Smartphone Applications To Influence Travel Choices: Practices and Policies

Chapter 3. Smartphone Application Types Promoting Transportation Efficiency and Congestion Reduction

Source: Thinkstock Photo

Smartphone apps are transforming mobility by improving access to transportation services, increasing mobility, and enhancing traveler engagement. These apps are spawning new businesses, services, and mobility models. For example, within a short period, app-based innovations leapfrogged the livery industry with services, such as Uber, Lyft, and Flywheel. Using smartphones to facilitate mobility is becoming the new norm. Smartphone apps have transformed the way that many travelers arrange for-hire vehicle services, plan for trips, or get real-time transportation information. This chapter includes a brief summary of existing smartphone application types, their features, and business models. It also provides a scan of transportation-related smartphone apps.

Types of Apps Impacting Transportation

There are four broad categories of apps impacting transportation. These categories are delineated by the apps’ primary function. The categories are: 1) mobility apps; 2) vehicle connectivity apps; 3) smart parking apps; and 4) courier network services (CNS) apps. For the non-mobility apps, the focus in this chapter is on their features that could impact mobility either now, such as by including information on the energy and health implications of transportation choices, or in the future as a result of demonstrating features that could be deployed in forthcoming mobility apps.

Mobility Apps

Mobility Apps are apps with a primary function to assist users in planning or understanding their transportation choices and may enhance access to alternative modes (Jones, 2013). While mobility apps may influence the user’s health, energy use and environmental impacts, or the total cost for transportation, these impacts are generally not recorded or stated.

The mobility app marketplace is both broad and deep. Accordingly, the primer further categorizes mobility apps into eight sub-categories.

The eight sub-categories are:

|

1. Business-to-Consumer (B2C) Sharing Apps are apps that sell the use of shared transportation vehicles from a business to an individual consumer, including one-way and roundtrip trip carsharing (e.g., Zipcar). |

|

2. Mobility Trackers are apps that track the speed, heading, and elapsed travel time of a traveler. These apps often include both wayfinding and fitness functions that are colored by metrics, such as caloric consumption while walking (e.g., GPS Tracker Pro). |

|

3. Peer-to-Peer (P2P) Sharing Apps are apps that enable private owners of transportation vehicles to share them peer-to-peer, generally for a fee (e.g., Spinlister). |

|

4. Public Transit Apps are apps that enable the user to search public transit routes, schedules, near-term arrival predictions, and connections. These apps may also include a ticketing feature, thereby providing the traveler with easier booking and payment for public transit services (e.g., Washington, DC’s Metrorail and Metrobus). |

|

5. Real-Time Information Apps are apps that display real-time travel information across multiple modes including current traffic data, public transit wait times, and bikesharing and parking availability (e.g., Snarl). |

|

6. Ridesourcing/TNC Apps are apps that provide a platform for sourcing rides. This category is expansive in its definition so as to include "ridesplitting" services in which fares and rides are split among multiple strangers who are traveling in the same direction (e.g., UberPOOL and Lyft Line). |

|

7. Taxi e-Hail Apps are apps that supplement street hails by allowing location-aware, on-demand hailing of regulated city taxicabs (e.g., Flywheel). |

|

8. Trip Aggregator Apps are apps that route users by considering multiple modes of transportation and providing the user with travel times, connection information, and distance and trip cost (e.g., Transit App). |

Vehicle Connectivity Apps

Vehicle connectivity apps are apps that allow remote access to a vehicle through an integrated electronic system that can be used in times of emergencies (e.g., locked out of a car, asking for help when in an accident, etc.). The vehicle connectivity apps are generally developed by auto manufacturers (e.g., General Motor’s OnStar).

Smart Parking Apps

Smart parking apps provide information on parking cost, availability, and payment channels. These apps are often paired with smart parking systems (e.g.,SFpark). These apps can be grouped as follows:

e-Parking is used broadly to describe the integration of technologies to streamline the parking process—from real—time information on space availability to simplified payment methods (Shaheen & Kemmerer, 2008). e-Parking apps provide important information regarding real-time parking cost and availability (e.g., Park Whiz) and accessible payment channels for parking (e.g., Parkmobile).

e-Valet is used broadly to describe a for-hire parking service where drivers use an app to dispatch valet drivers to pick-up, park, and return vehicles. In addition to parking, some of these services also offer fueling, cleaning, and other vehicle services. Valet Parking Apps provide the ease of on-demand valet parking with flexible drop off and return locations (e.g., Luxe).

Courier Network Services (CNS) Apps

Courier Network Services (CNSs) (also referred to as flexible goods delivery) are apps that provide for-hire delivery services for monetary compensation using an online application or platform (such as a website or smartphone app) to connect couriers using their personal vehicles, bicycles, or scooters with freight (e.g., packages, food). These apps can be sub-divided into two types:

Peer-to-Peer (P2P) Delivery Services are apps that enable private drivers to collect a fee for delivering cargo using their private automobiles (e.g., Roadie).

