Slide 1:

National Multimodal Freight

Trends/Issues/Forecasts/

Policy Implications

Slide 2:

Objectives…

Discuss emerging trends

Present national freight analysis efforts including forecasts

Identify some of the emerging policy issues toward transportation reauthorization

in 2002-2003

Slide 3:

Emerging Freight Trends and Issues

Markets/Logistics (demand)

From national markets to global markets

From a manufacturing to a service economy

Increased DOD reliance on commercial freight system

Moving to customer dictated just-in-time delivery system

Carriers/Transportation Systems (supply)

From modal fragmentation to cross-modal coordination

From system construction to system optimization

Public Policy

From economic deregulation to safety regulation

From modal to multi-modal surface transportation policy

Increased environmental accountability

Slide 4:

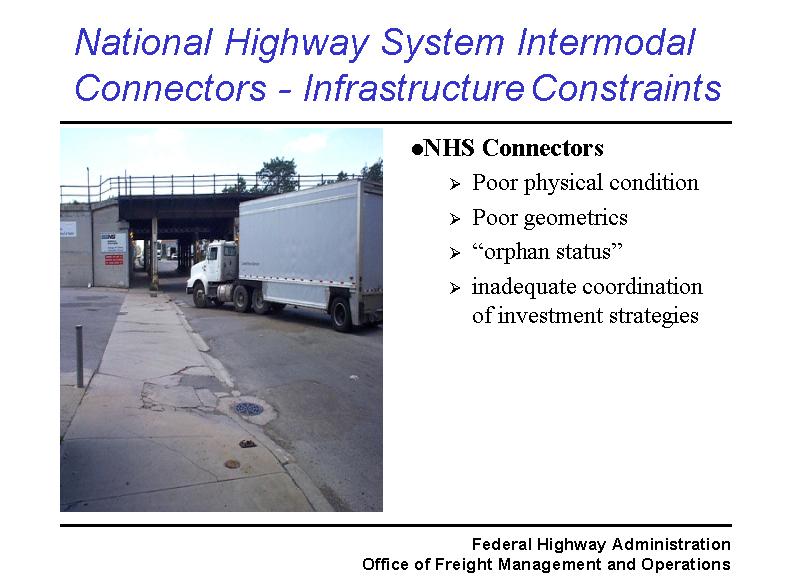

National Highway System Intermodal Connectors - Infrastructure

Constraints

NHS Connectors

Poor physical condition

Poor geometrics

“orphan status”

inadequate coordination of investment strategies

Slide 5:

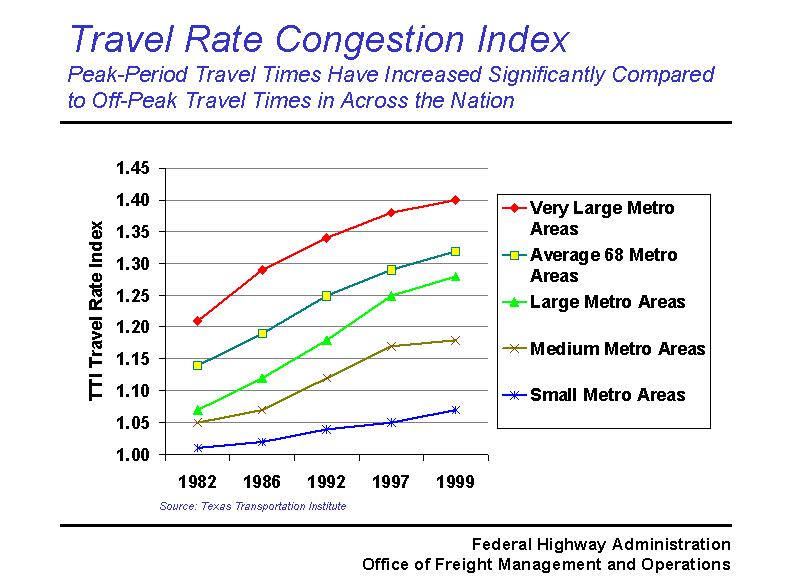

Travel Rate Congestion Index Peak-Period Travel Times Have Increased Significantly Compared to Off-Peak Travel Times in Across the Nation

Slide 6:

