Virginia Port Authority - Truck Reservation System Expansion and Automated Work Flow Data Model: Advanced Transportation and Congestion Management Technologies Deployment Initiative

Section 1 - Project Description

Section 1.1 – Introduction of Project

The Virginia Port Authority (VPA), marketed as The Port of Virginia, hereinafter referred to as the port, is pleased to submit this proposal in response to the United States Department of Transportation (USDOT) Notice of Funding Opportunity (NOFO) for the Advanced Transportation and Congestion Management Technologies Deployment (ATCMTD) Initiative. The port is growing faster than any other port on the east coast. Part of this growth is related to possessing the capability to handle Post-Panamax container ships, which is afforded by very few ports on the east coast. This growth requires densification of existing terminal resources in the short term, as well as a more comprehensive plan to handle the long term logistics needs for the U.S. East Coast. The port is addressing both of these time horizons. The long-term plan covers the next 15 years and includes the development of the Craney Island Marine Terminal. The short-term plan will necessitate the use of additional levels of automation to efficiently handle the increase in throughput.

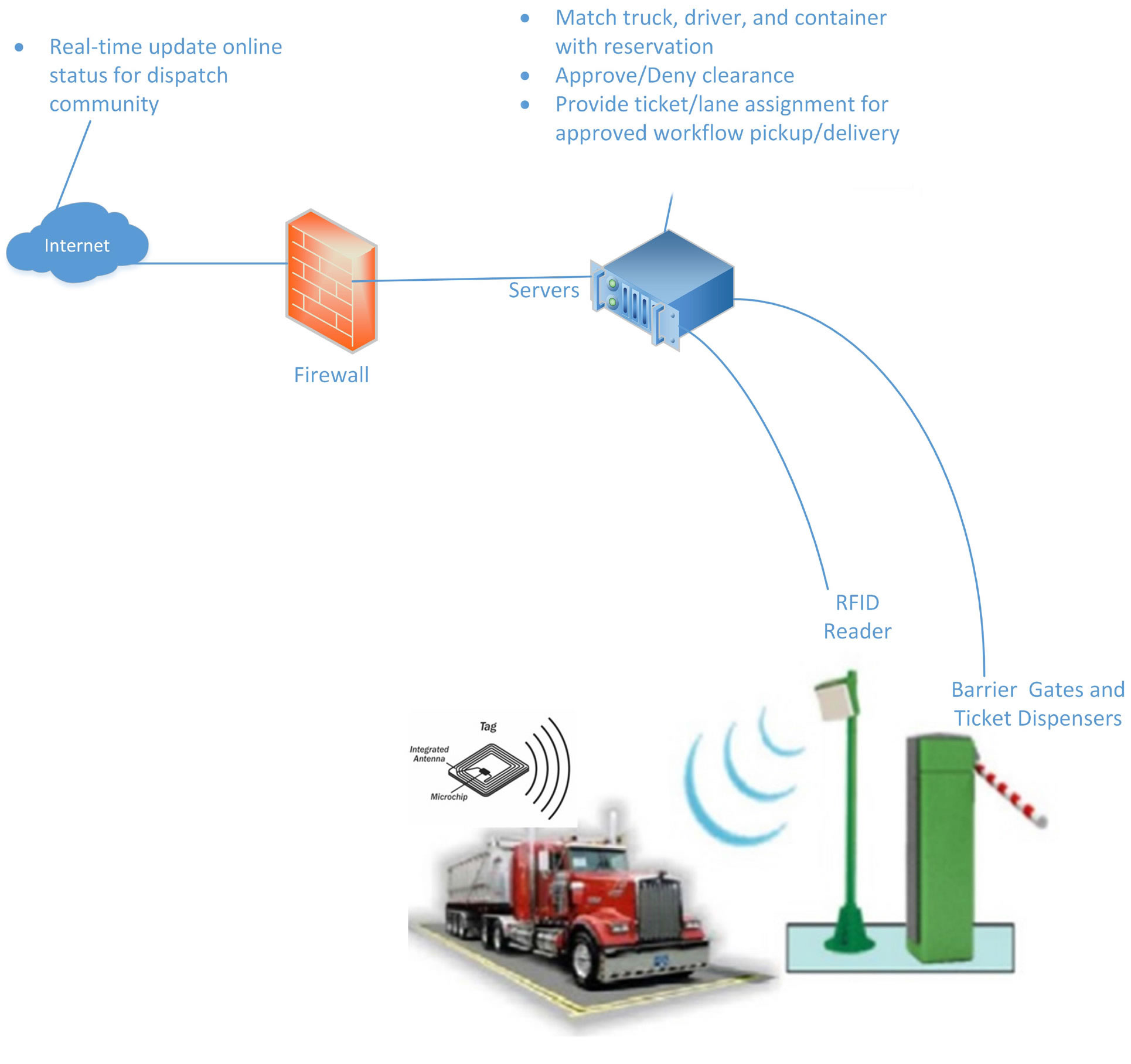

Virginia International Gateway (VIG) and Norfolk International Terminal (NIT) are operated by the port through a master services agreement with Virginia International Terminals (VIT). Radiofrequency identification (RFID) technology has been in use at the port on a limited basis since 2007. Last year a plan was created to install a newer technology RFID system that would provide enhanced functionality to meet the demands of the new automation projects which are currently underway at both VIG and NIT. The newer technology RFID system is also consistent with similar technology deployed at the Port of New York/New Jersey (NY/NJ), the Port of Baltimore, and in the Port of Los Angeles/Long Beach. The new technology has been deployed at NIT at both the existing south gate complex as well as in the new $42 million North Gate complex set to open in late June 2017. VIG has begun switching its system over and should finish the deployment by the first quarter of 2018. In concert with the installation of new RFID readers at NIT and VIG, the port has been aggressively deploying the new RFID tags via its new PRO-PASS trucker access portal system. To date, more than 1,400 of the 4,500 trucks that routinely serve the port have been registered and RFID tags issued. To facilitate this deployment the port has been offering a 76% discount on the cost of the RFID tags through the end of June 2017. Since the port moves more than 60 percent of its containerized cargo exclusively by over-the-road trucks on state and interstate highways, it is important to provide efficiency in handling the interaction with the trucking community, and to provide consistency across all of the terminals in Virginia.

The main focus of this project will involve the requirements analysis, design, implementation and deployment of the first version of a second-generation truck reservation system. The successful deployment of mandatory truck reservations in the Port of NY/NJ in early 2016 has demonstrated the feasibility and value of structuring the access to container terminals. Virginia was an early adopter of truck reservations when the VIG terminal opened in 2007. In 2014 the concept was extended to the NIT terminal. In both cases the deployment was limited by the demands of supporting rapid growth in the port. We are currently updating the port truck reservation systems to a