Paired On-Demand Courier Services are apps that allow for-hire ride services to also conduct package deliveries (e.g., UberEATS).

Non-Transportation Apps Deploying Strategies that May Be Useful for Transportation Apps

Additionally, three categories of non-transportation apps that deploy strategies that may be useful for future transportation apps include: 1) Health Apps; 2) Environmental / Energy Consumption Apps; and 3) Insurance Apps.

Health Apps

Health apps are apps that assist users with monitoring their health (e.g., calories burned, heart rate, etc.) and changing their behavior (e.g., exercising more and eating less), as well as understanding the health impacts of their transportation choices. Outside of mobility, health apps integrate health records, provide low-cost medical care, and create motivational communities to support good health (e.g., Map My Walk).

Environment / Energy Consumption Apps

Environment / Energy Consumption Apps are apps that track environmental impacts and the energy consumption of travel behavior. For example, these apps might predict the Greenhouse gas (GHG) emissions associated with different modal choices (e.g., Refill). This category also includes eco-driving/eco-routing apps that encourage environmentally conscious driving by providing real-time feedback on driving behavior as related to energy use, efficient routing information, or both. The category also includes apps that help locate car charging stations for electric cars (e.g., greenMeter). Outside of mobility, environment/energy apps are motivating users to reduce their material consumption and carbon footprint, along with raising environmental awareness.

Insurance Apps

Insurance apps generally aim to tie a traveler’s behavior, especially as a driver, to an individual’s insurance premiums and user experience. These apps enable users to opt for pay-per-mile automobile insurance (e.g., Metromile) and other usage-based pricing and incentives, related to distance, time-of-travel, and safe driving (e.g., Allstate’s usage-based insurance app). Outside of mobility, insurance apps are speeding the insurance claims process and reducing insurance fraud.

Smartphone App Characteristics

To complete this scan, the Transportation Sustainability Research Center (TSRC) at the University of California, Berkeley conducted a smartphone services and mobility literature review and Internet search.

TSRC did not review mobile operating systems that were not mainstream in the U.S. marketplace. As a corollary, operating systems specific to the Asian and European markets and apps that are not available in English were excluded from this analysis.

Additionally, public transit agency apps were omitted from this analysis. Many of these apps are not available on the app marketplace but instead are available for download directly from the public transit agency’s website. As such, an accurate census of these apps is difficult to obtain due to the vast number of public transit agencies nationwide.

However, where applicable, this literature scan references data from a Transportation Research Cooperative (TCRP) Synthesis 91, titled "Use and Deployment of Mobile Device Technology for Real-Time Transit Information" (Schweiger, 2011). While this synthesis report included a review of the websites of 276 U.S. transit agency members of the American Public Transportation Association (APTA), a similar methodology is not possible today. At the time of their survey, the open data standard commonly known as General (formerly Google) Transit Feed Specification (GTFS) had recently been developed and was not in widespread use. Since the development of GTFS open data, there has been a proliferation of innumerable public transit apps developed by third parties offering a variety of timetable, trip planning, and real-time app-based services.

Broadly speaking, the review covers two different scopes of apps. First, it covers the qualitative aspects and range of functionality across the entire universe of apps. Second, researchers completed a quantitative analysis of the more limited universe of apps with more than 10,000 total downloads.

In the entire universe of apps, the scan includes notable developments and new applications to account for recent innovations that may not have been available in the marketplace long enough to achieve a significant number of downloads. The findings of app cataloging are included, as appropriate.

In this more limited universe, the primer catalogs key data points available from the app marketplaces including operating system(s), geographic availability, business model, real-time information availability, gamification, and incentives. Eighty-three transportation-related smartphone applications across all four marketplaces, with more than 10,000 total downloads, were successfully identified. Applications with fewer total downloads were excluded from this analysis to focus on those in more widespread use.

The quantitatively surveyed smartphone apps can be categorized and characterized across six dimensions: operating system, geographic availability, business model, real-time information availability, gamification, and incentives. The apps within the high-download universe are characterized along these axes below.

Operating Systems

A review of applications by operating system found that the majority of transportation-related applications were only available on Android and iOS and thus were generally unavailable on Windows and Blackberry. Only 36% and 23% of transportation applications were available on Windows and Blackberry, respectively, compared to 86% and 80% availability on Android and iOS (TSRC, unpublished data, 2015). This suggests potential gaps in transportation app service availability on second-tier and emerging operating systems. A recent study of U.S. smartphone users by comScore found that as of January 2015, Android was the largest mobile OS with 53.2% of the market share, followed by Apple iOS with 41.3%. Microsoft, BlackBerry, and Symbian each had 3.6%, 1.8%, and 0.1% market share, respectively (Soomro, 2015). Thus, while the transportation apps are relatively unavailable on the Windows and Blackberry operating systems, the smaller market shares of these operating systems result in fewer users who are impacted by this gap. In turn, that low availability on those OSs may not significantly impact the transportation system.

