The Freight Technology Story: Intelligent Freight Technologies and Their Benefits

For More Information: https://ops.fhwa.dot.gov/freight/index.cfm

Contact Information: FreightFeedback at FreightFeedback@dot.gov

This publication is an archived publication and may contain dated technical, contact, and link information.

U.S. Department of Transportation

Federal Highway Administration

Office of Freight Management and Operations

Room 3401

400 Seventh Street, SW

Washington, DC 20590

Phone: 202-366-9210

Fax: 202-366-3301

Web site: https://ops.fhwa.dot.gov/freight/

Toll-free help-line: 866-367-7487

June 2005

FHWA-HOP-05-030

EDL 14118

Table of Contents

- Report Documentation Page

- Quality Assurance Statement

- Executive Summary

- Introduction

- I. The Innovation and Implementation Process

- II. The Reach of Intelligent Freight Technologies

- III. Intelligent Freight Technology Benefits

- IV. Results and Conclusions

- Appendix A. References and Points of Contact

- Appendix B. Acronyms

Report Documentation

1. Report No. FHWA-HOP-05-030 |

2. Government Accession No. | 3. Recipient's Catalog No. | |

4. Title and Subtitle The Freight Technology Story: Intelligent Freight Technologies and Their Benefits |

5. Report Date June 2005 |

||

| 6. Performing Organization Code: | |||

7. Author(s) Michael Wolfe and Kenneth Troup |

8. Performing Organization Report No. | ||

9. Performing Organization Name and Address The North River Consulting Group |

10. Work Unit No. (TRAIS) | ||

11. Contract or Grant No. |

|||

12. Sponsoring Agency Name and Address U.S. Department of Transportation |

13. Type of Report and Period Covered |

||

14. Sponsoring Agency Code |

|||

| 15. Supplementary Notes | |||

16. Abstract The U.S. Department of Transportation's (DOT's) Federal Highway Administration (FHWA) and the Joint Program Office (JPO) work collaboratively with private industry to identify technologies that improve efficiency and productivity, increase global connectivity, and enhance freight system performance. FHWA and JPO also support their testing and evaluation in the field. Independent evaluation of technology performance, costs, and benefits is a key part of DOT's efforts. This report shares information about the state of the art and the adoption of intelligent freight technologies by industries and their customers. Specifically, the report discusses the innovation and implementation processes for intelligent freight technologies, triggers for and barriers to deployment, the types of intelligent freight technologies and their benefits, and field operational test results. Today, intelligent freight technologies are used to improve freight system efficiency and productivity, increase global connectivity, and enhance freight system security against common threats and terrorism. These technologies are currently deployed in several areas: 1) asset tracking, 2) on-board status monitoring, 3) gateway facilitation, 4) freight status information, and 5) network status information. |

|||

17. Key Words intelligent freight technologies, asset tracking, on-board status monitoring, gateway facilitation, freight status information, network status information, field operational tests, benefits, implementation |

18. Distribution Statement |

||

19. Security Classification (of this report) Unclassified |

20. Security Classification (of this page) Unclassified |

21. No of Pages 66 |

22. Price |

Form DOT F 1700.7 (8-72) Reproduction of completed page authorized

Quality Assurance Statement

The Federal Highway Administration (FHWA) provides high-quality information to serve Government, industry, and the public in a manner that promotes public understanding. Standards and policies are used to ensure and maximize the quality, objectivity, utility, and integrity of its information. FHWA periodically reviews quality issues and adjusts its programs and processes to ensure continuous quality improvement.

Executive Summary

This report discusses advancements in information technologies and telecommunications that have improved the efficiency, reliability, and security of freight transportation and increased global connectivity. It also describes how these technologies work and the benefits they deliver, including the results from intelligent freight technology field operational tests (FOTs) and other initiatives.

The Innovation and Implementation Process

Successful technology innovations follow a four-step process: (1) A bright idea that sets the stage for (2) tests and demonstrations. Successful results and a strong business case then combine to move market leaders to (3) initial adoption and deployment. Once the viability of a new technology is well established and its benefits are clear, (4) wide adoption will occur. Step 4 cements the transition of the bright idea to market penetration. However, the biggest hurdle in the process is building sufficient confidence in the technology, through tests and demonstrations, to prompt initial adoption—the move to step 3.

Three principal triggers move businesses to implement intelligent freight technologies:

- Pursuit of competitive advantage is likely to be the main trigger for market leaders and innovators as they seek to improve their firm's standing and profitability in the marketplace. The critical element is a credible business plan.

- Keeping up with competitors is the apparent catalyst for market followers. Success by market leaders progressively erases doubt and skepticism about new solutions and shifts the debate in other firms from whether to when and how.

- Compliance may arise from customer demands or government regulations. Commercial compliance comes into play when customers demand innovation as a condition of doing business. Regulatory compliance is self explanatory.

There are also several barriers to the acceptance of new technologies and operating practices:

- Skepticism about efficacy is the fundamental concern.

- Immature standards can deprive vendors and users of a common and fair template for deployment.

- Concerns about negative operational impacts, such as the need to replace batteries in the field, may mobilize opposition from service providers.

- The credibility of the business case is often the dominant concern, with the strongest skepticism reserved for estimates of benefits.

- Exposure to government actions or inaction adds barriers to some intelligent freight projects that depend on government funding to deploy common infrastructure or affects decisions on which path to take.

- Concerns about the loss of proprietary information may keep some firms from committing to new technologies and networks.

The Reach of Intelligent Freight Technologies

Intelligent freight technologies monitor and manage physical assets and information flows. Five clusters of technologies can be applied individually or in tailored combinations:

- Asset tracking uses mobile communications, radio frequency identification (RFID), and other tools to monitor the location and status of tractors, trailers, chassis, containers and, in some cases, cargo.

- On-board status monitoring uses sensors to monitor vehicle operating parameters, cargo condition, and attempts to tamper with the load.

- Gateway facilitation uses RFID, smart cards, weigh-in-motion, and nonintrusive inspection technologies to simplify and speed operations at terminal gates, highway inspection stations, and border crossings.

- Freight status information uses web-based technologies and standards to facilitate the exchange of information related to freight flows.

- Network status information uses services to integrate data from cameras and road sensors and uses display technologies to monitor congestion, weather conditions, and incidents.

The U.S. Department of Transportation (DOT) began its FOT program in the late 1990s, using public/private cost sharing and formal independent assessments to test high-potential combinations of intelligent freight technologies. The Freight Technology Story integrates information from all six DOT field operational test programs and also pulls together the highlights of several non-DOT field test programs.

U.S. Department of Transportation ITS Field Operational Tests

| Test | What It Tests |

|---|---|

| Electronic Supply Chain Manifest | Smart cards, biometrics, and electronic manifesting for air freight terminal access |

| Pacific Northwest FOTs | Electronic seals, truck transponders, web-based tracking |

| Freight Information Real-Time System for Transport | Electronic tracking of chassis and containers and web-based port info system |

| Cargo*Mate | Wide-area chassis tracking and e-seal integration |

| Freight Information Highway and Chassis Tracking | Web portal data exchange and wide-area chassis tracking |

| Hazardous Materials Safety and Security | Tests of multiple technologies including asset tracking to monitor four types of hazmat shipments and show improvements in safety and security |

Intelligent Freight Technology Benefits

Successful deployments of intelligent freight technologies yield three types of benefits: 1) private sector, 2) public sector, and 3) freight network.