level consistent with best practices on the U.S. East Coast. In doing this we recognize the need to significantly extend the concept to further advance the state of the art. This is the basis for the need to create a "second generation" system. This effort will include a published data model to provide real-time updates to dispatchers and truckers via their Truck Management Systems. The system also will include a Data Subscription Model to get information out to the truckers and other logistics chain stakeholders (shippers, brokers, shipping lines, etc.) using a cloud based system ubiquitous across all of Virginia's terminals. The proposed Data Model will serve as the basis for a standard industry dataset to scale across other ports. While the initial deployment will be limited to the port, the work will serve as a platform for future enhancements that will extend its reach to various levels up and down the logistics chain. This will allow the trucking community to monitor cargo status when it arrives at the terminal (allowing them to schedule a truck for pickup), notifying them about holds on their container (Customs, payment hold, etc.) as well as confirmation of truck arrivals and departures from the various terminals.

Another key goal of this project is to scale the RFID deployments to the remaining container terminals serving the trucking distribution channels—Portsmouth Marine Terminal (PMT), Richmond Marine Terminal (RMT) and the Virginia Inland Port (VIP). The extension of the new technology to these other terminals will allow for the full implementation of the Truck Reservation System which is being pilot tested at NIT to be extended to all terminals in the port. The ability to record and match against the truck's RFID will eliminate four minutes from each gate entry transaction, and in turn will reduce the overall turnaround time for each truck.

Increasing the efficiency of the overall system will aid in lowering emissions from idling trucks, improve the throughput for each terminal and reduce general traffic congestion at each terminal associated with the entry gate processing time. As a secondary benefit, the proposed system will allow for two-way data flows with other supply chain stakeholders (e.g. truckers, railroads, shippers and brokers). This type of real-time data subscription delivery can give the end users more confidence in knowing where their goods are, when they can obtain access to their goods and the estimated time of arrival. All of this combined creates efficiencies in the supply chain and thus lowers the amount of excess inventory stored at the end users' facilities.

The transportation system surrounding the terminals in the Hampton Roads area is highly variable and is subject to occasional disruptions due to congestion and unplanned events. The truck reservation system will provide a one-hour (hour of the day) reservation window, along with a 30-minute grace/flex period to allow for early or late arriving trucks. To better operate the system, we will partner with Old Dominion University's Virginia Modeling and Simulation Center (VMASC) to evaluate the size of scheduling windows, consider time of day variations and evaluate peak versus off-peak demand. This data driven approach will assist in the optimization of the scheduling window that takes into consideration the effects traffic congestion may have on travel-time reliability to the various terminal facilities. These models also will contribute to the creation of operating policy related to reservation time slot flexibility (e.g. early arrival cases, late arrival cases, etc.). We expect this work will be generalized to the point that it could be adopted to other ports.

