Slide 1:

ALAMEDA CORRIDOR

“A Project of National Significance”

Slide 2:

Project Purpose

The Alameda Corridor Project is needed to keep pace with the steady growth of

cargo moving through the Ports of Los Angeles and Long Beach

U.S./Pacific Rim trade has doubled during the last decade

The Port’s share of West Coast container cargo increased from 42% in 1976

to 52% in 1999 with increasing market share projected in future years

Cargo volume in 2000 exceeds the forecast by the Independent Cargo Consultant

for 2006

Factors affecting future growth

18 million population in six county area

Larger container ships

Vessel sharing arrangements

Increase in discretionary cargo

State of the art facilities at Ports

Ports are the “Load Center” of West Coast

Slide 3:

Project Schematic

Slide 4:

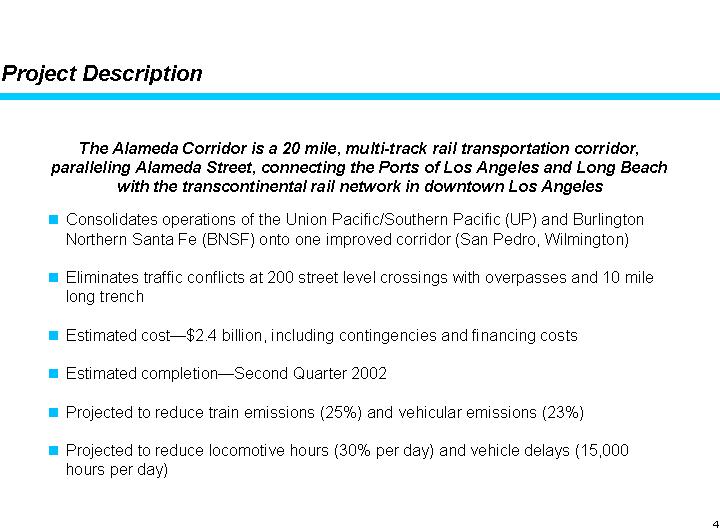

Project Description

The Alameda Corridor is a 20 mile, multi-track rail transportation corridor,

paralleling Alameda Street, connecting the Ports of Los Angeles and Long Beach

with the transcontinental rail network in downtown Los Angeles

nConsolidates operations of the Union Pacific/Southern Pacific (UP) and Burlington

Northern Santa Fe (BNSF) onto one improved corridor (San Pedro, Wilmington)

nEliminates traffic conflicts at 200 street level crossings with overpasses

and 10 mile long trench

nEstimated cost—$2.4 billion, including contingencies and financing costs

nEstimated completion—Second Quarter 2002

nProjected to reduce train emissions (25%) and vehicular emissions (23%)

nProjected to reduce locomotive hours (30% per day) and vehicle delays (15,000

hours per day)

Slide 5:

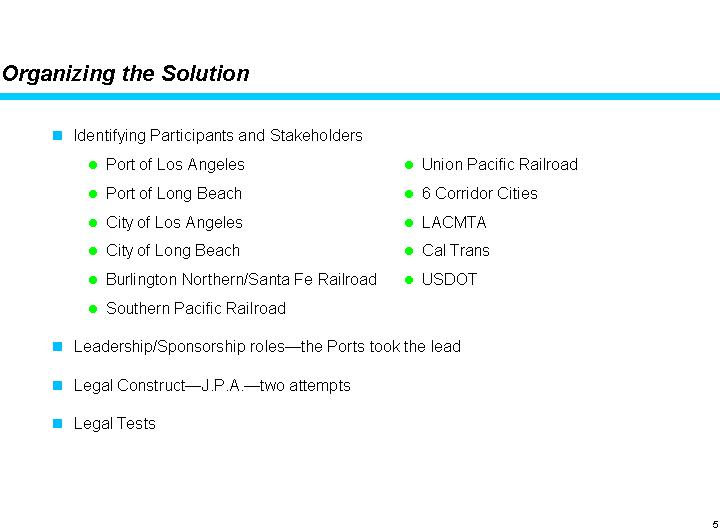

Organizing the Solution

Identifying Participants and Stakeholders

Port of Los Angeles

Port of Long Beach

City of Los Angeles

City of Long Beach

Burlington Northern/Santa Fe Railroad

Southern Pacific Railroad

Leadership/Sponsorship roles—the Ports took the lead

Legal Construct—J.P.A.—two attempts

Legal Tests

Slide 6:

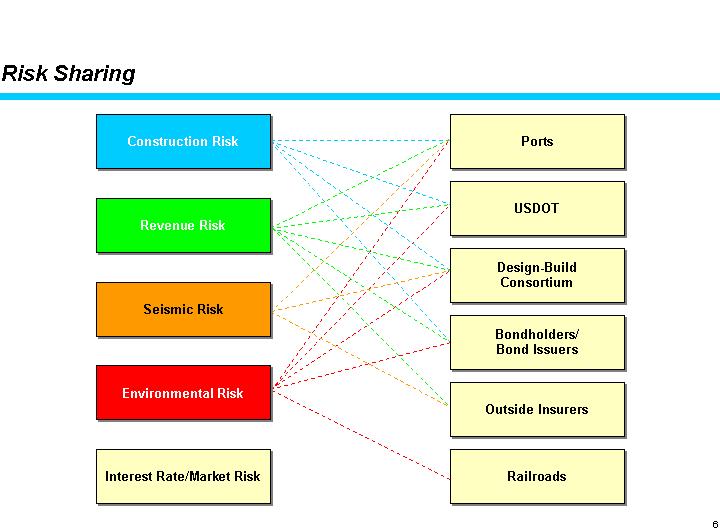

Risk sharing

Slide 7:

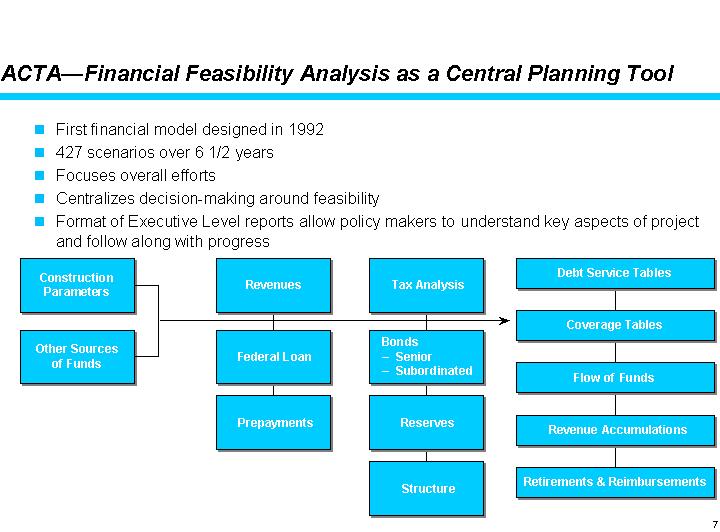

ACTA—Financial Feasibility Analysis as a Central Planning

Tool

First financial model designed in 1992

427 scenarios over 6 1/2 years

Focuses overall efforts

Centralizes decision-making around feasibility

Format of Executive Level reports allow policy makers to understand key aspects

of project

and follow along with progress

Slide 8:

The Original Funding of the Project

One-time resource:

Federal

Congress, TEA-21 and Demonstration Programs $700

USDOT–Other Programs 30

Air Quality—EPA 8

ISTEA 40

State and Regional 100

LACMTA–Regional STIP 0

Ports 400

Cities 40

Revenues—Recurring Sources—For bonds and/or Loan 600

Ports—Shippers 5% Gross Wharfage Surcharge

Truck Tolls $3 toll

Railroads—User Fees $30/box

Total : $1.838 BB.