Private Sector Benefits

Increases in efficiency and productivity are key private-sector benefits that can be measured with relative ease. The Hazardous Materials (Hazmat) Safety and Security FOT reported asset-tracking savings ranging from $7,866 to $15,222 per tractor per year. The Electronic Supply Chain Manifest (ESCM) FOT evaluators documented up to $16.20 in savings per airfreight shipment from faster manifest preparation and security processing. The Cargo*Mate evaluation estimated annual benefits to carriers of $210.35 per container chassis. This class of benefits enables operators to deliver a given level of service with fewer resources.

Improved reliability and service are other private-sector benefits that help users of freight transportation services. Better schedule adherence, speed, and operational flexibility translate into inventory management and customer service-related benefits. Two small tests outside the DOT FOT program—the U.S. Trade Development Agency's Bangkok Efficient and Secure Trade project and the industry-funded Smart and Secure Tradelanes initiative—reported about $400 per container in benefits to shippers from better asset tracking.

The private sector also benefits from enhanced shipment and service integrity, which apply to both freight system users and providers. A dray operator in the Cargo*Mate FOT captured a "pre-9/11" benefit related to potential equipment abuse when missing chassis dropped from four percent of the fleet to zero.

Public Sector Benefits

By smoothing traffic flows around major freight hubs, intelligent freight technologies can deliver tangible environmental and quality-of-life benefits and help increase the effective capacity of transportation infrastructure. Public agencies also derive direct efficiency and productivity benefits from successful deployments. For example, state highway enforcement agencies can increase the number of trucks that an inspector processes in an hour, and Customs officials can screen more inbound containers and cross-border trailers. Successful deployment of these technologies can yield significant safety benefits as well. Some technologies permit agencies to focus their enforcement attention on problem areas, yielding proportionally greater benefits. On-board vehicle sensors may reduce the number of incidents by calling attention to defective brakes or tires. The Hazmat FOT also reported better emergency response, as evaluators found that rapid notification of incidents could lower environmental mitigation costs and potential public exposure to these releases. Finally, the public sector could benefit from intelligent freight technologies in the area of national security. To the degree intelligent freight technologies enhance security against terrorism, they contribute to the society as a whole.

Freight Network Benefits

Freight network benefits are qualitatively different than the intelligent freight technology benefits discussed above; the focus shifts from results achieved by individual firms and projects to large-scale system impacts. Higher quality, lower cost transportation services deliver the most important network benefits when they affect other industries and, through them, the economy as a whole.

The key to realizing network benefits is to enable industries that depend on freight transportation to produce the same amount of goods and services for less. In response to freight transportation improvements, industries can change how much it costs to produce goods from the input cost of raw materials to the cost of finished product delivery. Better freight networks can stimulate advantageous shifts in demand and supply curves for goods and services—an improved freight network thus generates economic growth and greater prosperity. Recent history illustrates the potential value of such shifts: since 1980, transportation and logistics improvements freed up seven percent of the U.S. Gross Domestic Product—a benefit worth about $650 billion to the economy in 2003 alone.

Results and Conclusions

The discussion of triggers and barriers suggests that a credible business case is the single most important hurdle to clear in deciding to implement a new technology. When market leaders pursue competitive advantage to enhance profitability, a strong business case is a potent trigger for action. However, market followers will not embrace and expand the use of new technologies unless market leaders and innovators demonstrate marked success.

This report and the FOT results show there are gains to be made from the use of intelligent freight technologies, not only for the private and public sectors, but also for the economy as a whole. To the degree these technologies expand the effective capacity of our transportation system and firms succeed in using the technologies to capture efficiencies, improve reliability, and enhance shipment integrity, freight network benefits are expected to kick in, boosting national productivity and prosperity.

Technology trends are moving in the right direction, but there are barriers that work against implementation. The challenge is to accelerate progress—not rush, but accelerate—and thus increase the present value of intelligent freight benefits for firms and for the economy.

Introduction

The freight industry and its customers use information technologies and telecommunications to improve freight system efficiency and productivity, increase global connectivity, and enhance freight system security against common threats and terrorism. In short, these technologies help us operate the transportation system more intelligently. Most importantly, they do so in ways that improve safety, whether related to hazardous materials transport, heavy truck maintenance, or load limit compliance.

The U.S. Department of Transportation's (DOT's) Federal Highway Administration (FHWA) and Joint Program Office (JPO) work collaboratively with private industry to identify technologies that meet common goals and support their testing and evaluation in the field. Independent evaluation of technology performance, costs, and benefits is a key part of DOT's efforts. FHWA and JPO also publish information and sponsor workshops, forums, and groups, such as the Intermodal Freight Technology Working Group, to encourage widespread information exchange on freight technologies.

Intelligent freight technologies are currently deployed in several areas:

- Asset tracking: Mobile communications and global positioning systems, bar codes, and radio frequency identification (RFID) tags track the location of trucks, containers, and cargo to improve efficiency and to ensure the safety and security of shipments.

- On-board status monitoring: Sensors record vehicle operating conditions, check the condition of cargo, and detect tampering or intrusion.

- Gateway facilitation: Non-intrusive inspection technologies, such as scanners and RFID tags, are used at terminals, inspection stations, and border crossings to search for contraband and enhance national security.

- Freight status information: Web-based technologies facilitate the exchange of information on freight shipments and improve data flows.

- Network status information: Cameras, road-sensors, and display technologies monitor congestion, weather conditions, and incidents.

The Freight Technology Story provides information about the state of the art and the adoption of effective technologies by the freight industry and its customers. Specifically, this report discusses:

- innovation and implementation processes for intelligent freight technologies;

- triggers for and barriers to deployment;

- the five types of intelligent freight technologies and related operational tests;

- private, public, and network-based benefits of using these technologies; and

- business case perspectives and operational test results.

The appendix provides an annotated list of references and points of contact for more information about formal test programs.

I. The Innovation and Implementation Process

Successful technology innovations, including intelligent freight innovations, follow a four-step process from "bright idea" to acceptance as "best practice."

- The bright idea. The innovation may come from users who are wrestling with an operational or business problem, from a technology supplier, or from collaboration between a supplier and a user. The bright idea, perhaps turned into a prototype, is the starting point. A proof-of-concept may mark the transition to the next stage.

- Tests and demonstrations. Tests vary in scope, thoroughness, and formality of evaluation. They usually go through several iterations, growing in scale. Our industry partners tell DOT informally that test results and data, especially independent test results, are important tools to help managers decide whether to move to the next stage.

- Initial adoption. The decision by a market leader to implement the new technology or process is a critical milestone. The leader may deploy in stages, moving from a pilot project to progressively larger roll-outs, but the context is implementation, not more testing. As more early adopters succeed, the project or solution moves from a high potential test result to a new industry best practice.

- Wide adoption. This step cements the transition to "best practice"; status as mainstream firms embrace the success and follow the example of the market leaders. The total benefits to the economy multiply as more transportation firms and their customers reduce costs or increase quality.

Traffic management centers, like this one,

use data from road sensors, cameras, and other sources to adjust traffic

flow. Source: FHWA

Once there is a clearly defined bright idea, the biggest hurdle is building sufficient confidence in the solution to precipitate a decision for initial adoption. The next sections address the trigger factors that lead to such decisions and the barriers that impede them.

Triggers for Implementation

There are three big triggers for business implementation of intelligent freight technologies: 1) pursuit of competitive advantage, 2) keeping up with competitors, and 3) compliance.