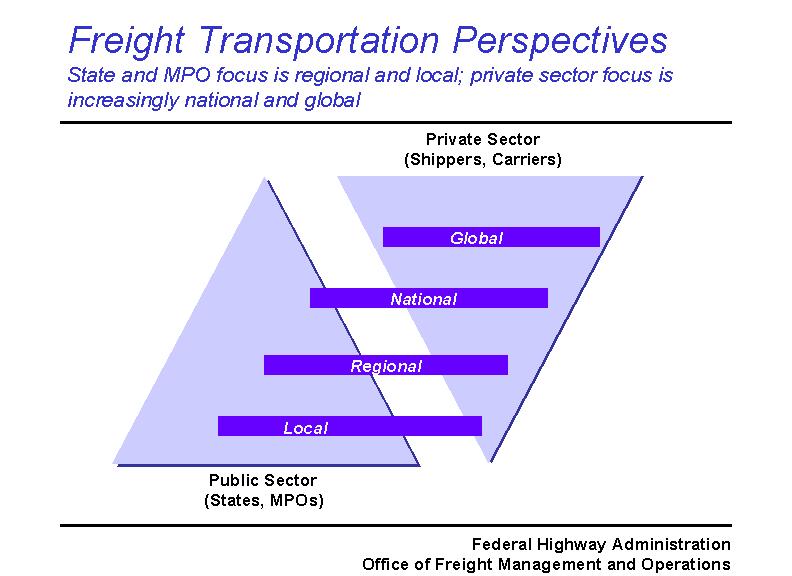

Freight Transportation Perspectives State and MPO focus is regional and local; private sector focus is increasingly national and global

Slide 7:

National Multimodal Freight Data and Policy Analysis Framework

Approximation of current national flows

Economic trade forecasts to 2020 (domestic and international) and estimated

modal components

Assessment of capacity and investment implications

Policy development tool for future legislation

Slide 8:

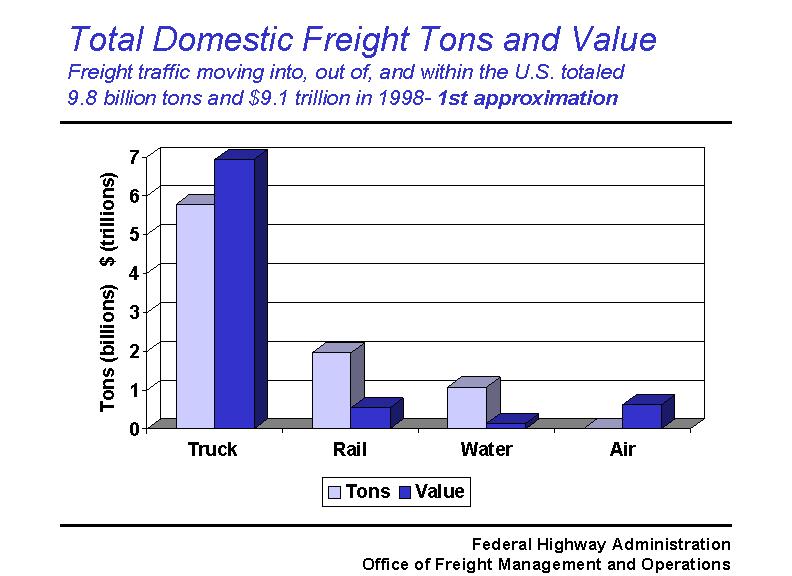

Total Domestic Freight Tons and Value Freight traffic moving into, out of, and within the U.S. totaled 9.8 billion tons and $9.1 trillion in 1998- 1st approximation.

Slide 9:

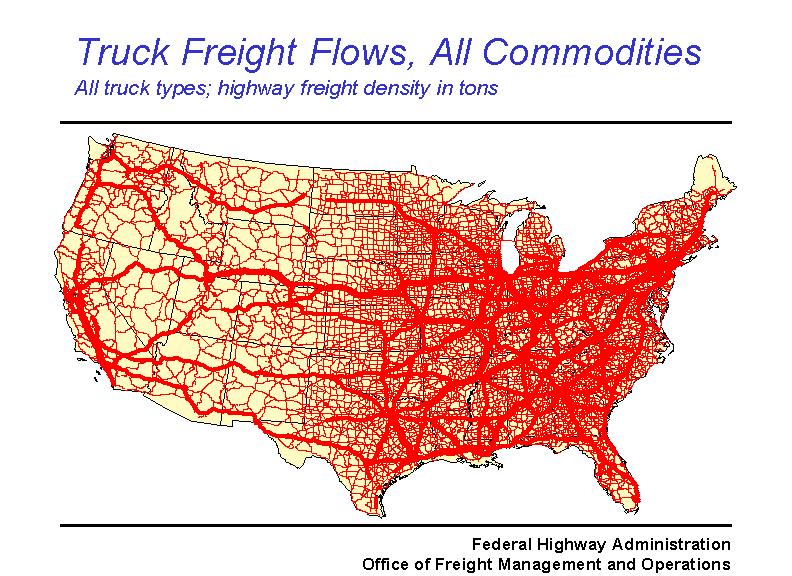

Truck Freight Flows, All Commodities All truck types; highway freight density in tons

Slide 10:

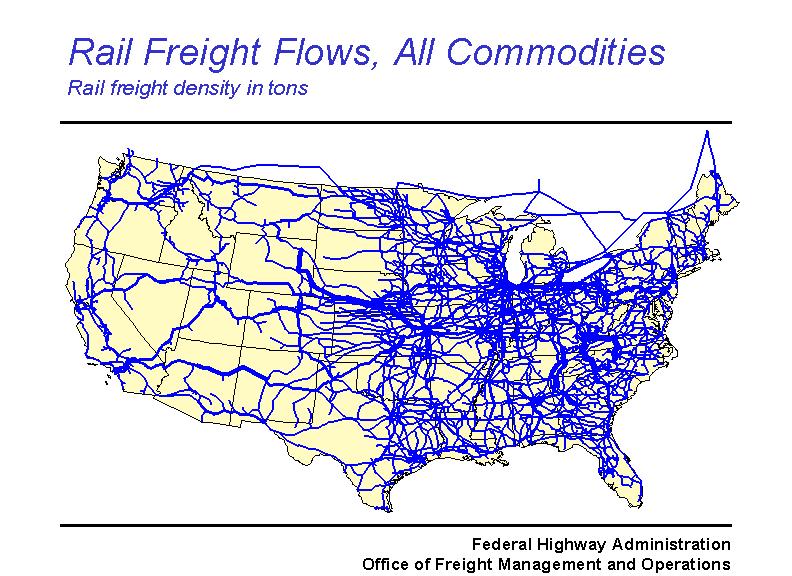

Rail Freight Flows, All Commodities Rail freight density in tons.

Slide 11:

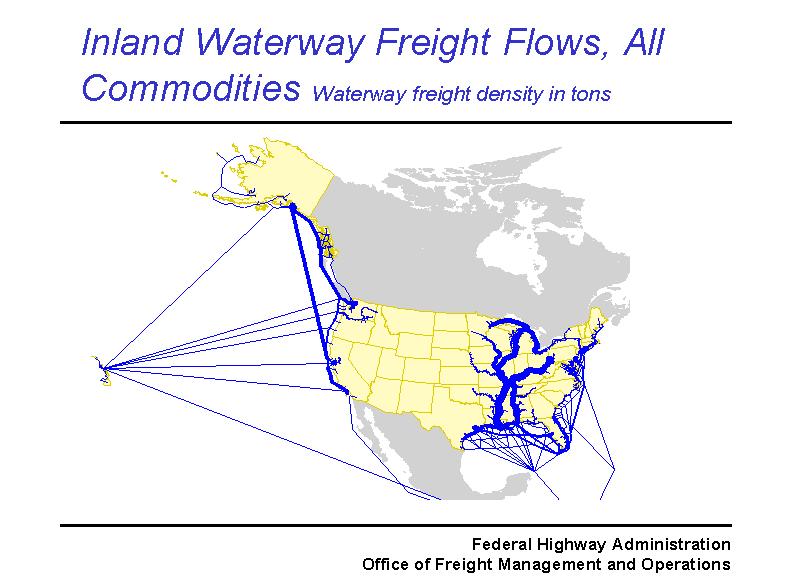

Inland Waterway Freight Flows, All Commodities Waterway freight density in tons.