Geographic Availability

Of the 83 transportation-related smartphone applications identified, 81 apps (98%) were available in North America, while 59 (71%) apps were obtainable in Europe (meaning that there is a fair amount of overlap). Fifty-three (64%) and 52 apps (63%) were available in Asia and Oceania (Australia/New Zealand), respectively. Sixty-two apps (75%) were available in developing regions of the world, including Africa, South America, and the Middle East. Smartphone applications not available in the U.S. were not assessed, and thus this review may overstate the regional availability of transportation-related applications in North America compared to other regions due to a sampling bias.

App Business Models

Independent and corporate application developers generally make their apps available in stores for users to download and install. Generally, a number of barriers exist within these closed-platform marketplaces. For example, most app stores only permit the sale and distribution of "approved" applications, and most stores also require developers to pay an annual subscription fee to submit apps and maintain their availability on a marketplace. In addition to downloading apps directly from a marketplace, a few app stores and mobile carriers permit the dissemination of an app through a hyperlink distributed through a web browser, text message, or multimedia message. Additionally, although their market share is negligible, a few mobile phone manufacturers have created their own app stores to market and sell third-party applications.

Not surprisingly, 93% of the transportation apps identified were offered free of charge (n=76/82). Seven percent of the transportation apps were only offered for purchase (n=6/82), and 17% offered a freemium version that has degraded features and/or the presence of advertising in contrast to the paid version (n=14/82). Freemium apps are free to download but also include in-app purchases for premium content, features, or the removal of advertising.

Boiling down this survey, the transportation apps can be classified into one of five common business models (Manoogian III, 2012). These include:

Sale of an app on an app marketplace;

Offering a free to download, periodic sale/subscription to use/update app (e.g., SaaS (software as a service), news services);

Offering a free app, with in-app purchase features or the close variant ‘freemium’ model;

Offering a free app supported through advertising; and

Offering a free app that provides access to paid services (e.g., Uber).

In the "freemium" model, an app developer offers an app free of charge but charges for premium features. For example, the premium version may have fewer or no advertisements. This model is becoming increasingly popular (Findlay Schenck, 2011). App marketplaces may prefer paid apps because they charge the app developers a commission on app fees while they do not receive any revenue from in-app advertising (Flynn, 2010). For example, Apple receives a 30% commission on apps sold in its marketplace (Flynn, 2010). App marketplaces do not make revenue from any advertising clicks unless the app uses an advertising platform that is also owned by the marketplace owner (i.e., Apple, Google, and Microsoft) (Flynn, 2010). Apps may also generate additional revenue by selling user data to third parties and individual transactions (e.g., Uber, Lyft, and Flywheel).

Generally, advertisers are more willing to pay for ad impressions than users are willing to pay for applications without advertising. A study by Cambridge University found that 73% of the apps on Android’s GooglePlay store were free of which 80% relied upon advertising revenue (Lunden, 2012). The study also found that only 20% of paid apps are downloaded more than 100 times (Lunden, 2012). Finally, the study found only 0.2% of paid apps are downloaded more than 10,000 times compared to 20% of free apps (Lunden, 2012). The Interactive Advertising Bureau estimated that mobile advertising revenue hit $19.3 billion in 2013, representing a 92% increase over the previous year (Interactive Advertising Bureau, 2014).

Real-Time Information Availability

The dispensing of real-time transportation data to smartphone users immediately after collection is the most important aspect of smartphone transportation apps supporting active travel demand management (ATDM). The availability of real-time information, such as traffic conditions, roadway incidents, parking availability, and public transit wait times, distinguishes newer apps from many early smartphone app services, such as those just providing static public transit timetables. Seventy-one percent of the transportation apps identified incorporated some type of real-time information into the application. The TCRP study of public transit data and apps found that 16% of APTA member agencies (45 of 276) provide some information on mobile devices with approximately 5% (15 of 276) providing real-time information (Schweiger, 2011). That number is sure to be much higher today.

Gamification and Incentives

Gamification is the use of game theory and game mechanics in the mobile app context to engage smartphone users to employ an app in a particular way (Herger, 2015; Marczewski, 2012). Apps using gamification structure the end user as a "player" within the gamified app design. The use of leaderboards, badges, levels, progress bars, and points are examples of gamified applications meant to encourage and/or discourage particular user behaviors (Herger, 2015) (Marczewski, 2012). For example, a user might receive points, increased rankings, or rewards for environmentally-conscious behaviors, such as carpooling or riding public transit instead of driving alone or using an alternative mode on a "spare-the-air" day. By employing these techniques, gamification uses the social aspects of competition, achievement, and status to encourage players to compete within an app. A 2011 survey of Global 2000 companies found that 70% of companies planned to use gamification as a marketing and customer retention strategy (Van Grove, 2011). As such, gamification represents one potential strategy for encouraging positive transportation behaviors in the mobility context.