Pursuit of competitive advantage for sustainable profitability is the main and preferred trigger for market leaders and innovators. Their strategies may focus on greater efficiency (cost reduction), more effective service (revenue enhancement), or better shipment integrity (risk management), but are likely to cut across and blend several of these strategies. Regardless of the mix, market leaders and innovators seek to improve a firm's standing and profitability in the marketplace. Of course, all firms are concerned about their competitive standing and profits, but the dynamics are different for market leaders and market followers.

The critical element of any change in business is a credible business plan—the ability to articulate and demonstrate that a proposed change has value. There may be a tug of war between visionaries and skeptics about what constitutes credibility, but in most cases, they agree there is a need for quantitative analysis and expected return on investment (ROI). Market leaders, however, are willing to blend more qualitative judgments into that mix.

Good business plans for intelligent freight technologies look beyond the direct costs of the innovation itself. Because these technologies usually change the way business is done, good business plans address the innovation's operational and incidental effects on the business process. In a classic example of looking beyond the numbers, a landmark decision to implement satellite-based tracking in a large trucking company hinged on a qualitative judgment by the Chief Executive Officer (CEO) that being among the first to deploy satellite fleet management technology would prove to be a market differentiator.[1]

Keeping up with competitors seems to be a more important trigger factor for market followers. Market leaders have already mastered—or survived—the bleeding edge of innovation and are reaping benefits in the marketplace, perhaps in operating ratios and profitability, perhaps in revenue and customer gains. Success by market leaders progressively erases doubt and skepticism about new solutions, and shifts the debate in other firms from whether to when and how. Internal skeptics may still challenge cost estimates and benefit assumptions, but the dynamic is different after senior management decides that competitors x and y are forging ahead based, to some extent, on technology and process innovation.

Compliance may arise from customer demands as well as government regulations. We know neither situation is easy because both involve an element of force, yet in some cases, compliance triggers an innovative profit orientation, not just an accommodation to a demand.

The Electronic Freight Manifest (EFM) project is one of DOT's high priority freight initiatives. It is designed to test improvements in speed, accuracy and visibility of freight information exchange between supply chain partners and to evaluate the benefits to government and industry. Specifically, the EFM will test and evaluate 1) standardized electronic messages that are shared between business partners, 2) a concept for transferring information through the Internet with linkage to the entire supply chain, 3) a system architecture to define the linkages to all user parties in the supply chain, and 4) a business case to define rules and procedures for supply chain partners participating in the deployment test. The project will be completed in 2006.

Commercial compliance comes into play when a major customer demands innovation as a condition of doing business. The best examples today involve passive RFID tags. In 2003, Wal-Mart and Target separately required their top suppliers to begin applying the tags to cartons and pallets by January 2005. In 2004, Boeing and Airbus went further, jointly requiring their suppliers to add tags to next generation aircraft and engine parts. Although the trade press is rife with articles about the lack of return on investment for RFID implementation among suppliers, the return is almost beside the point. The crucial trigger question for its big suppliers is not "will we achieve enough benefit internally from RFID?" But "since we won't walk away from this customer's business, how do we manage this investment and get something out of it internally if we can?"

Regulatory compliance can be a blunt trigger in the case of new and modified mandates. The 24-hour advanced manifest rule for ocean container imports required action by shippers and carriers in 2002. There were choices about how to comply, but not whether to comply. If the universal Electronic Freight Manifest (EFM) were available when the 24-hour rule was mandated, then the new manifest rules might have made adoption of EFM a relatively easy choice. Even without EFM, new U.S. Customs and Border Patrol (CBP) manifest rules for land shipments may influence a decision by more shippers and carriers to adopt transponder-based systems for cross-border facilitation. A more dramatic and hypothetical example to consider is a sudden shift in the regulatory environment after a freight-related terror incident, with the U.S. Department of Homeland Security (DHS) mandating deployment of the best available smart trailer or smart container technologies.

This RFID transponder is mounted in the cab

of a truck to relay vehicle identification information to an electronic

reader at the roadside. The roadside inspection station then sends clearance

or other information back to the driver. Source: FHWA

The compliance trigger can be more subtle for established regulations. Highway permitting requirements and weight limitations predated RFID technology, so there was no sudden requirement for carriers to sign up for RFID compliance facilitation programs. In this case, the more traditional triggers applied within the context of a regulatory framework: "If states are installing reader networks, then shall our company invest in the RFID hardware and database modifications to participate, and what would be the benefit to our company of participating?"

Barriers to Implementation

There are technical and institutional barriers to the acceptance of new technologies and operating practices in most industries. Some barriers for intelligent freight applications, however, may be more complex when decisions by private firms depend on government budgets and actions.

Concerns must be addressed on several levels: at face value, as legitimate issues, in terms of perception versus reality, and in terms of underlying concerns. The last point recognizes that a potential user or stakeholder may be most concerned about the cost of a customer's new technology demands but finds it more politic to raise issues about technical performance and the quality of maintenance cost forecasts.

Concerns and Barriers to Implementation

- Efficacy and technical immaturity

- Standards and acceptance

- Operational impacts and systems integration

- Cost

- Business case and benefits

- Exposure to government action and inaction

- Protection of proprietary information

- Reluctance to change

Efficacy is the fundamental concern. Does the new process work, does it work as advertised, and do potential users perceive that it works? Is the solution stable and is the underlying technology sufficiently mature? A second-order benefit concern is whether businesses and their contractors have the skills and resources to implement the new process successfully?

Concerns about standards and technical regulatory regimes, such as radio frequency access, reflect a more general concern about the acceptance of a solution in all critical geographic areas. That varies from a concern about non-interoperable compliance facilitation systems, such as toll tags, to the ability to use a single container security device in all major trading nations. Another manifestation is that some firms may resist open network freight data hubs or moves to data standards in order to protect a proprietary information.

Managers may raise questions about and objections to potential negative operational impacts, such as the need to inspect and replace batteries in the field or the difficulty of managing a mixed fleet during a deployment and transition period. Executives of information technology (IT) companies may be concerned about the unanticipated impacts on legacy systems and interfaces with supply chain partners as a result of proposed supply chain data sharing requirements.

Skepticism about investment and operating cost estimates is the primary cost barrier. The secondary cost barrier may be a corporate focus on return on invested assets, which can discourage investment projects.

The credibility of the business case is often a major barrier and the dominant concern. Skepticism about quantitative benefit estimates seems to reside in the DNA of most corporate comptrollers. Skepticism about soft and qualitative benefits can be even more profound, especially among senior executives who may not have personal experience related to the particular project.

Exposure to government actions and inaction adds barriers for some intelligent freight projects. For example, dependence on public sector funding and implementation for public infrastructure is a concern for some short-range asset tracking solutions. In another area, lack of clarity about security regulations is a barrier for deployment of security-related tracking systems.

Most private firms are intensely protective of proprietary information. Intelligent freight projects that address freight status information can raise concerns about inadvertent exposure, especially in open network systems, and about vulnerability to tort discovery and Freedom of Information requests. These concerns apply as much to private-sector data hubs as to public-sector hubs.

Resistance to change is the final barrier. The motivation may be thoughtful ("let's let someone else take the big risks first") or habitual ("it works well enough now"), but inertia is a factor.

There is an interesting interplay between the triggers and barriers. For example, market leaders, searching for competitive advantage, seem to concentrate on efficacy, operational effects, and the credibility of the business case, but the barriers seem to be framed as interesting challenges and opportunities. Market followers, with more of an emphasis on caution, seem a bit stymied, almost intimidated by the same barriers until wrenched into action by competitive necessity.

