National Freight Strategy Framework

Section III. Trends and Challenges

Many of the themes heard from the Freight Economy roundtables match up with the trends and challenges identified by DOT in the draft Plan. The draft Plan identified six key trends and challenges affecting goods movement and our Nation's freight system that were identified based on a review of state freight plans that States have prepared in recent years, including plans prepared after MAP-21 was enacted in2012, public listening sessions on freight conducted in 2013 and 2014 by DOT modal Administrators and Deputy Administrators, and through a series of public meetings of the National Freight Advisory Committee (NFAC), a 47-member federal advisory committee chartered in 2013 by DOT Secretary Ray LaHood and continued under Secretary Anthony Foxx. The NFAC provided feedback on several DOT initiatives, including the provision of "Proposed Recommendations to U.S. Department of Transportation for the Development of the National Freight Strategic Plan" and specification of draft freight networks, beginning with the draft Primary Freight Network. The Primary Freight Network was a MAP-21 initiative intended to identify where freight moves; however, because it was limited to highway miles, it failed to address the multimodal and interdependent nature of freight movement in the U.S., of which highway-based goods movement is only one component. This feedback was instrumental in the development of the draft Plan and helped shape the DOT's formulation of a more comprehensive preliminary multimodal freight network which was published as part of the draft Plan.

The following Trends and Challenges from the draft Plan remain relevant today and, in our minds, should inform the development of the National Freight Strategic Plan under the FAST Act. As noted in the draft Plan, "The NFSP discusses six major trends affecting freight transportation and the challenges they present. If our freight transportation system is to continue to enable our way of life and serve as a competitive advantage for the U.S. economy, we must confront these challenges and seize on the resulting opportunities." An updated discussion of these six trends and challenges is provided here:

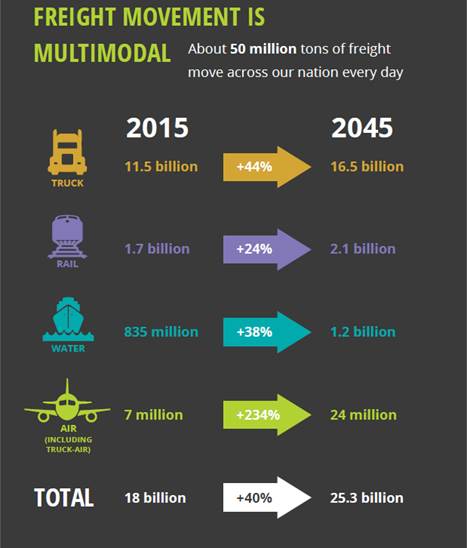

Expected Growth in Freight Tonnage. The U.S. economy is expected to double in size over the next 30 years. By 2045, the nation's population is projected to increase to 390 million people, compared to 320 million in 2015. Americans will increasingly live in congested urban and suburban areas (megaregions), with fewer than 10 percent living in rural areas by 2040 (compared to 16 percent in 2010 and 23 percent in 1980). To support our projected population and economic growth, freight movements across all modes are expected to grow by roughly 42 percent by the year 2040. For example, container traffic at ports will likely increase steadily as the volumes of imports and exports transported by our freight system more than double over this period. Air freight is expected to triple in response to demand for the rapid movement of high-value merchandise, while multimodal shipments are predicted to more than double.

The freight tonnage numbers cited in future reports will change as more current models and data are applied. Although fuel supply, fuel prices, automation, post-Panamax vessels, trade policies and other factors may alter production levels, trading partners, and shipping patterns, the United States can expect to continue to see a strong and growing need for intermodal and multimodal shipping services. As growth occurs in the various modes of transportation, communities will feel some aspects of this growth in negative ways unless sufficient planning is done to put operational, infrastructure, safety, and environmental improvements in place ahead of time.