Twenty-three percent of the transportation apps identified for this scan incorporated some form of gamified incentive, such as savings, raffles, or favicons (a special badge denoting a level of achievement (n=19/81). Loyalty points that could be cashed in for various rewards were the most common incentive representing approximately one-fifth (21%) of all incentives (n=4/19).

Gamification is also often closely associated and paired with "incentives." Mobile app incentives often involve the user being incentivized to give up something to get something else (Dabbs, 2013). App developers commonly recognize two drop-off periods in engagement/use: 1) from install to first use and 2) first to second use. As such, app incentives commonly target these two periods (Dabbs, 2013).

For transportation, the goal is to get users to switch their behaviors repeatedly, thereby precipitating a long-term impact on the transportation network. Thus, app-based incentives in a transportation context might mean giving up the convenience or privacy of driving alone but being rewarded to ride in a high occupancy vehicle lane that reduces travel time. It may mean riding public transit to work more frequently, which can be perceived as less convenient, in exchange for a transportation demand management subsidy or rider incentive. Rider incentives for ongoing behaviors can include discounts, coupons, gift cards, and other rewards.

With mobile applications, there are in essence two types of incentives: 1) incentives to download the app and 2) incentives to use the app (or more specifically, gamified incentives that encourage or discourage a particular type of application use or behavior that is tracked by the application).

Restrictions against incentives to download an app are designed to maintain the integrity of app download ratings and discourage the practice of encouraging a high number of incentivized app downloads that in turn artificially raises the download count and increases an app’s download ranking within an app marketplace. In July 2014, Apple began issuing rejection notices to app developers that offered incentives to users who post feedback about an app on social media (Bolluyt, 2014). Finally, as with all apps, continued customer engagement and retention are challenges following the collection of the incentive.

Mobility Apps

This section provides an example of each of the apps that impact transportation (mobility, parking, health, environment and energy, and insurance) identified in Section 3.1. Mobility apps are further broken down into the sub-categories, also noted in Section 3.1. The app examples are provided for illustrative purposes and do not represent an endorsement by the report authors or any other party involved in the development of the primer document.

Business-to-Consumer Sharing Apps

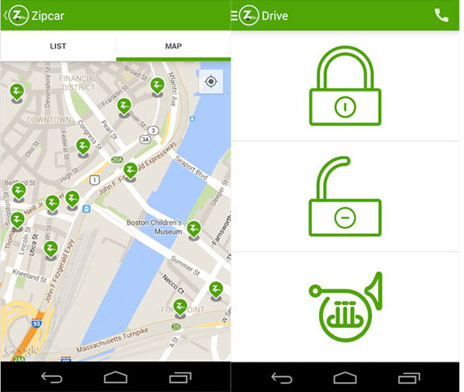

Zipcar (Figure 2) is an example of a Business-to-Consumer (B2C) carsharing service, which provides users short-term access to a fleet of cars owned by the business and not by individuals. Zipcar rentals are usually available in places like city centers, and they can be accessed by the hour or for the whole day. Fuel and insurance are also included, making it easier for the customer to use it instantly without owning a car. Zipcar operates in more than 150 U.S. cities and is also available in Austria, Canada, France, Spain, the UK, and Turkey. Other B2C apps in this space include City CarShare and Enterprise CarShare (both roundtrip carsharing); car2go and ReachNow (formerly DriveNow) (both one-way carsharing services); Scoot Networks (Scooter Sharing); and Bridj and Via (both microstransit services).

Figure 2. Screenshot depicts available Zipcar locations in San Francisco. Source: Google Play Store, March 2016

Mobility Tracker Apps

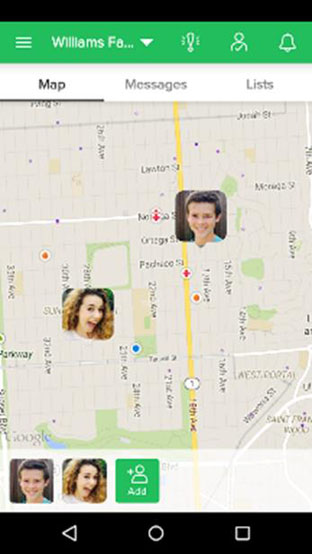

GPS Tracker Pro (Figure 3) is an example of a mobility app that allows users to find and track friends and get directions to their location. The app also allows users to track their own mobile phone, if the device is lost or stolen. Other apps in this space include: EmergenSee, Friend Locator: Phone Tracker, and GPS Phone Tracker Pro.