II. The Reach of Intelligent Freight Technologies

This chapter and the next cover a lot of information. This chapter describes the types of intelligent freight technologies and their connection to key field operational tests (FOTs) sponsored by DOT and others. The next chapter outlines what the freight community has learned about the benefits of those technologies through the tests. To help readers think about potential benefits as they read this chapter, the box below outlines the benefit framework used in the next chapter.

| Direct Benefits to Private Firms |

|

|---|---|

| Direct Public Sector Benefits |

|

| Indirect Freight Network Benefits |

|

Intelligent freight technologies can help monitor and manage vehicles, their contents, and the networks within which they move. As shown in the box, five clusters of technologies can be applied individually or in combination to simultaneously support different stakeholders. As discussed, the asset tracking tools are primus inter pares—first among equals—because they frequently provide a mobile platform for, or critical input to, other clusters.

| Asset Tracking |

|

|---|---|

| On-Board Status Monitoring |

|

| Gateway Facilitation |

|

| Freight Status Information |

|

| Network Status Information |

|

DOT works with freight industries to identify high potential technologies and processes and to support their testing and demonstration. The FOT program has been the centerpiece of this effort since the late 1990s. FOTs focus on near-market-ready technologies in project teams of vendors and users. Most of the FOTs use cost-share partnerships to increase the odds that a project has market-worthy potential and industry commitment. Every FOT receives an independent arms-length evaluation of project performance, costs, and benefits.

Table 1 includes information on six DOT FOTs plus three related projects. Every test included multiple technologies and processes. Appendix A provides information on test reports and points of contact for each project.

| Test | What It Tests |

|---|---|

|

Smart cards, biometrics, and electronic manifests for air-freight terminal access tested at Chicago O'Hare, New York JFK, and Los Angeles Airports. (DOT-funded FOT, 2000-2002) (Reference 1) |

|

E-seals, truck transponders, web-based tracking tested on I-5 corridor between Seattle/Tacoma and Vancouver, British Columbia. (DOT-funded FOTs, 1999-2004) (Reference 2) |

|

Electronic tracking of chassis and containers and web-based port info system tested at Ports of New York/New Jersey. (DOT-funded FOT, 2001-2003) (Reference 3) |

|

Wide-area chassis tracking and e-seal integration tested in Charleston, New York/New Jersey, and in U.S. Department of Defense (DOD) military operations through Norfolk. (DOT-funded FOT, 2002-2003) (Reference 4) |

|

Web portal data exchange wide-area chassis and tracking tested in Oakland and Memphis. (DOT-funded FOT, 2001-2003) (Reference 5) |

|

Tests of multiple technologies including asset tracking to monitor four types of hazmat shipments and show improvements in safety and security. (DOT-funded FOT managed by the U.S. Federal Motor Carrier Safety Administration, 2003-2004) (References 6.A and 6.B) |

|

Two tests that estimated the benefits to shippers of technologies and processes designed to improve security via intermodal cargo visibility. The U.S. Trade Development Agency sponsored the APEC Secure Trade in the APEC Region (STAR) Bangkok Efficient and Secure Trade (BEST) project, and industry sponsored the SST projects. The projects covered shipments from Thailand and Malaysia through the Ports of Seattle and Tacoma, 2003-2004. (References 7.A, 7.B, 7.C) |

|

Test and demonstration of centralized driver identification verification, radiation detection, and container yard management. (Implemented with funds from a variety of sources by Virginia Port Authority, 2002-2003) (Reference 23) |

|

Extensive set of tests and demonstrations focused on global surface container supply chain security. (DHS-sponsored FOT, 2003-present) (Reference 8) |

Asset Tracking

A State highway inspector conducts a safety

inspection using wireless hand-held technology to record and receive

data. These inspections also facilitate freight mobility. Source: FHWA

Asset tracking capabilities are the core elements of intelligent freight technologies. Although they are not part of every other application, asset tracking can contribute to or interact with nearly all of the other tools. It is worth taking the time to describe the component technologies before discussing asset-tracking applications.

Component Technologies

Critical asset tracking functions include communications, location determination, access to electrical power, and on-board processing.

The type of communications used drives both benefits and costs. Long-distance mobile communications, including satellite and cellular systems, enable high-end benefits based on the ability to report in at any time in the transport cycle. Short-range communications, usually RFID, limit reports to within 100 meters or less of handheld or fixed reader sites. Long-distance mobile communications cost more per vehicle, but the cost is relatively constant per vehicle. Short-range communications usually have modest costs per vehicle accompanied by large infrastructure costs. The amortization of short-range infrastructure costs across a fleet of vehicles and differences in long- versus short-range operating costs can complicate financial analysis needed for making decisions.

Mobile systems need to determine their current location when they record an event or send a message. The most common method is on-board calculation of latitude and longitude with telemetry data from a global positioning system (GPS). Short-range systems are less likely to use GPS because they can derive the location of message events from the known location of the fixed readers that collect the data.

The source and stability of electrical power is important to the design and usability of tracking technologies. Tractor-based mobile systems have it easy, drawing their power from the tractor's electrical system. Some trailer- and chassis-based systems can trickle charge their batteries when tethered to a tractor, but must depend on a battery when untethered. Active RFID devices, those that can initiate communication, must have a battery. Passive RFID devices can be battery-free because they derive the power they need from the energy in the signal from a reader. Passive devices may use a battery to boost the signal.

Batteries raise concerns about duration, field replacement, and cost. Mid-lifecycle battery replacement in the field is an operational burden and a meaningful barrier to asset tracking deployment for long-life assets, such as marine containers. Battery technologies are improving, offering longer life. Elegant tracking device designs can reduce the demand for power, effectively extending battery life. Solar cells and trickle chargers also offer promise, but raise their own issues of vulnerability to damage and inattention.

Asset tracking devices cover a wide range of on-board processing power. Some mobile long-range systems include dedicated on-board computers, while others have simpler microprocessors. Examples in connection with on-board status monitoring technologies are discussed in this report. Active RFID systems include at least sufficient processing power to decide when to initiate a search for a reader, and passive RFID systems usually have the most rudimentary processes, such as testing the integrity of a seal when queried and powered by a reader.

Asset Tracking Applications

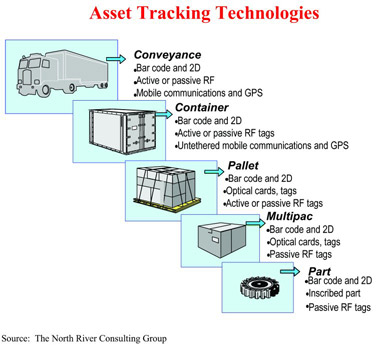

Freight transportation assets include conveyance power units, trailers, chassis, containers, pallets, cartons and individual items. Depending on the stakeholder and the business issue, each level of aggregation can benefit from more accurate and timely tracking information.

Key: 2D = two dimensional, RF = radio frequency,

GPS = global positioning system

An end-to-end freight movement usually involves changing relationships at a level of aggregation; for example, pallets of LTL (less than truckload) freight link to different trucks and trailers as they move from pickup to linehaul to delivery. Because of this, the persistent historical challenge of freight operations management is maintaining correct and current relationships among the levels of assets in each movement. That is the essence of intransit visibility. Figure 1 illustrates that challenge, showing the need to track each level of aggregation and the relationships among them. The figure also shows tracking devices used at each level. These devices range from active telecommunications to traditional visual bar codes and labels.

