decided to filter the FICA savings back to offset the subsidy program. Doing so defrays 30% of the cost to provide the subsidy. From June 2000 through January 2003, the subsidy, less the FICA savings, totaled $666,464.

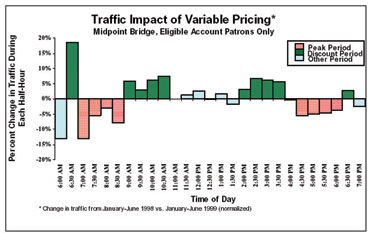

Results and Challenges

Due to the high level of bus service in the downtown core, Hennepin

County’s marketing and outreach is focused on encouraging bus

ridership. The combination of subsidies and pre-tax incentives captured

the attention of employees and increased bus ridership by almost 900

employees in one year. Success for Hennepin County is measured by increased

participation in the transit subsidy program. Since the changes in the

program, SOV rate has reduced to approximately 60% with an estimated

15% of employees carpooling, 2% vanpooling, 3% teleworking, 5% using

flextime and 15% utilizing transit.

Despite the initial success of the transit subsidy/pre-tax incentive

program, employees complained about the confusing pre-tax parking process.

As the pre-tax parking benefits operate differently than the popular

and familiar flexible spending accounts, employees became frustrated.

Hennepin County’s Benefits Unit kept an open-door policy and sought

and responded to feedback on a regular basis. County newsletter articles

and e-mail announcements were used to both inform and clarify the program

to employees.

One employee responded to a newsletter article with an e-mail stating,

“Pre-tax parking is confusing and stupid.” That quote was

used as the title for an employee mailing that explained changes that

made the program easier for employees to use. Feedback loops and consistent

updates increase the appeal to employees, and therefore participation.

The local MetroTransit group recognized Hennepin County’s innovative

funding model with a transportation benefits program award.