Figure 3. Screenshot of the GPS Tracker Pro mobility app. Source: Google Play Store, March 2016

Peer-to-Peer Sharing Apps

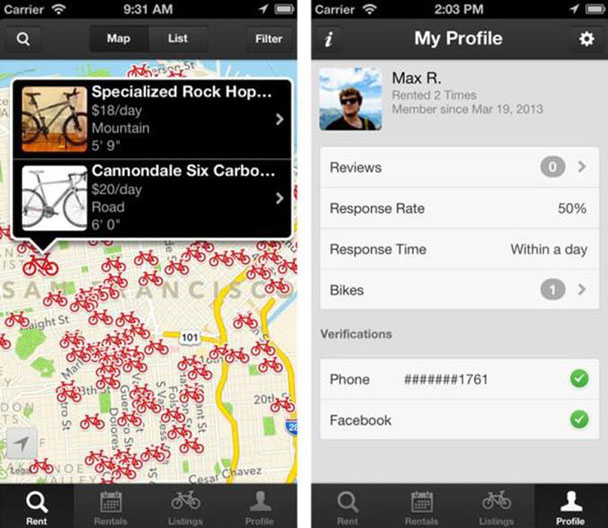

Spinlister (Figure 4) is an example of a peer-to-peer bikesharing service provider offering users short-term access to a fleet of privately-owned bicycles. The Spinlister app enables bicycle owners to list bikes for rent and users to locate available bikes for reservation and access using the smartphone application. As of June 2015, Spinlister was available in Amsterdam, Austin, Boston, Chicago, Denver, London, Los Angeles, Miami, New York City, Portland, San Francisco, and the Seattle metropolitan areas. Other apps in this space include: BitLock (Peer-to-Peer bikesharing) and FlightCar, Getaround, and Turo (formerly known as RelayRides) (all Peer-to-Peer Carsharing operators).

Figure 4. Screenshot depicting Spinlister peer-to-peer bicycle listings. Source: Google Play Store, March 2016

Public Transit Apps

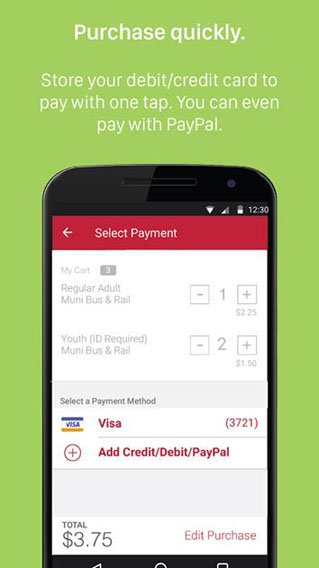

The MuniMobile public transit application (Figure 5) provides app-based fare payment and ticketing for the San Francisco Municipal Transportation Agency (commonly referred to as Muni). The app allows users to purchase and use fares and passes instantly on a smartphone without paper tickets. Other apps in this space include: D.C. Metrorail and Metrobus; MyTransit NYC Maps & Schedules; and New York MTA Subway Map (NYC).

Figure 5. MuniMobile app screenshots showing the user interface and mobile fare payment. Source: Google Play Store, March 2016

Real-Time Information Apps

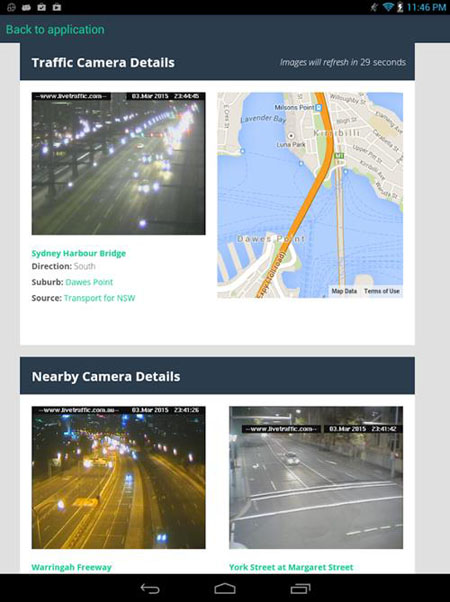

Snarl (Figure 6) is an example of a real-time information app for Australian drivers. The Snarl app provides free traffic and roadway incident updates and displays real-time traffic information and traffic hot spots. Additionally, the app features a driving mode enabling drivers to dynamically navigate around traffic and roadway incidents. Other apps in this space include: 511 Transit; Commute: Live Traffic Alerts; and Florida 511.