Tractor and truck tracking with mobile communications and location determination is highly advanced and productive in many segments of the trucking industry. About 15 years ago, the innovators were the irregular route truckload carriers, which reaped significant benefits per tractor per year and transformed these technologies into industry best practices. As costs drop and successful experience continues to accumulate, usage has been spreading to other industry segments, including LTL and drayage.

The Hazmat FOT applied mobile communications to track truck and trailer combinations with tangible success, as discussed in the next chapter. The U.S. Department of Defense (DOD) and the U.S. Department of Energy (DOE) also use these technologies to track commercial carriers that haul their sensitive freight. The Defense Transportation Tracking System (DTTS) monitors shipments of arms, ammunition, and explosives, and DOE's Transportation Tracking and Communications (TRANSCOM) System monitors radioactive waste shipments (References 24 and 25).

Many truckers use tractor-mounted RFID transponders, but less for fleet tracking than for compliance facilitation and toll payment. Some of the Pacific Northwest FOTs piggybacked off those applications to monitor the progress of containers drayed along the I-5 corridor between Seattle/Tacoma and the Canadian border. The FOTs used the State of Washington's port-to-border crossing "TransCorridor" transponder network to track progress as trucks passed under reader antennas at weigh stations, port terminal gates, and border crossings.

Chassis and trailer tracking marries mobile tracking technologies to these dependent conveyances. First generation products faltered around the turn of this century because of technical performance and battery issues, but the biggest barrier has been economic. The CEO of the largest U.S. truckload carrier said in 1999 that he thought "the next revolution" in fleet management would be untethered trailer tracking, but the costs were not yet right. By 2004, second generation digital products gained more acceptance in the market, with roughly 80,000 units in commercial use.[2]

The Cargo*Mate and Freight Information Highway (FIH) FOTs tested a near-market ready container chassis tracking system called Cargo*Mate. It packages GPS, cellular communications, sensors, and a battery within the chassis frame to improve the visibility and management of chassis fleets and, when they are loaded, the containers and cargo associated with the chassis.

The HazMat FOT tested untethered trailer tracking, but the focus was less on fleet efficiency than on using the technology to ensure the security and safety of high hazard commodity shipments.

Container tracking is a close cousin of chassis and trailer tracking from a technical perspective, but it faces more challenging hurdles because of the nature of the international container industry. While chassis and trailers are unlikely to leave the United States, let alone North America, the free-flow global nature of the container business makes it much harder to recover the value of an investment in a maritime container—the investor cannot count on repetitive use of the same container.

In the mid-1990s, DOD began to use active data-rich RFID tags to track ocean going containers and air-freight pallets. As a large shipper concerned about the visibility of its freight, DOD loaded manifest information onto the data rich tags. Readers at terminals and gateways throughout the world provide location information.

Electronic seals are used to ensure shipment

integrity and to track cargo. Typically electronic seals are used on

high-value loads, agricultural products, and other shipments requiring

enhanced security. Source: FHWA

The Pacific Northwest FOT used electronic cargo seals (e-seals) as surrogate container tracking devices, but two other tests went further. The Asia Pacific Economic Cooperation (APEC) Bangkok Efficient and Secure Trade (BEST) project assessed an RFID e-seal for both security and asset tracking; thirty containers were instrumented and tracked from Bangkok into the Pacific Northwest. A privately funded set of pilots, the Smart and Secure Tradelanes (SST) initiative, instrumented over 800 container movements on 18 trade lanes. The BEST and SST tests yielded intriguing benefit estimates that are discussed in the next chapter.

At the case and pallet levels, shippers have begun to implement simple passive RFID "license plates" to improve the visibility and management of their supply chains. Most of these initiatives are built around the electronic product code global tag standard developed by the Massachusetts Institute of Technology AutoID Center and its industry partners. Commercial compliance has been the principal trigger as dominant buyers, including Wal-Mart, Target, and DOD, mandated that major suppliers begin shipping tagged goods in 2005.

Route adherence monitoring is a special application of asset tracking. Geofencing, as it is often called, uses algorithms to analyze and display location data, enabling commercial dispatchers and conceivably law enforcement officials to quickly address exceptions such as route deviations, entry to restricted areas, and developing schedule failures. Geofencing can work with any mobile communications-based tracking of tractors, trailers, and chassis. The HazMat FOT assessed geofencing, and both DOD's DTTS and DOE's TRANSCOM System use it successfully.

Looking across the freight levels in Figure 1 and their asset-tracking technologies, it seems likely that in a few years auto-nesting technologies will be used in the field. RFID readers aboard trailers will record the loading and removal of freight, and associating shipments automatically with the trailer and then with a tractor. (References 18 and 20).

On-Board Status Monitoring

There are established and growing demands for on-board status information related to freight vehicles and their cargoes. Most solutions simply collect sensor data to transmit en route or store for download at the destination. More robust solutions collect the data, evaluate it, and trigger autonomous actions without prior authorization from central dispatch. An extreme example of the latter, developed in South Africa, is a series of internal pepper gas dispensers to discourage thieves who trigger trailer intrusion detection alarms. A more benign example is automatic restart circuits on refrigerated containers.

Some truck fleet operators use sensor data on vehicle operating parameters, from engine revolutions per minute to highway speed, from tire pressure to brake wear. The information helps managers anticipate maintenance problems and reinforce safe and efficient driver behavior.

The use of commercially oriented cargo and freight condition sensors is well established. Perhaps best known, temperature sensors and recorders improve the quality and accountability for perishable shipments. Pressure and toxic sensors enhance the safety of hazmat shipments. Accelerometers tied with GPS help ensure that rail and highway impacts and shocks stay within contracted limits, assign responsibility for problems, and map problem patterns. The Cargo*Mate FOT extended the concept, including change-of-status detection for tethered or untethered chassis.

Antiterror-oriented cargo and freight condition sensors are less well-established. Explosives and radiation detection technologies are reasonably dependable, but cost-effective biological agent sensors are not on the horizon.

Intrusion and tamper detection sensors have a long history, traceable to the Phoenicians. The simplest devices in use today, metal or plastic indicative seals, are the direct descendants of ancient wax and terracotta seals that, by damage or absence, implied tampering. Intelligent freight technologies start by marrying electronics to the security basics of indicative and protective barrier seals.

E-seals test the integrity of their closure for tampering and report the results to a reader, usually via RFID. The Pacific Northwest FOTs included both simple disposable e-seals and "dual-capability" devices acting as security seals and truck transponders. Seals were usually placed on in-bond containers in Seattle and Tacoma after a CBP or agricultural inspection, then monitored until crossing the border in Blaine, Washington. The Northwest FOTs showed the efficacy of e-seals and laid the groundwork for the Hazmat FOT, which integrated some of the e-seals to report through mobile truck and trailer communications. The SST phase 1 review showed how early startup problems, both technical and training, could be corrected during the course of a deployment (Reference 7.C).

Container and trailer security devices (CSDs and TSDs) are generally RFID devices that are more complex than e-seals. Their technical foundation is usually a magnetic or pressure-based door sensor tied with an internal light sensor to detect entry through a container wall or ceiling. The CBP "Smart Box" test has been working with one type of CSD since January 2004, and Operation Safe Commerce tested other variations. The most aggressive development in this area is the Advanced Container Security Device program, a DHS research and development initiative aimed at developing cost-effective "six wall" intrusion detection systems (References 11 and 21).

