Commercial Motor Vehicle Parking Shortage

Printable

Version [PDF 700KB]

You may need the Adobe® Reader® to view the PDFs on this page.

May 2012

Table of Contents

Executive Summary

Introduction

Geography of Truck Flows and Facilities

Truck Parking Program and Responses

Safety Enforcement Community Observations

Conclusions

Appendix. Truck Parking Studies

Executive Summary

The Conference Report accompanying the Consolidated and Further Continuing Appropriations Act of 2012, Pub. L. No. 112-55, 125 Stat. 552 requested the Federal Highway Administration (FHWA) to: "study the shortage of commercial motor vehicle parking, including the impact of such on operators' compliance with federal safety requirements, and to report findings to the Committees on Appropriations within 180-days of enactment of this Act." Several national studies have estimated the scope of the truck parking shortage, examined the role of public and private sectors in addressing the shortage, and defined safety implications tied to the shortage of truck parking opportunities. Of significant note, the FHWA convened a “Rest Area Forum” in 1999 and published the Study of Adequacy of Commercial Truck Parking Facilities in 2002. The study found that existing demand for truck parking spaces outstripped the available supply, projected increases in vehicle miles of travel by truck would worsen the problem, and truck parking shortages have safety implications. Other national studies published during that time reached similar conclusions. This report updates the major findings of these studies with current estimates and forecasts of long-distance truck activity, information from the Truck Parking Pilot Grant Program, and observations made by the safety enforcement community.

Although the updated information in this report is largely anecdotal, the evidence indicates that truck parking shortages remain widespread and, at least in some geographic areas, acute. Anticipated growth in truck movements will exacerbate the shortages unless there is improved utilization of existing parking capacity and investment in additional capacity. The private sector invests in commercial truck stops where profitable, and the FHWA recommended in 2002 additional actions such as creating public-private partnerships to provide additional capacity where needed.

Introduction

The Conference Report accompanying the Consolidated and Further Continuing Appropriations Act of 2012, Pub. L. No. 112-55, 125 Stat. 552 requested the Federal Highway Administration (FHWA) to:

"study the shortage of commercial motor vehicle parking, including the impact of such on operators' compliance with federal safety requirements, and to report findings to the Committees on Appropriations within 180-days of enactment of this Act."1

The FHWA published a report, Study of Adequacy of Commercial Truck Parking Facilities, in 2002, which found that existing demand for truck parking spaces outstripped the available supply and that projected increases in vehicle miles of travel by truck would worsen the problem. The National Transportation Safety Board (NTSB) and the National Cooperative Highway Research Program (NCHRP) also conducted national studies during that time with similar conclusions. This report updates the major findings of these studies with current estimates and forecasts of long-distance truck activity, information from the Truck Parking Pilot Grant Program,2 and observations made by the safety enforcement community. Finally, the report summarizes the findings of the national truck parking studies noted above and illustrative studies completed by individual States and metropolitan planning organizations (MPOs).

Geography of Truck Flows and Facilities

The FHWA's Freight Analysis Framework (FAF) indicates that the volume of freight moved by long-distance trucking has grown since the national truck parking studies were completed a decade ago, and this growth increases the demand for places to park. The FAF integrates data from the Commodity Flow Survey and other sources to measure freight flows within and among regions and forecast freight flows through 2040. The FHWA also measures truck travel time through its Freight Performance Measures program, a cooperative venture with the trucking and communications industries that tracks the movement of over 400,000 trucks on major intercity highways. Together, the FAF and Freight Performance Measures program data are useful in identifying segments on the National Highway System that carry a significant level of highway freight and may require truck parking capacity.