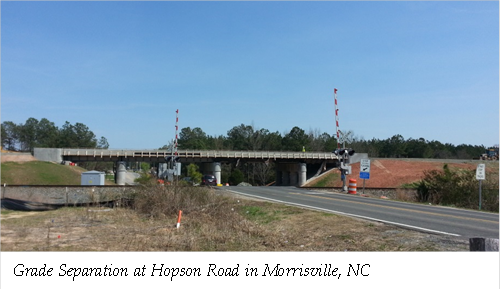

Whether a community uses Global Positioning System (GPS) probe data to identify critical areas of highway congestion affecting or caused by freight activity, or applies rail car data provided by rail carriers to develop public/private investment strategies for new grade separation projects, or works with the State DOT to implement a delivery optimization system to reduce empty truck movements and idling at ports and intermodal facilities, there are tools and data ready for use that will help the public sector anticipate and plan for this growth. Some of these innovative approaches were included in applications for the Smart City Challenge of 2016 – the winning proposal included a freight component focused on reliable routing and traffic condition information to enable Smart Logistics.

The emphasis by DOT in recent years on the President's Ladders of Opportunity initiative has also helped identify impediments as well as opportunities where ways to use transportation can provide for improvements and investment to improve the quality of life; increase access to jobs, schools, healthcare; and meet other needs of citizens in communities across the United States

Projects to cap highways and provide pedestrian and bike linkages across busy freight corridors, or to recess train tracks through active business districts, such as the well-regarded Alameda Corridor in California, are making a difference today. Projects to identify truck parking needs generated by port activity might require operational adjustments and facility improvements, such as the expanding hours of port operations or improving infrastructure to allow staging of trucks in a freight-appropriate area away from residential streets and highway ramps. Regardless of the type of solution, more strategic planning, partnership with the private sector, and continued strategic investment will help prepare for the future.

Underinvestment in the Freight System. Numerous studies have identified the need for more and better-directed investment in freight infrastructure. Freight projects can be costly to undertake. There are seldom public-sector funds dedicated to them and they do not compete well with non-freight projects for general funding because of the manner in which public investments are evaluated, but these projects can provide significant public benefits. As noted below, they often involve multiple transportation modes, jurisdictions, and stakeholders, each of which may have different objectives or operate under different investment timeframes. There may be adequate private sector financing to invest in privately owned freight railroad and pipeline infrastructure which could help to reduce some of the financial burden necessary for the public to incur. However, these privately-funded investments may not include features that specifically generate public benefits unless the private sector can pay for these features through higher freight rates or the public sector directs funding to pay for them. Further, there is growing recognition that the workforce needed to build, maintain, and operate the system—including truck drivers, railroad engineers, skilled planners, and others—will be insufficient unless further investment is made in education, recruitment, and training.

The FAST Act authorized $10.8 billion over five years in new funding specifically for freight and freight-related infrastructure, operational improvements and planning. This amount includes $6.3 billion for the National Highway Freight Program (NHFP), which is distributed to States by formula, and $4.5 billion in funding for competitive discretionary grants under the new FASTLANE (Fostering Advancements in Shipping and Transportation for the Long-term Achievement of National Efficiencies) program to support both highway and other modal freight needs, including for rail and port facilities, intermodal connectors, and railroad grade separations.

While these new funding programs are unprecedented in their scope and eligibility, indications from just the first round of FASTLANE grant awards demonstrate widespread need for funding that far exceeds the budgeted capacity of the new programs. More than 212 applications totaling $9.8 billion competed for just $757 million in available FASTLANE grant funds after the application of necessary obligation limitations for the 2016 round of awards. A long-standing backlog of transportation infrastructure improvements exists today and is likely to continue to generate aggressive competition for discretionary funding. Surveys conducted by transportation stakeholder organizations have also identified tens of billions of dollars in additional freight-beneficial investment that could be made over the next 10 years.

The FAST Act requires States to produce State Freight Plans that include Freight Investment Plans by December 4, 2017 if they are to continue to qualify for NFSP funds. Once States complete their qualifying State Freight Plans/Freight Investment Plans it will be better understood how these funds are intended to be used by individual States and what constraints influence those funding decisions (e.g., program requirements, amount of funding, States' ability to match the funds, multimodal needs). DOT anticipates, however, that even the predictable, guaranteed formula funding authorized for States in the new NHFP can support only a limited number of the total needed freight and freight-related projects over the five-year span of the FAST Act.