Remote locking and unlocking systems attempt to elevate security beyond that of a traditional external lock or bolt seal. Some of these systems are akin to small bank vaults, with multiple sliding rods to secure the container or trailer doors. Some omit any external access point so that thieves or terrorists would not know where to drill to access the locking device. The remote control strategies range from electronic contact "keys" or personal digital devices with programmable access codes, through local RFID controls, up to wide-area monitoring and command via cell or satellite communications. Radio remote control locks may integrate geofencing information from the asset tracker to preclude unlocking except at specified coordinates, such as the proper destination.

RFID transponder-based placards are possible for hazmat loads. These tools could enable first responders at the scene of a hazmat incident to quickly identify the commodity and proper procedures. Technology is less the issue here than is the need for coordination among the hazardous materials regulators and stakeholders.

Emergency call buttons are tools that enable drivers to summon aid to their location with a single click. The technology is available as a wireless remote device that drivers can take with them during a rest stop, or it can be mounted in the truck cab. The core technology is relatively simple: a pre-programmed function on the on-board computer or communications system captures the GPS location and sends a "mayday" message. Additional functions tested in the HazMat FOT include automatic vehicle shutdowns via the engine governor, fuel line, or air brake system. In-cab emergency call buttons have been standard and successful parts of the DTTS and DOE TRANSCOM System programs for several years.

Triggers and barriers. Not surprisingly, the deployment of on-board technologies tailored to commercial concerns, such as vehicle operating and cargo condition sensors, has been driven by economic interests and perceived ROI. The situation is similar for some of the anti-theft technologies. The mix of triggers and barriers is more complex, however, for security devices aimed more at reducing risks of terror attacks.

Gateway Facilitation

This set of technology applications improves operations at terminals, inspection stations, and border crossings. They weave together threads of security validation, regulatory compliance, and operating efficiency.

Driver identification and validation is an essential function at freight pickup points, intermediate delivery terminals, and even at destinations. Intelligent freight technology and process innovations aim to improve the effectiveness of the function, reducing the risks of theft and terrorism while facilitating gate and reception processes, especially for drivers who make frequent pick ups and drop-offs at the terminal.

Biometric identification tools, such as fingerprint and iris recognition, may be incorporated in smart identification (ID) cards and integrated with on-line access to manifest, vehicle, and driver databases. The ESCM FOT applied this approach with notable success, and the HazMat FOT built on it. Looking ahead, the Transportation Security Administration (TSA) Transportation Worker Identity Card (TWIC) aims to deploy a common biometric smart ID card for all U.S. transportation workers.

Non-intrusive inspection technologies enhance security inspections by imposing smaller efficiency and cost penalties than traditional manual methods. X-ray and gamma ray scanners help CBP and law enforcement officials search for contraband, illegal aliens, and threats to homeland security.

Compliance facilitation applications can be doubly attractive, enabling tangible efficiency benefits for both commercial and governmental stakeholders. The applications can facilitate both state highway and NAFTA land-border crossing inspections.

The building blocks are RFID transponders aboard trucks, pre-registration of load and shipment information, integration of regulatory databases, and networked readers, sensors, and inspection stations. Automated exchange of permitting and licensing information sets the stage for automated screening of trucks at weigh stations: RFID readers pull truck mounted transponder information; the system immediately checks on-line databases and flashes no-stop green lights to known compliant vehicles. Safety and weigh stations in 30 states employ technologies that conform to DOT's Commercial Vehicle Information System Networks (CVISN) program.

Customs and border crossing facilitation is a variation of automated data exchange and database interrogation but with more factors in play, including agricultural controls, advanced manifest compliance, and other homeland security issues. The Pacific Northwest FOT applied these processes and technologies to in-bond container movements.

A transponder mounted in the cab of the truck

relays information to the roadside electronic reader through antennae

in the overhead structure. Source: FHWA

Weigh-in-motion is a subset of compliance facilitation, using sensor technology that permits calculation of truck weights without stopping on fixed scales.

Electronic toll payment systems mesh an asset tracking RFID transponder and reader with secure access to on-line financial databases. In cases such as EZ Pass in the northeast, several states and toll authorities made policy and institutional changes in order to recognize transponders and settle financial accounts across state lines.

Triggers and barriers. Compliance facilitation applications have been an "easy sell" for carriers because the benefits of reduced stops have been clear and the costs of adding transponders have been modest. The barriers are a bit more formidable for driver identification and validation applications because of the time it is taking to finalize the TWIC program.

Freight Status Information

These applications aim to facilitate the exchange of information about freight shipments among commercial and government stakeholders. The approaches include enhancing the standards for data elements and message sets and evolving information exchange protocols to eliminate speed bumps in data flows.

There are already active examples of commercial and public sector web-based freight portals. Carriers and third-party logistics companies offer Web sites to their customers for equipment reservations, rates, shipment status, and pick up information (Reference 19). Several port authorities and private firms, such as e-Modal, mix web access to port-based information, such as ship arrivals, with terminal gate congestion information (Reference 3). The Pacific Northwest FOT deployed a prototype Web-based border and port terminal screening system, the Trade Corridor Operating Systems (TCOS), which integrated CVISN transponder and e-seal reader network data. TCOS was the focal point that enabled users to cross-reference data and link key information for customs clearance. The DOD DTTS and DOE TRANSCOM System also provide web access to state and tribal officials who track high hazard shipments through their jurisdictions.

Better standards for intermodal data exchange definitions are a necessary foundation for moving beyond today's portals. Given the global nature of trade, the United Nations Trade Data Element Dictionary is an important building block for standard cross-modal data definitions. Electronic Data Interchange (EDI) message formats, a fundamental data exchange tool that has been used for two decades, still leave gaps to bridge between competing standards and across modes of transportation. The FIH FOT tested a new approach for freight data information exchange among the transportation modes. The FIH included a new set of data transfer standards and applications that enabled the automated translation of railroad and ocean carrier EDI business data exchange formats into a format called TranXML, facilitating interoperability (Reference 5).

Web services software offers another step ahead, providing a software system designed to support interoperable machine-to-machine interaction over a network. The software functions as a gateway between proprietary trading partner systems, facilitating automated interfaces using XML. Web services software was one of the concepts tested in the FIH FOT, and it will play a much larger role in the new EFM FOT (Reference 22).

A standard electronic freight information transfer is a logical complement to better data element and exchange standards, and it can be a big step toward removing those speed bumps in freight data flows. The ESCM FOT, not surprisingly given its title, was built around an internet-based manifest for land-air freight shipments. The standard information transfer structure, together with the biometrics and other elements of the FOT, produced significant benefits and set the stage for the new EFM FOT. The new FOT's goals include formalizing the information transfer standard for truck-air-freight interfaces as an intentional step towards a universal EFM.

Triggers and barriers. Progress on freight status information applications has been positive but muted. Web-based portals make clear contributions, but struggles for competitive and proprietary advantage limit industry-wide solutions. Better standards and information transfer formats may make sense to industry leaders, but tedious standards development processes, jockeying for competitive advantage, and resistance to change slow progress.

Network Status Information

In an era of increasing congestion, with a consensus that we cannot build our way out of the problem, it is essential to make the best use of available transportation capacity. Technologies that collect, manage, and exploit network condition data are tools to that end.