Slide 12:

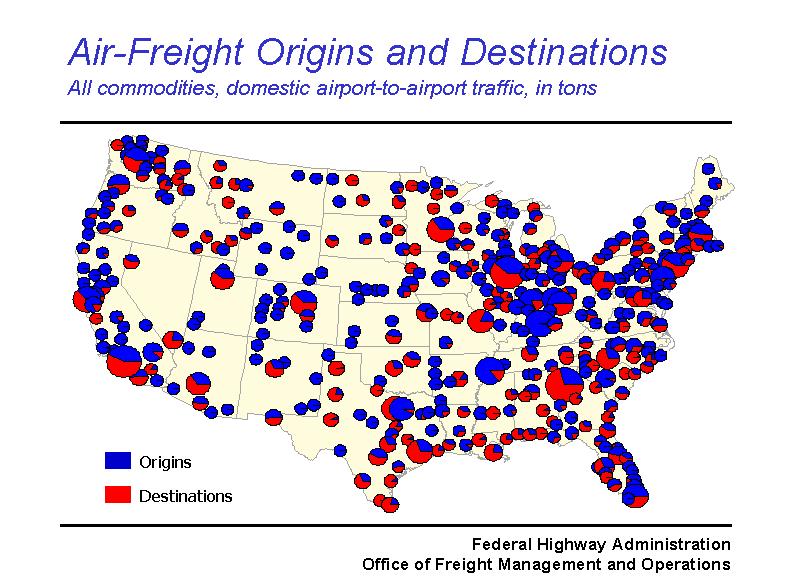

Air-Freight Origins and Destinations All commodities, domestic airport-to-airport traffic, in tons.

Slide 13:

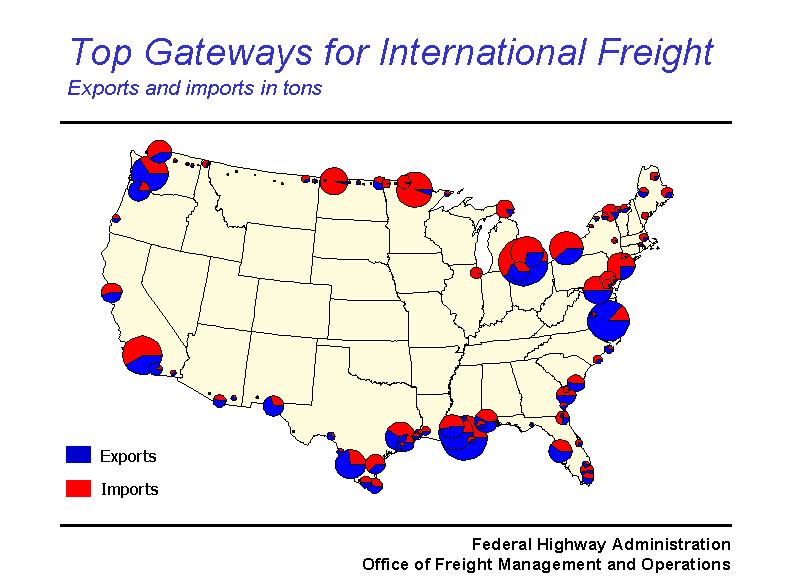

Top Gateways for International Freight Exports and imports in tons

Slide 14:

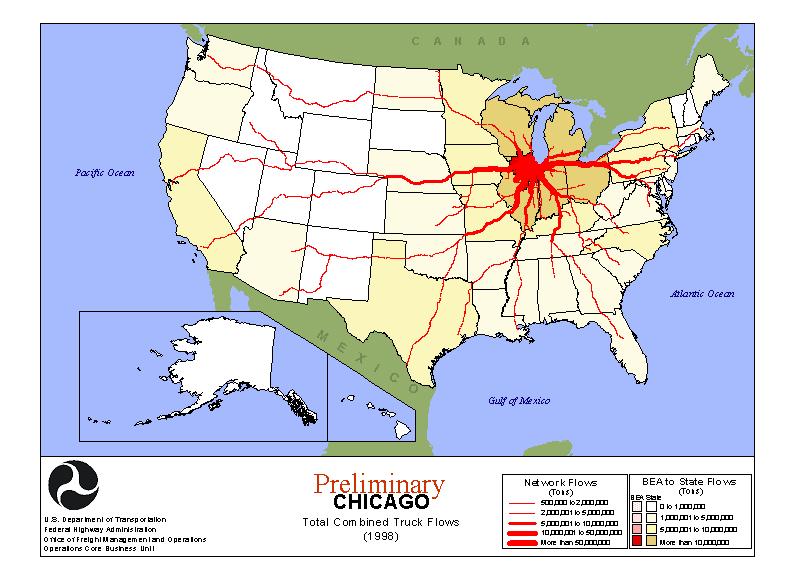

Total combined trcuk flows at Chicago in 1998.