Difficulty in Planning and Implementing Freight Projects. Most of our publicly-owned freight system (apart from the waterway system) is planned and managed by State and local governments, as well as by metropolitan planning organizations (MPOs), port authorities, and other public entities. These agencies must work with each other and a broad array of Federal and private sector partners, including freight railroads, trucking companies, ocean carriers and terminals, and pipeline companies. This decentralized approach has many benefits, including greater flexibility to identify and react to local needs. But when it comes to freight projects, especially those with national-level impacts, this approach presents a number of challenges such as fragmented decision-making.

The MAP-21 and FAST Act requirements for State Freight Advisory Committees stopped short of making these Committees mandatory at the State DOT level, and instead directing the DOT to encourage the development of these bodies. The leadership and staff of DOT has done so, encouraging both the creation and active engagement of these Committees in numerous forums, publishing a "Guidance on State Freight Plans and State Freight Advisory Committees" in the Federal Register, holding webinars and establishing strategic implementation goals to track the existence and frequency of communication of these valuable stakeholder communication structures.

DOT expects that the quality of the State freight planning and investment decisions will be higher in States with active and diverse State Freight Advisory Committees. Those with active involvement from regional stakeholders and MPOs are generating innovative planning tools, using data to support their analyses and planning, prioritizing issues for action and projects for investment, leveraging private sector investment and engagement and generally raising the bar for public sector activities to support the needs of both freight system operators and the communities they serve.

Fortunately, the provision of discretionary funds and eligibilities for formula funding has engendered partnering on specific projects and the formation of multi-state coalitions for discrete freight planning and investment purposes. Hopefully, more States will join the 35 that have established State Freight Advisory Committees and learn to use them in constructive ways that go beyond the development of State Freight Plans and identification of network segments.

-

Continued Need to Address Safety, Security, and Resilience. Recent trends show impressive improvements in freight safety. There was a 27 percent increase in freight ton-miles for all surface modes between 1990 and 2011, but freight-related fatalities across all modes declined by 33 percent over that same period. However, more progress must be made. In 2013, 543 people died in incidents associated with freight rail, vessel, and pipeline operations. In 2013, 3,964 people were killed in crashes involving large trucks. Specific risks associated with our physical and cyber infrastructures—ranging from transport of crude oil by rail to climate change—create vulnerabilities that must be addressed and mitigated.

Along with the widespread implementation of Positive Train Control for the railroad networks (required by statute), automated vehicles (including automated trucks, drones and other self-propelled and self-guided vehicles) are likely to prove someday to be a game-changer for safety, offering opportunities to greatly shrink the number of freight transportation-related fatalities and injuries even as vehicle miles traveled increases with freight growth. Truck parking needs may also change with the advent of automated vehicles. These technologies will also benefit the environment and the reliability and resiliency of the freight system. The DOT's recently released Beyond Traffic framework, offers a vision into some of these new frontiers, which hold exciting promise to address some of the issues and limitations that constrain our nation's success.

In the meantime, the DOT continues to identify areas for improved technical assistance, investment, regulatory oversight, guidance and enforcement to protect people, assets and the environment from the negative impacts of goods movement. Truck parking capacity and information on spaces remains a major focus of DOT, which fostered the creation of a National Coalition on Truck Parking in 2015 and joined with key partner organizations including American Association of State Highway and Transportation Officials (AASHTO); American Trucking Associations (ATA); Owner-Operator/Independent Drivers Association (OOIDA); National Association of Truck Stop Operators (NATSO); and Commercial Vehicle Safety Alliance (CVSA) to host four regional meetings around the country and has plans for continued dialogue, solution-building and attention to the issues.