According to the FAF, trucks carried 13.3 billion tons of freight in 2007, up 12 percent from 2002 when the FHWA study was published. Of the freight moved by truck in 2007, 1.0 billion tons were moved between places more than 500 miles apart. Most trucks hauling freight more than 500 miles need to stop during the journey because truckers are limited to 11 hours of driving followed by 10 consecutive hours of rest. With each truck carrying an average of 16 tons of cargo, the volume indicates that more than 173,000 trucks per day need a place to park during their journey. If tonnage increases 11 percent by 2020 after recovery from declines in 2008 and 2009 as forecasted by the FAF, then more than 190,000 long-haul trucks will need a place to park en route every day.

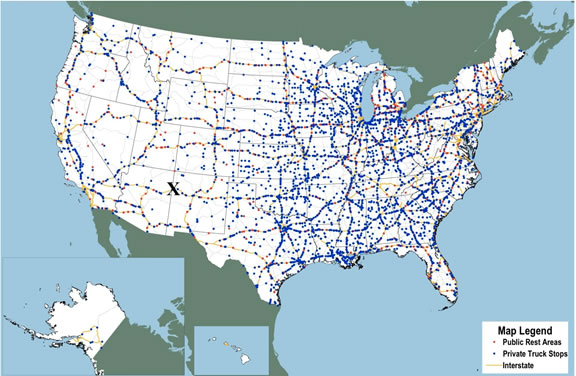

Figure 1 shows potential long-term growth in truck flows, and Figure 2 identifies many of the rest areas and truck stops that provide places for trucks to park. Commercial truck stops are located where the demand for fuel, food, and other services is profitably provided given land and other costs. Although the number of locations is extensive, the number of trucks accommodated at each facility varies from a few to several hundred. Moreover, approximately 1,700 miles of the Interstate System are more than 30 miles from the nearest rest area or truck stop.

Figure 1. Average Daily Non-local Freight Truck Traffic on the National Highway System: 2007 and 2040

Notes: Non-local freight trucks typically serve locations at least 50 miles apart. This map excludes trucks that are used in movements by multiple modes and for mail.

Source: U.S. Department of Transportation, Federal Highway Administration, Office of Freight Management and Operations, Freight Analysis Framework, version 3.1.1, 2010.

Figure 2. Public Rest Areas and Private Truck Stops

Notes: Locations may not be complete or current for some States. X indicates the truck stop on Interstate 40 at the border between Arizona and New Mexico cited in the text.

Source: dieselboss.com, altaonline.com and findfuelstops.com.

Interstate 40 at the border between Arizona and New Mexico illustrates the limitations of currently available rest areas and truck stops shown in Figure 2. Data from the Freight Performance Measures program indicate that trucks leaving Southern California for the eastern United States will reach the 11-hour driving limit on the 80-mile stretch of Interstate 40 between Holbrook, Arizona, and Gallup, New Mexico. This portion of Interstate 40 carries, on average, more than 10,000 non-local trucks per day and has 300 parking spaces for trucks in 5 locations.

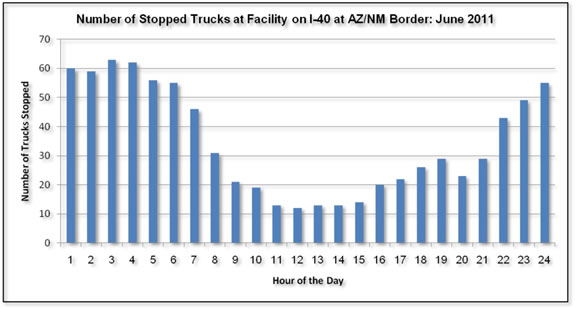

The Freight Performance Measures program database can be used to locate stopped trucks with enough precision to determine whether the truck is in a parking area or along the side of the road. The database represents only a portion of the trucking industry and is thus a conservative indicator of the problem. Using the facility closest to the center of the 80-mile stretch of Interstate 40 as an example, trucks are found along the frontage road and the truck-stop parking lot, suggesting that capacity is being exceeded. The database shows that the number of stopped trucks peaked after midnight in June 2011, the month sampled in Figure 3.