Slide 15:

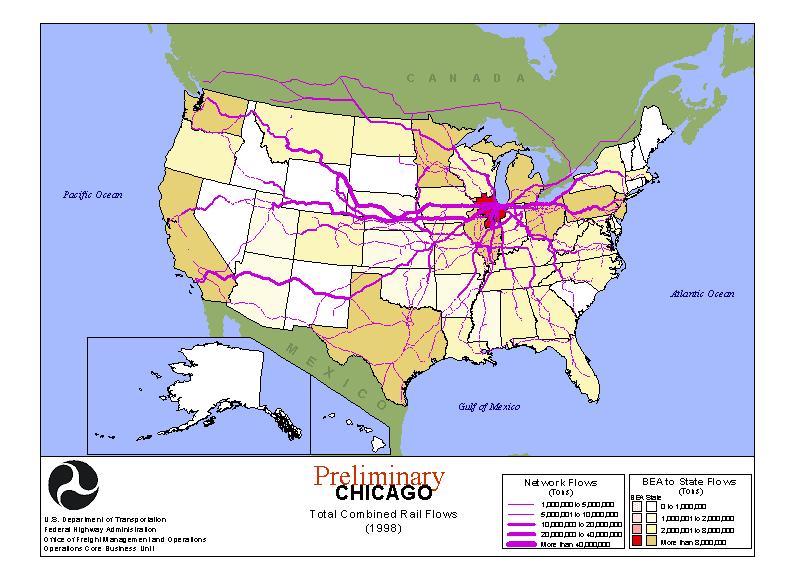

Total combined rail flows at Chicago in 1998.

Slide 16:

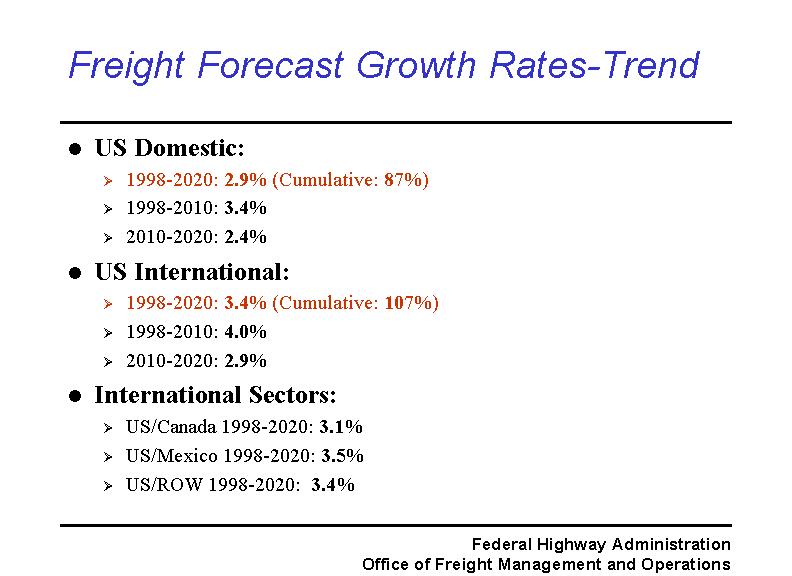

Freight Forecast Growth Rates-Trend

US Domestic:

1998-2020: 2.9% (Cumulative: 87%)

1998-2010: 3.4%

2010-2020: 2.4%

US International:

1998-2020: 3.4% (Cumulative: 107%)

1998-2010: 4.0%

2010-2020: 2.9%

International Sectors:

US/Canada 1998-2020: 3.1%

US/Mexico 1998-2020: 3.5%

US/ROW 1998-2020: 3.4%

Slide 17:

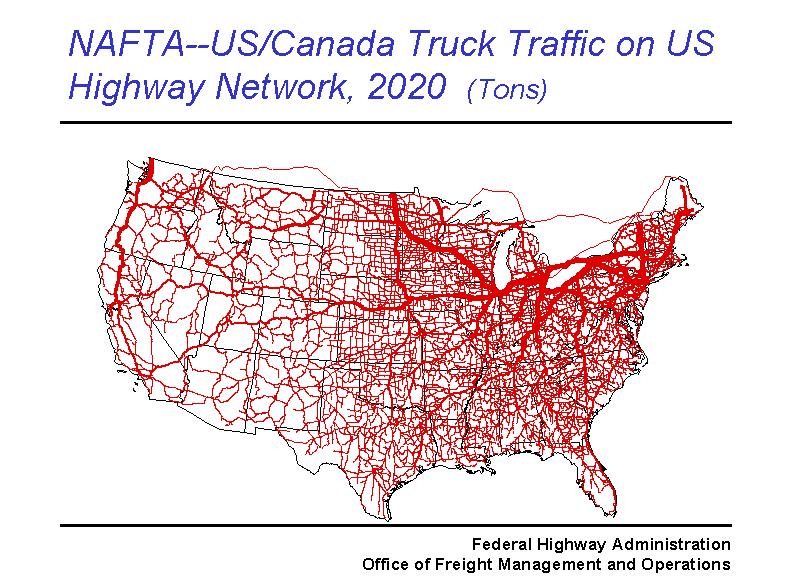

NAFTA--US/Canada Truck Traffic on US Highway Network, 2020 (Tons)

Slide 18:

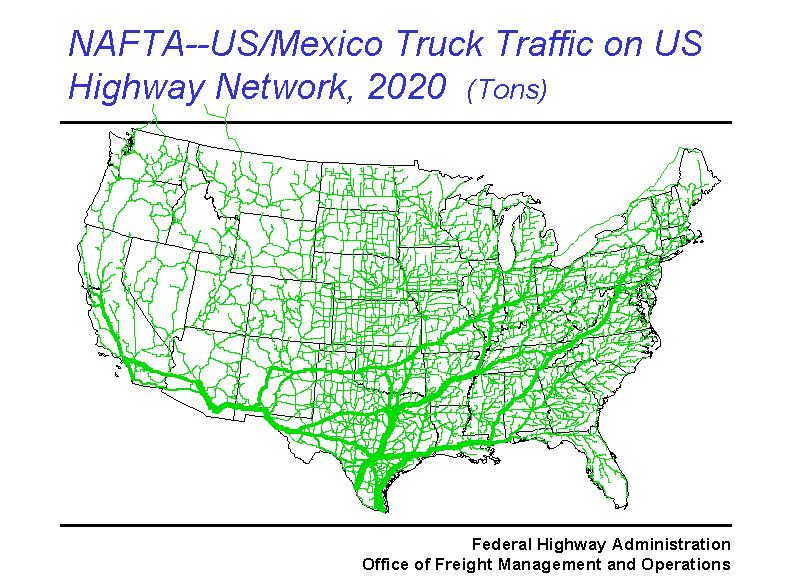

NAFTA--US/Mexico Truck Traffic on US Highway Network, 2020 (Tons)

Slide 19:

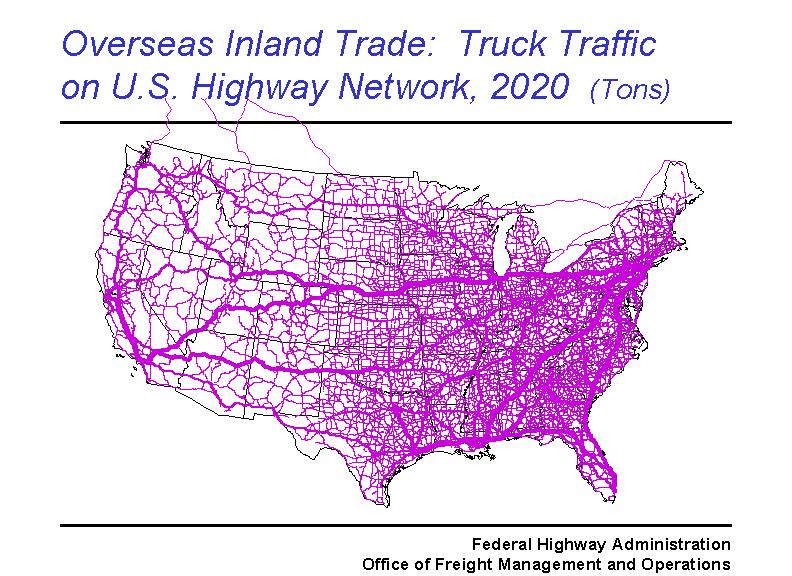

Overseas Inland Trade: Truck Traffic on U.S. Highway Network, 2020 (Tons)

Slide 20:

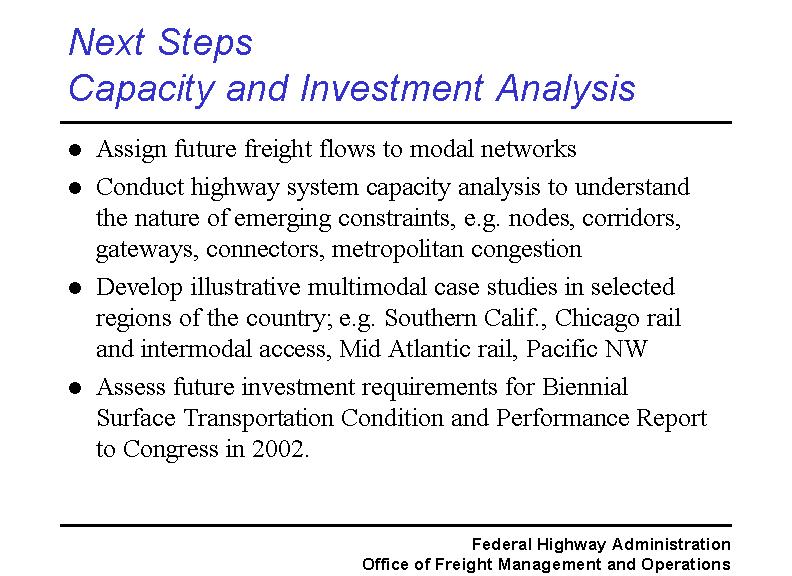

Next Steps

Capacity and Investment Analysis

Assign future freight flows to modal networks

Conduct highway system capacity analysis to understand the nature of emerging

constraints, e.g. nodes, corridors, gateways, connectors, metropolitan congestion

Develop illustrative multimodal case studies in selected regions of the country;

e.g. Southern Calif., Chicago rail and intermodal access, Mid Atlantic rail,

Pacific NW

Assess future investment requirements for Biennial

Surface Transportation Condition and Performance Report to Congress in 2002.

Slide 21:

The Policy Challenge

Both passenger and freight demand upon the nation’s infrastructure will

increase significantly

Freight volumes will nearly double to 2020; with higher growth in some corridors

and nodes

Current planning and financing methods do not adequately address freight’s

unique concerns

Intermodal linkages not seamless

Increased focus on safety and environmental issues

Economic competitiveness at stake

Slide 22:

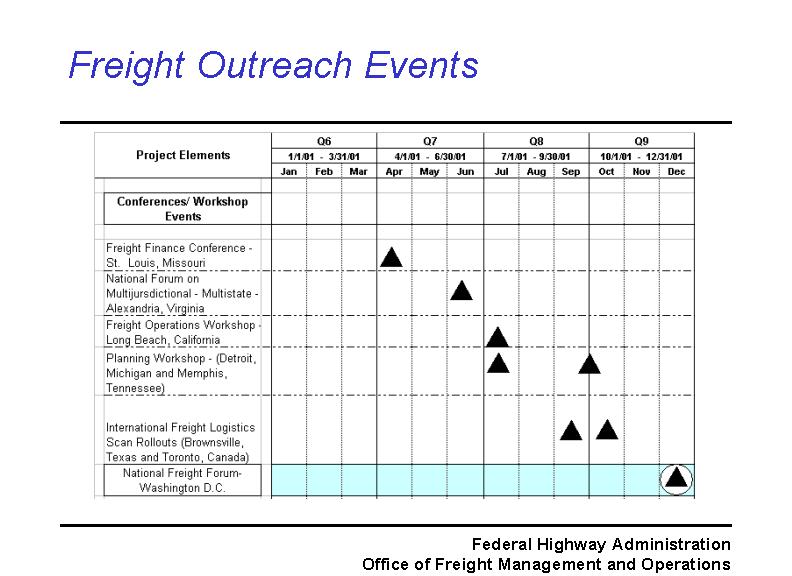

Freight Outreach Events

Slide 23:

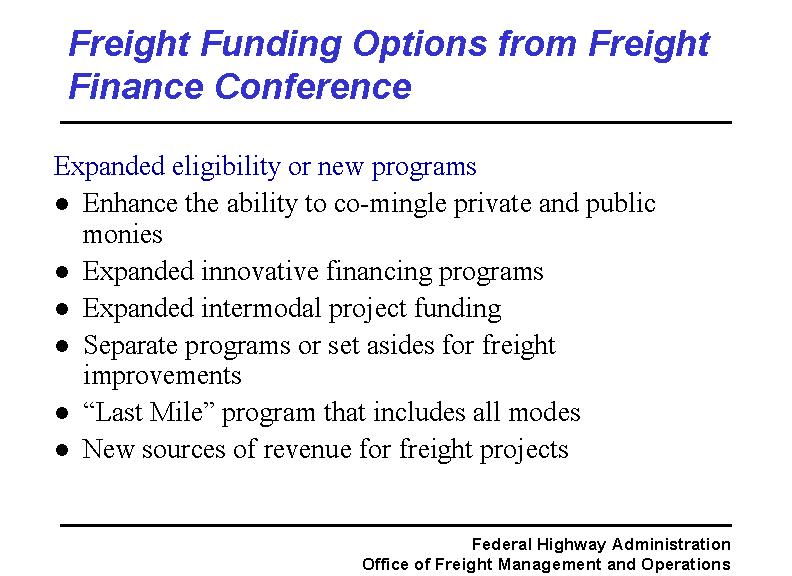

Freight Funding Options from Freight Finance Conference

Expanded eligibility or new programs

Enhance the ability to co-mingle private and public monies

Expanded innovative financing programs

Expanded intermodal project funding

Separate programs or set asides for freight improvements

“Last Mile” program that includes all modes

New sources of revenue for freight projects

Slide 24:

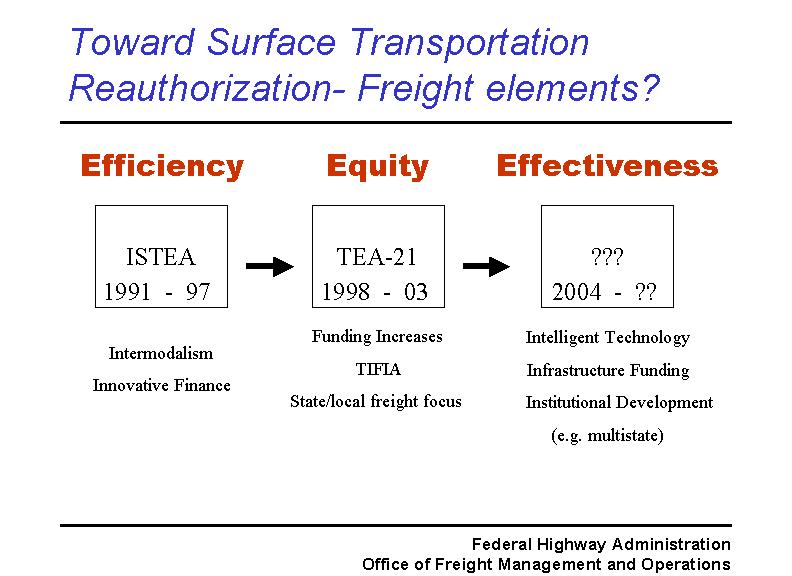

Toward Surface Transportation Reauthorization- Freight elements?

Slide 25:

Toward Surface Transportation Reauthorization- Freight elements?

FHWA Office of Freight Management and Operations, USDOT

http://www.ops.fhwa.dot.gov/freight

Gary Maring

Director

gary.maring@fhwa.dot.gov