Figure 6. Screenshot of the Snarl app. Source: Google Play Store, March 2016

Ridesourcing Apps

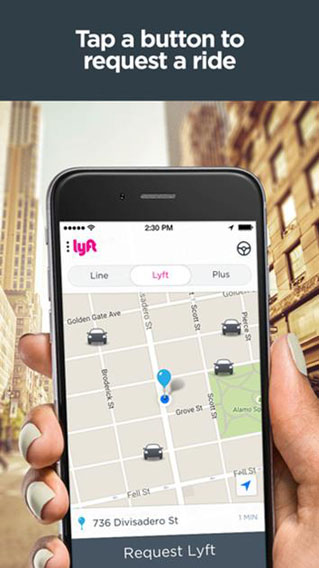

Lyft (Figure 7) is an example of a transportation network company application offering on-demand real-time for-hire vehicle services. The app uses an online platform to connect passengers with drivers using their personal vehicles for compensation. As of December 2015, Lyft was available in 31 states and the District of Columbia. Other apps in this space include HopSkipDrive and Uber.

Figure 7. Screenshot of the Lyft app. Source: Google Play Store, March 2016

Taxi e-Hail Apps

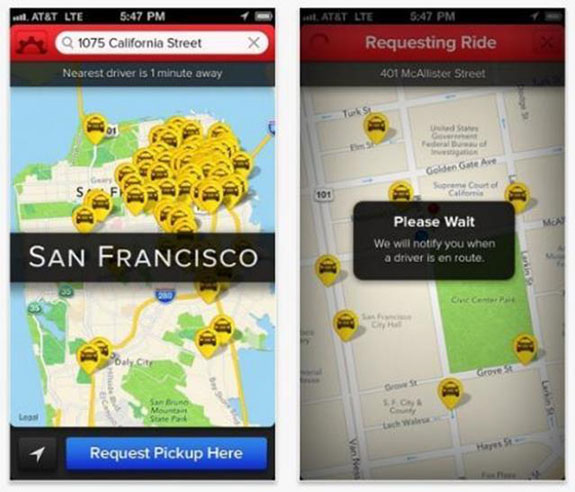

Flywheel (Figure 8) is an example of a mobile application for the taxi industry that connects passengers with taxi drivers. Flywheel enables passengers to e-Hail taxi drivers real-time, track taxi arrival via GPS, and pay their taxi fares from their smartphones. As of June 2015, Flywheel was available in the Los Angeles, Sacramento, San Diego, San Francisco, and the Seattle metropolitan regions. Other apps in this space include: AeroTaxi, Bandwagon, Easy Taxi, Gett, Hailo, and mytaxi.

Figure 8. Screenshots of the Flywheel e-Hail taxi app. Source: Mashable.com, March 2016

Trip Aggregator Apps

The "Swiftly App" (Figure 9) is an example of an all-in-one multi-modal aggregator displaying public transit options, timetables, and real-time arrival and departure information (in select regions). Additionally, the app can display shared mobility information for more than 90 metropolitan regions in seven countries on three continents. Other apps in this space include: GoLa (Xerox)and Transit App.

Figure 9. Screenshots from "Swiftly" app. Source: Swiftly, March 2016

Vehicle connectivity Apps

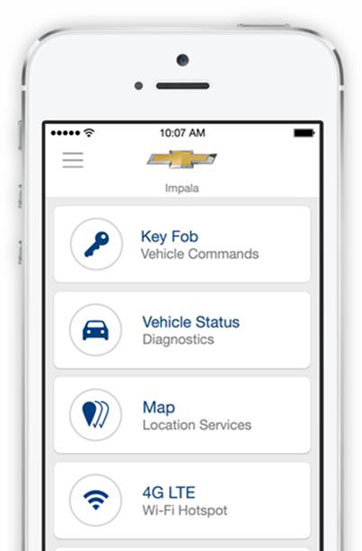

OnStar (Figure 10) is a vehicle connectivity app by the General Motors group that provides subscription-based communications, in-vehicle security, hands-free calling, turn-by-turn navigation, and remote diagnostics systems. It provides emergency services like "Automatic Crash Response," "Crisis Assist," and "Roadside Assistance." Additionally, it has sophisticated security features, such as "Stolen Vehicle Assistance,"including "Remote Ignition Block" and "Stolen Vehicle Slowdown." Other apps in this space include: Lexus Enform App Suite, M-B mbrace, and My BMW Remote.

Figure 10. Screenshot of GM’s OnStar app. Source: Apple iTunes Store, March 2016

Smart Parking Apps

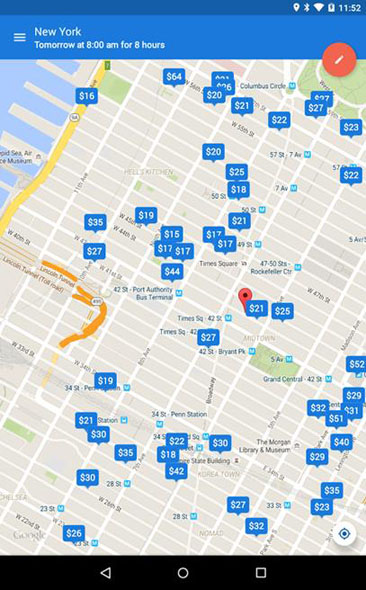

The ParkWhiz app (Figure 11) is an example of an e-parking app that allows drivers to search for available parking, view pricing, and make reservations at over 2,000 parking lots across the United States. Additionally, ParkWhiz customers are offered a discount for booking parking in advance. Other apps in this space include: Best Parking, ParkMe, and SpotHero.