Congestion alerts and avoidance are a fundamental capability of many Intelligent Transportation Systems that are useful to many transportation stakeholders and especially important to freight operators in and around crowded gateways, such as ocean terminals and border crossings. Current data from cameras, road sensors, and other sources can be fed into predictive models and distributed via Web portals and other means. The Freight Information Real-Time System for Transport (FIRST) FOT displayed videos of terminal gates and surrounding roadways for subscribers in the Port of New York/New Jersey. Vancouver, British Columbia, and the Virginia ports in the greater Hampton Roads area have operational systems with similar capabilities (References 3 and 23).

Carrier scheduling support is closely related to the transportation Web-based freight portals and congestion alerts and avoidance. Fleet and terminal manager software systems may be programmed to incorporate feeds from regional congestion monitoring portals. At the low end, dispatchers simply pass along bottleneck information to drivers, but the higher end may include dynamic adjusting of trip schedules and strategic shifts in operating policy, such as moving to more nighttime operations.

Network status information and asset tracking capabilities can be integrated with software and display technologies to support first responders to safety, homeland security, and traditional law enforcement incidents. Dispatchers can use these tools to help get the right resources to the right locations as quickly as possible. This capability was tested successfully in the Hazmat FOT with a commercial operations center that passed alert information to appropriate public emergency services personnel.

Triggers and barriers. The situation is similar to freight status information: positive but muted progress. Freight operators seem to welcome public investments that provide information on congestion and traffic conditions, but barriers impede data pooling and sharing. FIRST, for example, could not transition to an operational system because of stakeholder concerns about protecting proprietary information and defending proprietary data systems.

III. Intelligent Freight Technology Benefits

Successful deployments of intelligent freight technologies can yield direct benefits to private firms and the public sector, and indirect benefits to the freight network. This chapter describes each and weaves in what has been learned about them from the FOTs and other sources.

Private Sector Benefits

The ability to capture the quantitative and qualitative benefits available to businesses is the broadest overall trigger for private decisionmakers to deploy intelligent freight technologies. Some of those benefits are already well-proven, some are not, but all can be tied to three freight operations strategies: increasing efficiency, improving reliability and service, and enhancing shipment integrity.

Increased Efficiency and Productivity

Efficiency and productivity benefits reduce the cost of doing business. They tend to be quantitative, easier to measure than other benefits, and easiest—although not necessarily easy—to justify to skeptical corporate comptrollers.

The core rationale is using more accurate, timely, and detailed data about a host of operating factors, processed with algorithms or models, to better utilize people and equipment. Truckload carriers, for example, proved to themselves in the early 1990s that near real-time satellite truck location data and two-way digital communications could be a huge money-maker. Productivity benefits cross functional lines, affecting empty-miles, maintenance, and indirectly even driver turnover. In the Hazmat FOT, the productivity benefits of asset tracking were estimated to be between $7,866 and $15,222 annual savings per tractor, the largest benefit being a higher percentage of revenue miles (Reference 6.B). In one of the chassis tracking FOTs, the estimated annual savings per chassis was $210.35, mostly from increased utilization (Reference 5). The BEST and SST projects reported about $400 per container in benefits to shippers, mostly in inventory benefits from better asset tracking (References 7.A and 7.B).

Good automated tools that exploit intelligent freight data enable operators to reduce administrative burdens, shorten processing times, and therefore reduce cycle times as well. The ESCM, Pacific Northwest, and HazMat FOTs all illustrated such benefits. The independent evaluation of the ESCM FOT, for example, reported benefits of up to $16.20 per air-freight shipment from faster document preparation and security processing (Reference 1).

Automated interfaces with regulatory agencies eliminate most stops at weigh stations and can reduce border-crossing delays. Regional intelligent freight data networks and terminal gate scheduling systems reduce non-productive waiting time, emissions, and wasted fuel during idling. The independent evaluator on the FIRST project estimated that savings per drayage trip to an ocean terminal would range from $21.36 to $247.57 (Reference 3).

Better visibility coupled with better control systems enables operators to minimize errors and, when they occur, find and fix them more quickly and easily. Labor previously spent on "expediting" problems is put to better use, and fewer loaded miles are wasted on duplicative movements. In Norfolk, a yard management system was coupled with a control tower to facilitate oversight of container movements throughout the terminal. Tied to the truck entry gate, the system tells a driver where to pick up or drop off a container. The results, although not quantified, were tangible (Reference 23).

Net, this class of benefits means that operators can deliver a given level of service with fewer resources, enabling them to reduce slack capacity or provide higher levels of service without adding capacity. Beneficiaries may be carriers, terminal operators, third parties, and shippers.

Triggers and barriers. The credibility of savings estimates is very important to firms at the cusp of a new deployment decision. Industry members of an ROI panel at a fleet management technologies conference generally agreed that they needed firm estimates of project payback within 12-18 months in order to proceed.[3] The representative of a major package express firm, however, said his firm was convinced by their positive experience with asset tracking technologies and had not done a formal ROI analysis in six years. From another perspective, success with mobile tracking technologies transformed the potential barrier of driver skepticism into a positive as many drivers' take-home pay increased with the proportion of revenue-miles driven.

Improved Reliability and Service

Improving reliability and service provides both quantitative and qualitative benefits. However, because even the quantitative metrics are difficult to convert to revenue improvements or cost reductions, this class of benefits is more likely to be treated as qualitative and regarded with skepticism.

Improved reliability—better schedule adherence—is at the core of this benefit for freight transportation industries, and the reason lies in inventory theory. The same logic applies whether one's inventory is transport equipment or the goods being moved: variability in process time has an exponential effect on safety stock levels, while average process time has a linear effect. Simply put, small improvements in reliability deliver greater potential gains than small improvements in average speed. A reliability improvement strategy supports goals of increasing customer loyalty, winning more profitable customers, and growing market share. Management teams that are committed to a quality improvement philosophy, however, recognize that better quality can also lower costs, and that efficiency and improved reliability strategies may reinforce each other. Intelligent freight visibility and control technologies can improve both reliability and speed.

Better visibility and control via intelligent freight technology also increases operational flexibility. Disruptions and delays, realized soon enough, permit corrective action by the carrier and the carrier's customer, conceivably avoiding shutdown of a just-in-time production line. Another benefit is the opportunity to respond more rapidly to priority changes, as with diversion of en route shipments.

The most qualitative benefit is shipper confidence, especially the confidence that a freight transporter will deliver as promised or provide advance notice of problems and even alternative solutions. Qualitative or not, customer confidence is a catalyst that generates business loyalty and encourages more aggressive efficiency measures throughout a supply chain.

Intelligent freight tools can also generate confidence related to regulations, assuring regulators and customers that a firm complies fully with safety or security mandates. Higher confidence may translate to less special (added) surveillance and monitoring.

Triggers and barriers. Industry stakeholders take very different views of service improvement and qualitative benefits. The Chief Financial Officer of a major dray firm, speaking on the ROI panel mentioned earlier, said he totally discounts soft benefits: a project wins or loses funds based on hard numbers, and any soft benefits (qualitative) from successful projects are pure gravy. Representatives of truckload carriers, however, citing their solid experience with fleet tracking systems, said they consider the spin-off effects to be potent and important.

Enhanced Shipment and Service Integrity

Improving shipment integrity also provides quantitative and qualitative benefits. Shipment and service integrity includes both the "pre-9/11" (protection against theft and traditional contraband, such as narcotics) and "post-9/11" (protection against terrorism) forms of security. Two sets of technology applications are especially relevant to improving shipment and service integrity. The first are identification and validation tools, such as biometrics and smartcards, that reduce the risk of unauthorized pickups and deliveries. The second, and the more flexible in terms of benefits, are the combination of asset tracking and on-board sensors.