-

Increased Global Economic Competition. Our economy is increasingly reliant on international trade. Imported and exported goods carried are being transported by ever larger ships. Significant amounts of goods also move by air and by truck and train through land border crossings with Mexico and Canada. Ports must address congestion, dimensional, and equipment-shortage challenges generated by bigger, new-generation container ships as well as the larger bulk ships now able to transit the expanded Panama Canal with agricultural and energy exports. Port authorities are investing to modernize their facilities by dredging harbors, raising bridges, automating and expanding container yards, purchasing larger ship-to-shore cranes, and improving roads and rail connections to surface infrastructure. Where port congestion occurs, supply chains are increasingly able to react by changing supply sources, routes, and transportation modes. Even so, notable incidents of severe congestion (particularly at ports) have occurred over the last several years.

Land border crossings also face rising commercial traffic and congestion. From 1995 to 2012, surface trade between the United States and Mexico quadrupled from approximately $100 billion to $400 billion per year. Additionally, we have recently experienced a surge in domestic energy production and increased domestic manufacturing and assembly work. Ensuring that these products can efficiently reach both domestic and international markets is critical to the long-term success of these industries.

Whether the needs are driven by international trade or by near-shoring and increased domestic production, our ports, highways, rail lines, airports, pipelines and intermodal connectors will continue to need investment to carry agricultural produce, manufactured products and raw materials to their final destination. Supply chain networks continue to change and have experienced significant investment to meet demand rapidly in areas such as energy. Demands on our freight systems will continue to grow, and potential disruptions to the supply chain from natural and or manmade events require a transportation network that is flexible, robust and resilient. All components of our freight network will likely be needed at one time or another to and from any given geographic location, reflecting changing fuel prices and market destinations and providing resilience. DOT should continue to support initiatives to invest in infrastructure and human capital at our seaports and land ports of entry/international border crossings to ensure the ongoing safety, security, and efficiency of movement of our trade goods.

Application and Deployment of New Technologies. The freight industry is experiencing a technological revolution through many private sector initiatives as information and communications technologies are applied to optimize global supply chains. Better data collection, management, and analysis capabilities will enable faster and more accurate analysis of demand patterns, freight routes, travel times, and infrastructure capacity. Advanced automation will increase productivity in the freight industry and change the skill sets needed to work in freight, requiring skilled workers to maintain and operate new technologies. Technology will also be used to automate and expedite inspection processes, improving safety and lowering costs. Growth in autonomous vehicle technologies may soon transform freight transportation, allowing for increased throughput and more reliable trips on existing capacity. Technologies such as positive train control and the Federal Aviation Administration's Next Generation air traffic control systems should also provide additional benefits. Additionally, improvements in global positioning systems (GPS) allow for increased potential use of GPS-based freight/goods delivery systems employed by the public and private sectors.

The Federal and State DOTs' capacity to understand, support, guide, and regulate where necessary any new technologies depends largely upon research and data. Changing vehicles and new operations technologies will require additional study, and the demand for data-driven solutions would greatly benefit from additional Federal investment in R&D. The FAST Act provided continued support for transportation research through the University Transportation Research Centers Program, but did not address all of the significant data and research needs for freight transportation. As new technologies come on line from an innovating private sector, DOT must be ready to understand and guide the impacts that will be felt by the rest of the system. With the end of programs like the NCFRP and SHRP2, there are few opportunities to fund and communicate with the academic and research community to anticipate and address both the beneficial and the undesirable impacts of emerging technologies.

The many successful programs already in place to improve freight planning and investment rely on the provision of and modernization of the Freight Analysis Framework and the National Performance Management Research Data Set (NPMRDS or "probe" data). Additional new resources must be identified in the coming years to ensure that the federal role – that of safety and security, protections for the citizenry and the environment—can be sustained and ensured, and keep pace with innovation.

In addition, the public and private sectors would be well-served to coordinate with each other to facilitate improved freight data collection and analysis to address freight efficiency and safety issues as part of State Freight Plans as well as in more localized plans prepared by MPOs, port and airport authorities, and other intermodal freight facility operators. This is an important area that could be addressed in the next Plan.