Figure 3. Example of Demand for Truck Parking by Time of Day

Source: U. S. Department of Transportation, Federal Highway Administration, Freight Performance Measures program database, 2012.

Truck Parking Program and Responses

While construction of truck parking in rest areas is an eligible expense under the Federal-aid Highway Program, such as the National Highway System and Surface Transportation Program categories, investments in building new truck parking spaces and facilities must compete with high priorities such as bridge preservation. Most truck parking capacity has been provided as part of full-service commercial truck stops on private land adjacent to major highways.

Section 1305 of SAFETEA-LU established "a pilot program to address the shortage of long-term parking for commercial motor vehicles on the National Highway System." Over $30 million was made available from 2005 through 2012 for this program. Most projects funded through this program involve technology to detect and inform truck drivers of parking space availability, making better use of existing capacity, and some projects support construction of additional parking spaces. Awards to solutions based on Intelligent Transportation Systems in the early years of the program enabled very cost effective investments to be made through the program. In fiscal year 2011, the program saw the first significant investment in building new truck parking spaces; 6 projects were funded at $7.2 million which added 325 new parking spaces. The cost per space may not be typical for the nation, particularly given wide variations in land costs among regions and between urban and rural areas.

State responses to the program indicate that the truck parking shortage remains widespread and acute. States have proposed projects costing more than $231 million, eight times the amount of funds available for award. Only $2.9 million is currently available for the first round of project solicitations in FY 2012, for which FHWA has received 23 applications requesting almost $49 million in grants.

The proposed projects, cost sharing plans, and the rigor by which the need for investment is justified vary substantially among the applications. Although the amount of grant requests is an imprecise measure of need given these variations, the geographic distribution of the grant requests shown in Table 1 indicates that the need for truck parking is spread throughout the Nation.

In August of 2011, the Secretary of Transportation awarded funds to the State of Florida to build additional parking spaces adjacent to a privately owned and operated truck parking facility to relieve a severe over demand condition experienced regularly at that location. Congress included this activity as an investment eligible for funding under the Truck Parking Pilot Program; this serves as a significant, positive example of the type of public/private partnerships envisioned by FHWA's 2002 Adequacy Study.

Table 1. Section 1305 Grants: 2006-2012

| State | Amount Requested |

|---|---|

| Alaska | $2,300,000 |

| Arizona | $14,100,000 |

| Arkansas | $8,792,000 |

| California | $12,830,000 |

| Colorado | $20,220,000 |

| Connecticut | $17,800,000 |

| Florida | $11,020,712 |

| Georgia | $360,000 |

| I-95 Corridor Coalition | $10,500,000 |

| Idaho | $840,000 |

| Illinois | $4,550,000 |

| Indiana | $6,365,000 |

| Kentucky | $845,871 |

| Louisiana | $14,600,000 |

| Maine | $2,800,000 |

| Maryland | $4,488,000 |

| Massachusetts | $380,000 |

| Michigan | $9,495,000 |

| Minnesota | $2,040,940 |

| Mississippi | $4,000,000 |

| Missouri | $5,234,170 |

| Nevada | $16,277,222 |

| New Mexico | $777,000 |

| New York | $12,138,000 |

| North Dakota | $298,000 |

| Oklahoma | $1,464,000 |

| Oregon | $3,526,268 |

| Pennsylvania | $4,100,000 |

| Rhode Island | $445,000 |

| South Carolina | $255,000 |

| Tennessee | $3,800,000 |

| Utah | $6,320,132 |

| Virginia | $3,085,591 |

| Washington | $1,887,000 |

| West Virginia | $1,300,000 |

| Wisconsin | $6,403,444 |

| Wyoming | $15,759,530 |

| Total | $231,397,880 |

Safety Enforcement Community Observations

Parking shortages are a safety concern. As stated in the 2002 report, "an inadequate supply of truck parking spaces can result in two negative consequences: (1) tired truck drivers may continue to drive because they have difficulty finding a place to park for rest, and (2) truck drivers may choose to park at unsafe locations, such as the shoulder of the road and exit ramps, if they are unable to find available parking."

