Chapter 4. Interoperability

The straightforward concept of paying a fee for using the roadway becomes more complex once jurisdictional (national, State, and local) boundaries are considered. If the fee charged to the driver is to reflect the fee structure of the various locations driven (assuming inter-jurisdictional travel), then the ability to measure location is a vital feature of the system. For all the STSFA grantee sites, the State where the vehicle is registered is where the fees will be collected. Interoperability will allow the home State to collect fees on behalf of other States where that vehicle has been driven, and to reallocate those fees to the appropriate State.

As an example, a driver travels from State A to State B. For the system to be truly interoperable, the system would need to distinguish between the miles driven in each State, and be able to apply the State’s mileage fee and reallocate the fees between States. This reallocation becomes more important when crossing boundaries between jurisdictions with different fee structures, as the driver will be paying the accurate amount based on location of mileage driven, and jurisdictions will be receiving the correct amount. In situations where large populations live and work across State lines, or where significant amounts of driving occur in States other than the home State, the capability to measure location and apply the appropriate fee for mileage becomes even more important.

This chapter presents cross-cutting findings from the STSFA Phase Ⅰ explorations regarding the interoperability of location-specific technologies and approaches explored by the grantees.

CROSS-CUTTING FINDINGS REGARDING INTEROPERABILITY

- Measuring the location of miles driven will enable accurate collection of fees for out-of-State driving.

- RUC West and Eastern Corridor Coalition have laid the groundwork for RUC systems to be regionally interoperable.

- Consistency of data and standards between States will be critical to enable true interoperability.

Key Cross-Cutting Findings

Ability to Measure Location

At its most basic level, the ability to measure a vehicle’s mileage while crossing over a jurisdictional boundary would be enough to determine the mileage driven in other jurisdictions. Technically speaking, even manual odometer methods could support interoperability, but they would require vehicles to stop at any jurisdictional boundary for a reading; this approach would be very costly to administer and very inconvenient for drivers. Of the approaches explored by Phase Ⅰ grantees, the technology that is consistently used to measure location, thus enabling interoperability, is GPS. To measure the location of miles, today’s mileage reporting devices (MRDs) will need to be GPS-enabled. This technology can tag each mile driven to a specific location, allowing the fees to be calculated based on the location of the miles driven, and allowing the fees to be reconciled and reallocated once collected. Table 7 presents the ability to measure location of the mileage recording approaches explored by Phase Ⅰ pilot sites.

Table 7. Mileage recording devices and their ability to measure location.

| Mileage recording/reporting approach |

Mileage recording/reporting option |

Ability to measure location |

| Odometer-based |

Manual odometer reading |

No |

| Image-based odometer reading |

No |

| Odometer/smartphone hybrid |

Yes |

| Onboard diagnostic-based |

Onboard diagnostic standard II port |

No |

| Location-based |

Smartphone with location* |

Yes |

| Plug-in device with location* |

Yes |

| Alternative approaches |

Fleet-based |

Yes |

| Registration-based |

No |

*Smartphones typically include technology to measure location, although the particular mileage-capture software may not support its use.

Framework to Reallocate Funds

The ability to measure location is one aspect of interoperability. The other aspect needed is the framework to reallocate funds between jurisdictions from both the technical and administrative perspectives. States have explored reallocating fees based on available data estimates of mileage driven between States. While technically interoperable, it could be problematic for users who do not drive significant amounts out of State, who may be paying more per-mile based on the census estimate. Likewise, participants who drive significant amounts in other States with higher fees may not be paying an accurate amount for their road use. These issues would not be present for drivers using locational methods to track mileage.

Trade-Offs between Alternative Approaches to Achieve Interoperability

Those systems that include location-based data collection require more sophistication and complexity during the capturing of the mileage data, but enhance the ability and ease to reconcile fees between jurisdictions. They may also have associated privacy concerns. Conversely, systems where the capturing of mileages are relatively simplistic (i.e., odometer readings) require more sophisticated and complex calculations and estimation for fee allocation by location.

Significant Phase Ⅰ Efforts Exploring Interoperability

Several of the 2016 funding grantees explored interoperability between States, including RUC West, Eastern Corridor Coalition, Washington, and Oregon. Washington and Oregon studied an approach for measuring mileage and transferring fees to reconcile out-of-State driving. Participants using location-based MRD technologies have the specific State mileage fee associated with each mile driven in that State. In both of these approaches (Eastern Corridor Coalition and Washington and Oregon), transfers or mock transfers of fees were both State to State and did not include a regional clearinghouse entity as suggested in the RUC West ConOps.

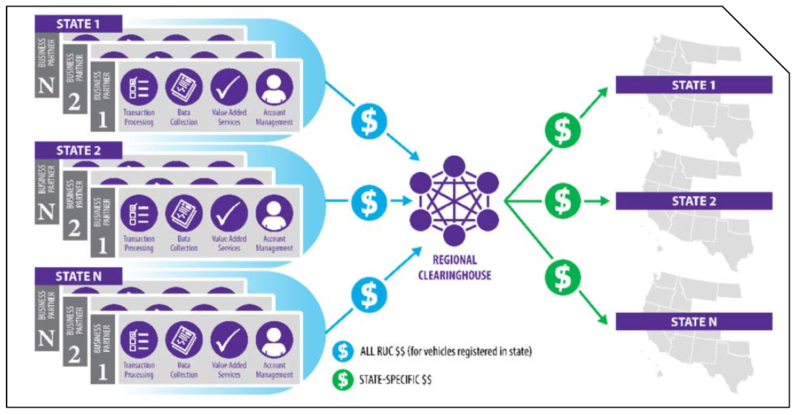

Road Usage Charge West Example

The RUC West consortium has established a high-level ConOps that outlines a framework for the transfer of data and fees between private account managers and States to a regional clearinghouse. This approach would allow a centralized system to settle the difference for miles driven between States and give each party a single entity to coordinate fees and data for out-of-State driving (Figure 1). This approach has the benefits of limiting the number of transactions needed to reconcile fees between States. Without such a system, each State and/or private account manager may need to reconcile data and fees between other States and account managers, generating increased complexity as more entities are involved. The RUC West ConOps offers a framework for uniform data collection and transfer, service quality, user privacy, data security, and uniformity in RUC data presentation and user controls to make interoperability as seamless and secure for the user as possible.

Source: RUC West

Figure 1. Diagram. Regional road usage charge pilot architecture with clearinghouse, with different set of business partners for region.

Eastern Corridor Coalition Pilot

The Eastern Corridor Coalition launched a pilot from May 2017 to July 2017, with 155 participants, testing a multiple technologies and approaches that enable interoperability between participating States. Technologies that enabled location measurement were tested, along with an onboard diagnostic standard II (OBD-II) device that did not measure location.

Seventeen States are part of the coalition, and a mileage fee was determined for each State based upon the average MFT paid per mile by State, which was then used as a basis for fees when participants drove out of State. For the 84 percent of participants who chose a location-enabled technology, a monthly invoice was generated that provided a breakdown of miles driven per-State with associated fee. For those who chose the device without location features, an invoice was generated that estimated the percentage of miles driven within the home State and estimates of miles driven in other States based on census data. Fees were then calculated using the total mileage driven with fees calculated on the estimated percentage driven in different States.