Slide 9:

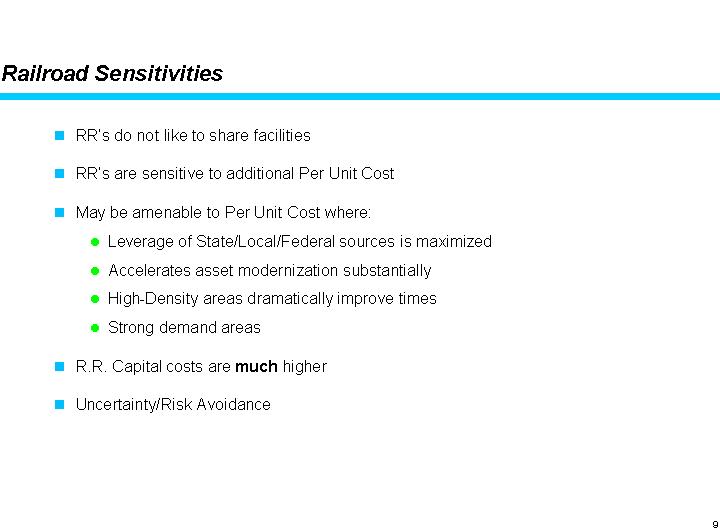

Railroad Sensitivities

RR’s do not like to share facilities

RR’s are sensitive to additional Per Unit Cost

May be amenable to Per Unit Cost where:

Leverage of State/Local/Federal sources is maximized

Accelerates asset modernization substantially

High-Density areas dramatically improve times

Strong demand areas

R.R. Capital costs are much higher

Uncertainty/Risk Avoidance

Slide 10:

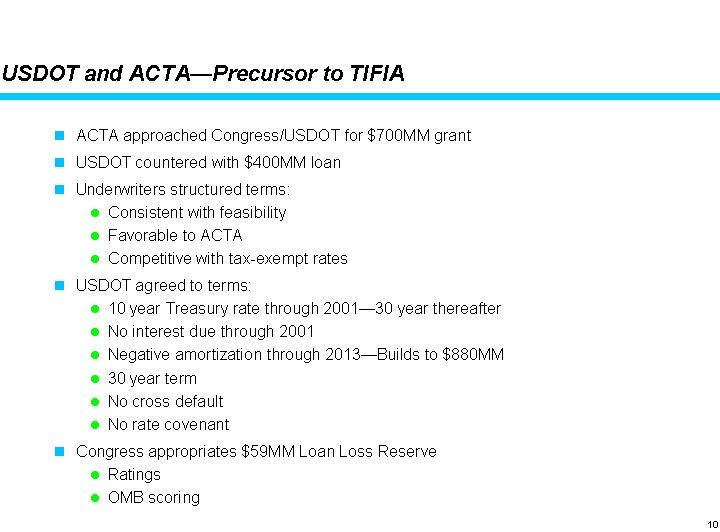

USDOT and ACTA—Precursor to TIFIA

ACTA approached Congress/USDOT for $700MM grant

USDOT countered with $400MM loan

Underwriters structured terms:

Consistent with feasibility

Favorable to ACTA

Competitive with tax-exempt rates

USDOT agreed to terms:

10 year Treasury rate through 2001—30 year thereafter

No interest due through 2001

Negative amortization through 2013—Builds to $880MM

30 year term

No cross default

No rate covenant

Congress appropriates $59MM Loan Loss Reserve

Ratings

OMB scoring

Slide 11:

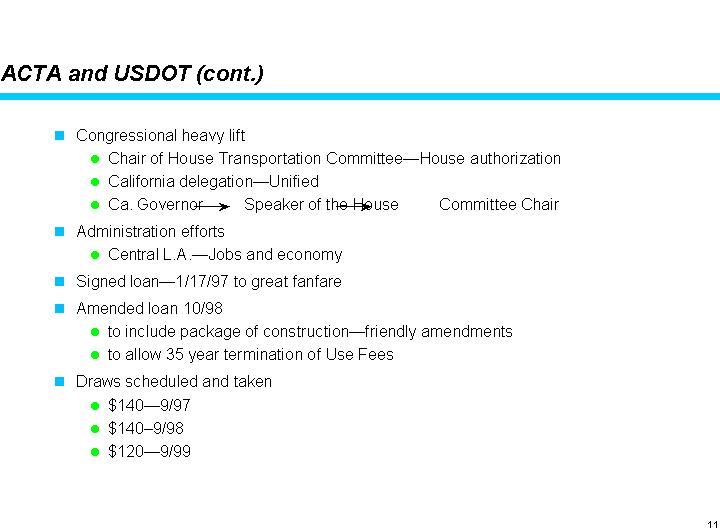

ACTA and USDOT (cont.)