Current Hours of Service (HOS) regulations require a driver to take 10 consecutive hours off duty after driving a maximum of 11 hours. Drivers need to find parking facilities that will accommodate long-term rest during a multi-day trip, typically between places that are over 500 miles apart. Because most rest areas along the Interstate System do not accommodate a full 10 hours of undisturbed rest, and drivers do not want to lose time diverging from their route, some truckers park along the side of roads, on rest-area ramps, and in rest areas that restrict parking to less than 10 hours.

Truck parking data are not collected nationwide, but the Commercial Vehicle Safety Alliance (CVSA) obtained information from several State law enforcement agencies to provide anecdotal evidence of the truck parking problem. Table 2 summarizes the HOS violations, the truck parking violations, and the percentage of illegally parked truck drivers who report to the enforcement officer that they cannot find a parking space and are out of HOS.

Table 2. Commercial Motor Vehicle Violations in Selected States: 2011

| State | HOS Violations 2011 | Truck Parking Violations 2011 | Illegally Parked Drivers Who Cannot Find a Parking Space and Are Out of HOS |

|---|---|---|---|

| Colorado | 3,048 | 0 | No data |

| Idaho | 2,506 | 39 | 25% |

| Kentucky | 2,078 | 19 | No data |

| Maine | 8,790 | 12 | 2% |

| Minnesota | 4,173 | 30 | <5% |

| Missouri | 15,798 | No data | No data |

| Montana | 10,524 | 0 | 3% |

| Nebraska | 4,750 | 342 | 73% |

| New Jersey | 4,261 | No data | No data |

| Virginia | 14,826 | 140 | No data |

| Wisconsin | 621 | 90 | 5% |

| Total | 70,754 | 672 |

Source: CVSA

Violation statistics may understate problems related to truck parking availability if enforcement officers are reluctant to cite truckers who are illegally parked and have reached their driving time limits under the HOS rules. Enforcement officers are presented with a difficult enforcement choice: force the driver to move the vehicle to a safer location when a driver has reached the HOS limit or leave the vehicle illegally parked.

Conclusions

Although the updated information in this report is largely anecdotal, the evidence indicates that truck parking shortages remain widespread and, at least in some geographic areas, acute. Anticipated growth in truck movements will exacerbate the shortages unless the public and private sectors respond with improved utilization of existing parking capacity and investment in additional capacity. The private sector invests in commercial truck stops where profitable, and the FHWA recommended in 2002 additional actions such as creating public-private partnerships to provide additional capacity where needed. The award of funds to the State of Florida to build additional parking spaces adjacent to a privately owned and operated truck parking facility illustrates the type of public/private partnerships envisioned by FHWA's 2002 Adequacy Study.

Appendix. Truck Parking Studies

National Studies

Four national studies, conducted between 1996 and 2003, established that truck parking shortages are a national problem that affects highway safety. The findings of these studies are summarized below.

Study of Adequacy of Commercial Truck Parking Facilities — Technical Report

FHWA, 2002

This report covered a broad range of issues associated with truck parking, including an assessment of the adequacy of truck parking capacity based on a national inventory of truck parking spaces and truck parking demand models. The study determined that existing demand for truck parking spaces outstripped the available supply and that projected increases in vehicle miles of travel by truck would worsen the problem. It also reported that plans for expansion of parking capacity were firm in 15 States and under consideration in an additional 22 States. Moreover, the study noted that 16 States were planning to improve the availability and utilization of truck parking facility locations using approaches based on Intelligent Transportation System technology.