Pre-9/11 Issues. Electronic intrusion detection and asset tracking technologies should help reduce theft. Although there are no verifiable figures available, cargo theft in the United States is anecdotally reported to be any where from $2 billion to $18 billion a year. Paradoxically, the large losses imply some good news: they create the potential for significant dollar benefits from effective use of theft-reducing intelligent freight technologies. However, a Stanford University study that estimated theft-reduction benefits related to intelligent freight technologies was conservative in its base numbers and forecast savings of 4 percent to 5 percent of the value of cargoes (Reference 7.B).

Long-distance mobile asset tracking may make it possible to interrupt some crimes in progress. For example, if a trailer door is opened outside an approved geofence, an automated message to the dispatcher could generate a request for police to go to the scene. This could also be a post-9/11 benefit. A thief was actually caught in the act thanks to the mobile chassis tracking in the Cargo*Mate FOT (Reference 4, p. 56).

Transportation services are stolen or "misappropriated" as well as cargo, and intelligent freight technologies can help carriers reduce these problems. For example, some customers misuse trailers, chassis, and containers during free time and some terminal operators and interlining carriers may be careless in using equipment belonging to other companies. Long-distance mobile asset tracking of untethered assets offers fleet operators a tool to identify and curb abuse. A dray fleet reduced its missing chassis from 4 percent of the fleet to zero during the Cargo*Mate FOT (Reference 4, pp. 43-44).

Biometric smart cards, like these, contain

information on the driver, including a photocopy of a commercial driver

license and a thumbprint of the driver. This information is used to

gain access to ports and intermodal transfer facilities. Source: American

Transportation Research Institute

Post-9/11 Issues. Intelligent freight technology benefits can address two of the three requirements for a secure supply chain. They can help reduce the risk of undetected tampering with shipments in progress, and they can help provide accurate and timely information related to the shipment. They offer little contribution towards the third requirement, assuring the integrity of the trailer or container loading process.

Post-9/11 terror threats uncovered a new deployment trigger. Several major firms are thinking about the shipment integrity issue quite differently, as a means to protect their brand equity from damage related to terror threats. As one major retailer put it, protecting brand equity means keeping your corporate logo out of network news stories about terrorist penetration. In more formal terms, these firms are experimenting with intelligent freight technologies in order to both reduce the risk of shipments being compromised and to provide evidence to regulators and customers of their efforts. When corporate marketing managers become attuned to the brand equity issue, they also become effective internal allies for supply chain managers pursuing resources for security innovations.

Triggers and barriers. One potential trigger in this area is underappreciated: the total (direct and indirect) cost to firms of cargo theft. If firms had better data on the indirect costs, then security officers might find comptrollers more willing to fund their projects. On the positive side of the ledger, the ESCM and Hazmat FOTs indicated that one potential barrier to intelligent freight security technologies is likely to be less of a problem: truck drivers reacted positively to the biometrics and smart cards as a replacement for manual credentials that highlight personal information.

Public Sector Benefits

Intelligent freight technologies produce benefits for public agencies and for the public at large. Some benefits mirror those of the private sector and others clearly move into different territory.

Public agencies derive direct efficiency and productivity benefits, as when state highway enforcement agencies use compliance facilitation applications to increase significantly the number of trucks that an inspector can process in an hour. Another example is the ability of U.S. Customs officials to screen more inbound containers and cross-border trailers with non-intrusive inspection technologies than they could manually.

Intelligent freight technologies also permit those same agencies to improve the quality of the service they deliver, akin to the way the technologies enable freight transportation firms to deliver more reliable and flexible service. Compliance facilitation systems, such as the CVISN network, enable carriers—and their customers—to save money by reducing time lost at inspection stations. Shipper and carrier members of the Customs-Trade Partnership Against Terrorism (C-TPAT) are to enjoy a higher tier of benefits and "almost" no entry inspections if they use approved "smart box" technologies.[4] The concept behind both the CVISN and CBP smart box programs is to use intelligent freight technologies as catalysts that enable agencies to reward high quality, high compliance shippers and carriers.

The public sector equivalent of shipment integrity benefits includes broader benefits for the public and the nation at large. To the degree intelligent freight technologies enhance security against terrorism, they contribute to national security. One could argue that those benefits—reducing the risk of freight-related terror events—are far greater for society as a whole than they are for individual firms, even those attuned to protecting their brand equity.

Successful intelligent freight technology deployments can yield significant safety benefits. On-board vehicle sensors may reduce the number of crashes by calling driver attention to under-inflated tires before they fail. Driver performance monitoring, by enabling firms to educate and improve driver behavior about high speeds and hard braking, can reduce fleet-wide incidents. Weigh-in-motion sensors can increase enforcement effectiveness and reduce the number of incidents related to the over-weight conditions of vehicles. More generally, just as intelligent freight technologies can enable agencies to reward quality shippers and carriers, the technologies permit agencies to focus their enforcement attention on poor performers, yielding proportionally greater benefits.

Better emergency response is closely related to safety, and intelligent freight technologies can contribute direct improvements. In the Hazmat FOT, evaluators found that rapid notification of incidents helped improve the effectiveness of incident response and reduce the consequences. The benefits were difficult to quantify but included lower environmental mitigation costs and less potential public exposure to hazmat releases (Reference 6.B).

To the degree that intelligent freight technologies succeed in smoothing flows around major hubs like ports, border crossings, and intermodal terminals, tangible environmental and quality-of-life benefits will result. Reduced congestion means fewer trucks and other vehicles stuck in traffic, burning fuel and affecting air quality. It also means less stress on affected neighborhoods and less time wasted sitting in traffic.

Perhaps the major public rationale for and the most important long-term benefit of investing in intelligent transportation systems is to reduce congestion, enhance mobility, and increase the effective capacity of transportation infrastructure. The Freight Analysis Framework estimates that U.S. freight volumes will increase by approximately 70 percent between 1998 and 2020. Given the growing role of international trade in the U.S. economy, container volumes through major ports could triple.[5] Better asset tracking, enhanced gateway facilitation, and more effective freight-network status information are tools that may enable better management that growth.

Triggers and barriers are, of course, different for public-sector benefits. Safety, long-term congestion mitigation, and national security are major policy priorities that trigger government action and support for programs like the FOTs. Funding constraints, competing demands for public funds, and concerns about proper government roles tend to be the barriers.

Freight Network Benefits

Network benefits are qualitatively different than the business benefits discussed earlier. The focus shifts from results achieved by individual firms to system effects, culminating in macroeconomic changes in productivity and prosperity. There are two levels of network benefits. Although the first is significant, the second can be profound.

First-order network benefits have to do with the costs and benefits of expanding network implementation. Adding to an existing network, especially a telecommunications and computing network, usually lowers marginal and average costs. Think of an RFID-based truck or container-tracking network: the initial deployment has high fixed cost because the entire infrastructure is new. Adding new trade lanes, however, should lower the marginal and average infrastructure cost. Once terminal X is instrumented to serve trade lane A, there will be no further costs for X to serve trade lane B when it is added to the network. Similarly, in a long-distance mobile communications network, the marginal cost of building the network management center will be higher for the first deployment than it should be for scaling up to add capacity (Reference 7.A).

Shrinking deployment costs create positive dynamics. As the project economics become attractive to more users, deployment accelerates and more supply chains begin to capture the business benefits of the intelligent freight innovations. The total benefit pie can grow exponentially.