Figure 11. Screenshots of the ParkWhiz app. Source: Google Play Store, March 2016

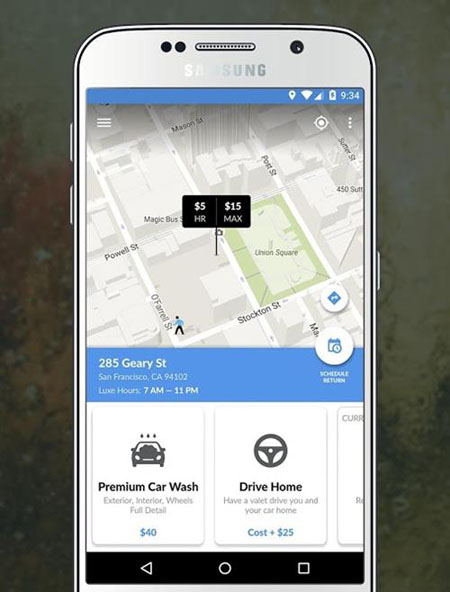

Luxe (Figure 12) is an example of an eValet parking app where car owners can hire experienced valets to park their car. There is the added flexibility of selecting different drop-off and return locations; some additional services offered by Luxe valets are washing and fueling of the car. As of October 2015, Luxe was available in nine U.S. cities: San Francisco, Los Angeles, Chicago, Seattle, Boston, Austin, New York, Philadelphia, and Washington D.C. Other apps in this space include: 1-2 Car Valet Services and Valet.

Figure 12. Screenshot of Luxe app. Source: Google Play Store, March 2016

Courier Network Services Apps

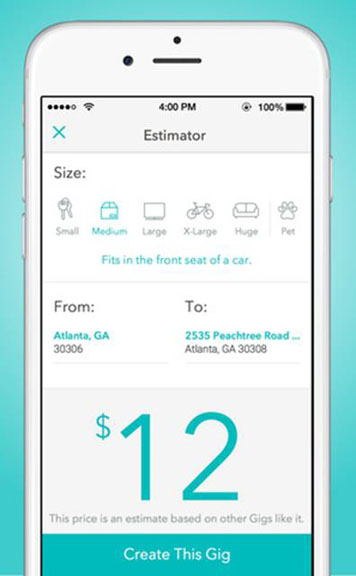

Roadie (Figure 13) is an example of a cargo delivery app permitting peer-to-peer delivery. Similar to ridesourcing, Roadie offers on-demand, real-time for-hire cargo services. The app uses an online platform to connect shippers with independent delivery drivers using their personal vehicles for compensation. As of March 2015, Roadie was available in all 50 states (Roadie, 2015). Other apps in this space include: DoorDash, Postmates, Shipbird, and Shyp.

Figure 13. Screenshots of the Roadie app. Source: Apple iTunes Store, March 2016

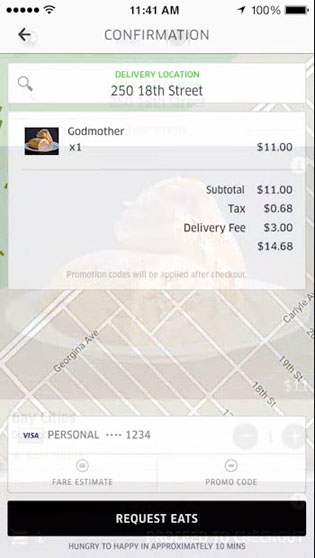

The second CNS model that has emerged is one in which for-hire ride services (e.g., ridesoucing) also conduct package deliveries. Uber has entered the paired on-demand courier network services market with UberEATS (food), UberRUSH (in New York City), and UberCARGO (in Hong Kong). UberEATS allows users to order their food from nearby restaurants and get it delivered on-demand and within a few minutes (three to 10 minutes in urban areas). As of April 2016, UberEATS was available in 12 cities around the world: Atlanta, Austin, Chicago, Dallas, Houston, Los Angeles, New York, Paris, San Francisco, Seattle, Toronto, and Washington D.C.