Dealing with Truck Parking Demands

NCHRP Synthesis 317, 2003

This study, which updated the 2002 FHWA report, surveyed truck parking facilities in all 50 States, the District of Columbia, and Puerto Rico. The study found that most truck parking spaces were located at commercially-owned facilities, and the shortage problem is concentrated at public rest areas.

Highway Special Investigation Report: Truck Parking Areas

NTSB, 2000

This report indicated that the shortage of adequate truck parking facilities was a contributing factor to crashes involving trucks. The NTSB found that 80 percent of public rest areas and 53 percent of private truck stops experienced more demand than could be accommodated on a daily basis. The NTSB also reported that States with restrictions on the number of hours a driver was allowed to stop at a public rest area impeded trucker compliance with HOS regulations.

Commercial Driver Rest and Parking Requirements: Making Space for Safety

FHWA, 1996

This study found that 90 percent of truck drivers surveyed experienced a significant shortage of truck parking spaces during the overnight hours. It noted that the duration of stays at public and private stops differed considerably and that a surplus of private spaces did not compensate for a shortage of spaces at public rest areas. The study estimated that between $489 million and $629 million were needed to meet future truck parking needs.

Illustrative Studies by States and MPOs

In response to concerns that truck parking capacity is inadequate, the American Association of State Highway and Transportation Officials developed the Guide for Development of Rest Areas on Major Arterials and Freeways. This guide has helped States to conduct their own studies of truck parking or incorporate analysis of truck parking capacity into statewide planning efforts. The MPOs also have conducted truck parking studies. Several of these efforts have collectively identified a demand for over 25,000 spaces in 14 States. Summaries of illustrative study findings and methodologies are presented below.

Arkansas (2006)

Between 2003 and 2006, the number of parked trucks increased by 31 percent. This can be attributed to the overall increase in the numbers of trucks on the roadways and to time-in-service rule changes. If all trucks parked in only marked spaces, there would be a deficit of 38 designated parking spaces. If additional truck parking spaces were made available at closed rest areas, weigh stations and inspection stations, there would be a surplus of 78 designated parking spaces. However, not all of these closed sites could be converted to designated truck parking areas due to safety, security, and nuisance concerns from local officials as well as complaints from residents and business owners in the area.

California (2010)

In California, 78 percent of respondents on Interstate 5 have encountered truck stops that were too full.

Maryland (2005)

In Maryland, 270 trucks were parked at 34 locations where signs prohibited parking.

Miami-Dade County, Florida (2010)

The county provides 293 parking spaces, but has a demand for 12,000 spaces requiring 1,177 acres of property.

New York (2010)

There are approximately 3,600 truck parking spaces along State corridors, and nearly

80 percent of these are provided by privately owned truck stops. More than half of New York State rest areas experience truck parking shortages on any given night, and many experience demand far in excess of capacity with trucks parking on ramp shoulders and in car parking spaces. In general, shortages occur in the late evening to early morning period. There are a number of rest areas experiencing shortages that are located close to large private truck stops.

Tennessee

The total supply of spaces in all rest areas and pull-out areas in the State is estimated to be 767. The actual number of parked trucks along Interstate highways is 1,224. Thus, approximately 470 trucks were parked along shoulders of ramps and through lanes and, in some cases, at undesignated locations inside a rest area or pull-out area. This represents almost 40 percent of parked trucks. Moreover, 27 percent of all parked trucks were found on regular interchange ramps not associated with rest areas or welcome centers. The largest numbers of parked trucks were found along 1-40 in Tennessee, which runs in an east-west direction for approximately 450 miles. Other Interstate highways in Tennessee, which run in the north-south direction, are not nearly as long as 1-40.

Wisconsin (2009)

Many truck parking problems occur at the outskirts of large metro areas such as Chicago, Illinois, where truckers park primarily to stage for customer appointment times. In most places, parking capacity shortages occur in the early evening or late at night. Truckers who experience a problem in finding an available parking spot tend to know little about parking availability in the nearby area. This is because they either lack the means or are unaware of how to find this information.