n Congressional heavy lift

Chair of House Transportation Committee—House authorization

California delegation—Unified

Ca. Governor Speaker of the House Committee Chair

Administration efforts

Central L.A.—Jobs and economy

Signed loan—1/17/97 to great fanfare

Amended loan 10/98

to include package of construction—friendly amendments

to allow 35 year termination of Use Fees

Draws scheduled and taken

$140—9/97

$140–9/98

$120—9/99

Slide 12:

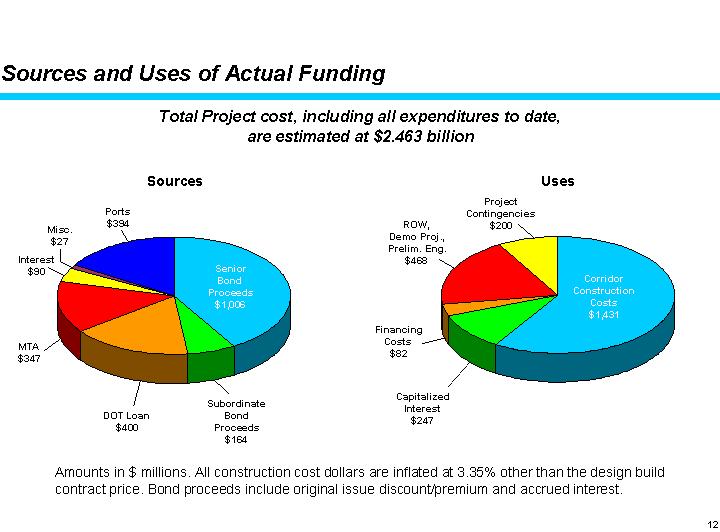

Sources and Uses of Actual Funding

Total Project cost, including all expenditures to date,

are estimated at $2.463 billion

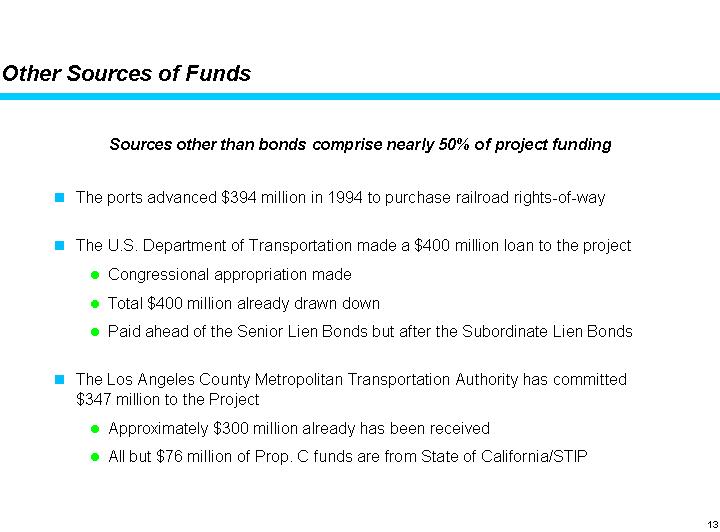

Slide 13:

Other Sources of Funds

The ports advanced $394 million in 1994 to purchase railroad rights-of-way

The U.S. Department of Transportation made a $400 million loan to the project

Congressional appropriation made

Total $400 million already drawn down

Paid ahead of the Senior Lien Bonds but after the Subordinate Lien Bonds

The Los Angeles County Metropolitan Transportation Authority has committed $347

million to the Project

Approximately $300 million already has been received

All but $76 million of Prop. C funds are from State of California/STIP

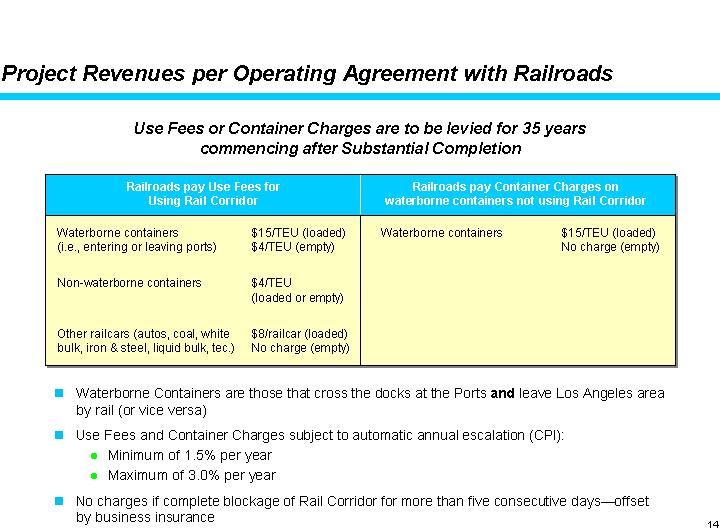

Slide 14:

Project Revenues per Operating Agreement with Railroads

Waterborne Containers are those that cross the docks at the Ports and leave

Los Angeles area by rail (or vice versa)

Use Fees and Container Charges subject to automatic annual escalation (CPI):

Minimum of 1.5% per year

Maximum of 3.0% per year

No charges if complete blockage of Rail Corridor for more than five consecutive

days—offset by business insurance

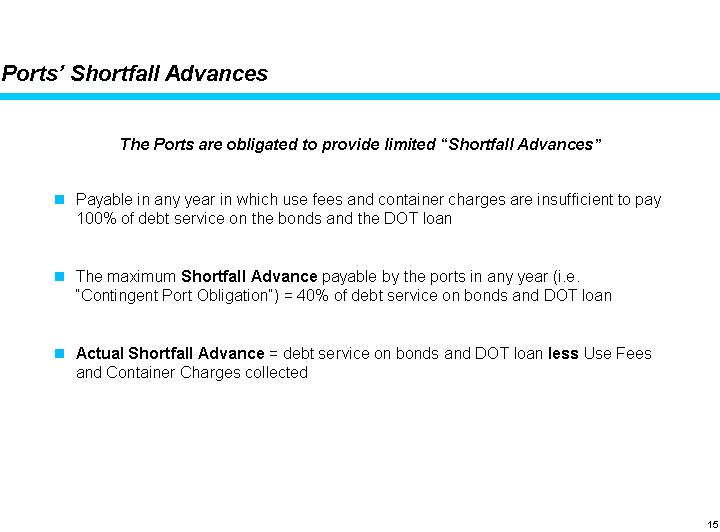

Slide 15:

Ports’ Shortfall Advances

Payable in any year in which use fees and container charges are insufficient

to pay 100% of debt service on the bonds and the DOT loan

The maximum Shortfall Advance payable by the ports in any year (i.e. “Contingent

Port Obligation”) = 40% of debt service on bonds and DOT loan

Actual Shortfall Advance = debt service on bonds and DOT loan less Use Fees

and Container Charges collected

Slide 16:

Detail of Revenue Bonds

ACTA has issued/will issue approximately $1.165 billion of 1999 Revenue Bonds

in four series

Slide 17:

Corridor Revenues

ACTA’s repayment obligations will be paid primarily from Use Fees and

Container Charges as projected by BST (based on the Mercer/DRI Cargo Forecast

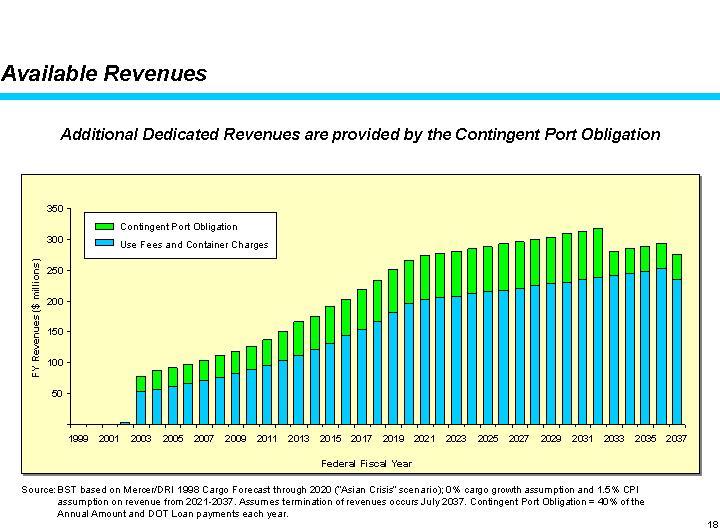

Slide 18:

Available Revenues

Additional Dedicated Revenues are provided by the Contingent Port Obligation

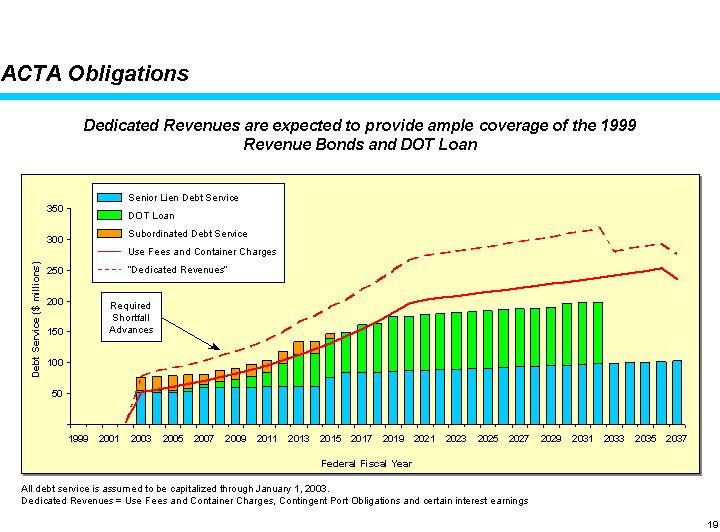

Slide 19:

ACTA Obligations

Dedicated Revenues are expected to provide ample coverage of the 1999 Revenue

Bonds and DOT Loan

Slide 20:

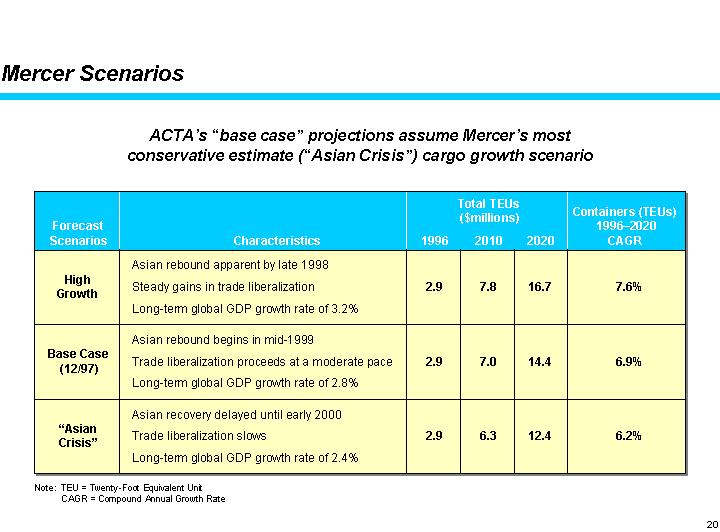

Mercer Scenarios

ACTA’s “base case” projections assume Mercer’s most

conservative estimate (“Asian Crisis”) cargo growth scenario

Slide 21:

Conclusion

Successfully secured the cooperation of major stakeholders including intense

competitors.

Local, state, and national elected officials fully supportive of project with

Federal government designating the Alameda Corridor as a “project of national

significance.

Policy maker decision making process facilitated with well developed model and

feasibility analysis.

Risk spread among various parties including construction contractor.

ACTA among first to use TIFIA program under TEA-21 resulting in $400 million

federal loan with highly flexible provisions.

Funding shared equally between private and public partners.

ACTA, on time and on budget, has been a public/private partnership success.

Slide 22:

Workers are working on the site.