Figure 14. Screenshot for UberEATS app. Source: UberEATS Official Website, March 2016

Health Apps

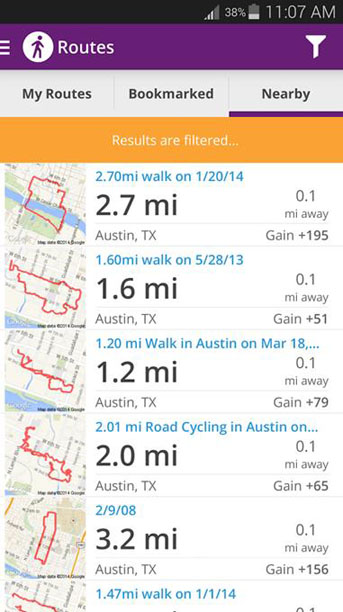

Map My Walk is a health app (Figure 15) aimed at encouraging walking by providing GPS guided walking and health tracking features, such as distance and time walked, calories burned, and diet tracking. Other apps in this space include: Pedometer, Walkmeter GPS Pedometer, Google Fit and Microsoft Health.

Figure 15. Screenshots from the Map My Walk app. Source: Google Play Store, March 2016

Environment and Energy Consumption Apps

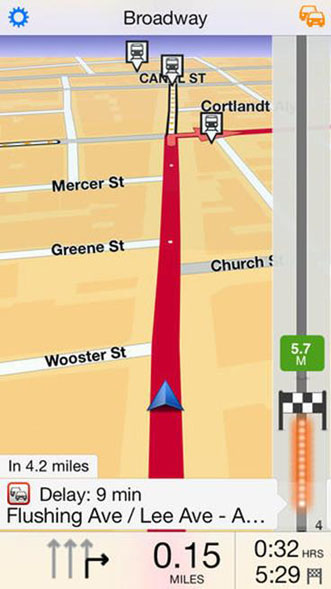

TomTom is a navigation app (Figure 16) with an eco-friendly routing feature that allows drivers to select the most fuel-efficient routes.

Figure 16. TomTom app depicting its navigation routing feature. Source: Apple iTunes Store, March 2016

Another example for environmental and energy consumption is greenMeter (Figure 17). It is an eco-driving smartphone application that computes a driver’s vehicle power, fuel usage, and driving characteristics. The app uses these metrics to evaluate a user’s driving and advises motorists on how to increase their efficiency, reduce fuel consumption, and reduce vehicular emissions. The app displays real-time results providing the driver with instantaneous driving feedback. Other apps in this space include: EcoDriving and Geco.

Figure 17. A screenshot showing the greenMeter app. Source: Apple iTunes Store, March 2016

Insurance Apps

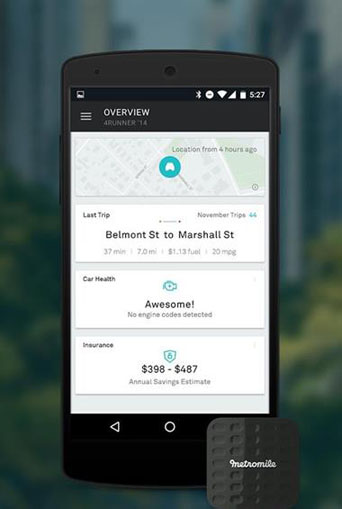

With the Metromile insurance app (figure 15), customers can "plug-and-play" a GPS and cellular-activated box into the vehicle’s diagnostic port, which reads various metrics and diagnostic codes from the customer’s vehicle and relays the info to the Metromile app on the customer’s smartphone. Using the Metromile app, customers can select their deductible and view their insurance bill, which combines a flat base rate with a per mile rate based on actual vehicle usage. In addition to tracking insurance savings, the app also allows customers to track miles per gallon, fuel cost, and driving times. Metromile advertises that customers who drive less than 5,000 miles per year can save an estimated 40 to 50% off their insurance premiums. As of April 2016, Metromile insurance was available in California, Illinois, New Jersey, Oregon, Pennsylvania, Virginia, and Washington. Other apps in this space include: Geico, Liberty Mutual, Progressive, and The General.

Figure 18. Metromile diagnostic plug and Metromile app depicting trip information. Source: Google Play Store, March 2016

Summary

In summary, mobility, vehicle connectivity, smart parking, courier network services, health, environment and energy consumption, and insurance apps are transforming mobility, improving access to transportation services, enhancing traveler engagement, and spawning innovative businesses, services, and mobility models. Android and iOS are the most common operating systems. Most mainstream transportation apps have limited availability on less common second tier operating systems, such as Windows and Blackberry. The vary majority of apps are offered free of charge in contrast to only 7% offered for purchase. Some of the free apps (17%) offer a freemium version with enhanced features or a user experience without advertising (n=14/82). Anecdotally, advertisers seem to be more willing to pay for ad impressions than users are willing to pay for applications without advertising and other premium services. The use of game theory and game mechanics, such as gamification and incentives, remain important elements of app design. Nearly one quarter of the transportation apps identified for this scan incorporated some form of gamified incentive. Incentives within mobile applications, such as incentives to download the app and incentives to use the app (or more specifically, gamified incentives that encourage or discourage a particular type of application use), are common strategies being employed by app developers to enhance user engagement and encourage user retention across a wide array of transportation applications. The next chapter reviews the behavioral and economic impacts of these applications.