The real and the perceived reliability of the truck reservations will improve the trucking community's acceptance of the system by providing real-time feedback and consistent response times, backed up by a set of policies supported by simulation data to make the system fair and reliable. This will also reduce the tendency for excessive truck queues first thing in the morning to "beat the rush." Trouble tickets are expected to significantly decrease with the reservation system by alerting dispatchers in advance of truck arrivals to prevent showing up too early or when a hold has not been released on a container. The use of ingress/egress RFID readers will allow for an automated check-in/check-out log of trucks at each terminal. By establishing thresholds, each terminal has the capability to use this system to increase situational awareness and security by identifying trucks that have entered the terminal but have not exited for an inordinate amount of time.

The total project cost is $3,100,000. The port is requesting $1,550,000 in federal funds (50 percent) from the ATCMTD program to compliment the $1,550,000 (50 percent) in committed port funds and terminal revenue.

The port is committed to initiate the activities identified in this submittal upon award and expected to complete the full implementation within three years of notice to proceed. The port will be working with its numerous stakeholders to help ensure the success of the project.

The proposed Truck Reservation System Expansion and Automated Work Flow Data Model project meets the selection criteria for the ATCMTD Grant Program. The following summarizes the project relative to the ATCMTD grant criteria contained in the NOFO. The quantifiable system performance improvements and projected benefits are contained in Section 1.8 and 1.9 respectively.

Technical Merit

- The Truck Reservation System Expansion and Automated Work Flow Data Model project aligns with the ATCMTD program requirements and USDOT goals including environmental benefits, dissemination of real-time information and economic benefits.

- Environmental Benefits. The project is expected to significantly reduce the time needed for a truck to complete a trip (approximately 66 percent reduction, or approximately 51 minutes per truck). This will reduce truck idling times, gas consumption and air emissions.

- Dissemination of Real-Time Information. This project will create a cloud based system using an open and standardized data model that will allow for real-time, two-way data flow with all supply chain stakeholders (e.g. truckers, railroads, shipping lines and brokers).

- Economic Benefits. Having real-time information provided to truckers and a reservation system will reduce congestion and delay entering the terminals and create an efficient and reliable process for moving containers into and out of the port.

- The Truck Reservation System is a project ready to be deployed to the remaining terminal facilities in Virginia. The Automated Work Flow Data Model will build off the first-generation system already in operation.

- The Truck Reservation System and Automated Work Flow Data Model project is scalable and can be readily implemented to other port facilities along the East Coast. The cloud-based data model can serve as the standardized data model for all other facilities throughout the United States.

- The project team and the project manager have first-hand experience in deploying RFID

technology, developing truck reservation systems and working collaboratively with

stakeholders.

Section 1.2 – Description of Entity

The VPA, marketed as The Port of Virginia (the port), is proposing a Truck Reservation System Expansion and Automated Work Flow Data Model. The port will be responsible for the administration of ATCMTD grant funding and will work closely with the USDOT on all aspects of project management, including all reporting, and other requirements defined in the ATCMTD NOFO.

The port operates six world-class terminals which collectively create the fifth largest port complex in the nation, moving more than 2.5 million twenty-foot equivalent unit (TEUs) of cargo through these facilities each year. These six terminals are made up of four deep-water marine terminals in the Hampton Roads area of southeastern Virginia, one upriver terminal in Richmond and an inland intermodal facility in Front Royal. The port's deep water harbor is the deepest on the U.S. East Coast and offers 50-foot channels, both inbound and outbound. In addition, it is the only East Coast port with congressional authorization to dredge to 55 feet. The port's other notable infrastructure includes:

- 1,864 acres

- Up to 50 feet deep berths

- 19,885 linear feet of berth

- 30 miles of on-dock rail

Nearly 30 international shipping lines offer direct, dedicated service to and from Virginia, with connections to more than 200 countries around the world. In an average week, more than 40 international container, breakbulk and roll-on/roll-off vessels are serviced at the port's marine terminals.

The port is served by a robust trucking industry serving all areas of Virginia, the East Coast, the Ohio Valley and beyond. In fiscal year 2016, trucks moved more than 908,000 containers to and from the port terminals which accounts for 63 percent of all the cargo moved.

Two Class I railroads, Norfolk Southern and CSX, serve the port via on-dock intermodal container transfer facilities at VIG and NIT. The railroad service is augmented by vital short line rail partners including the Norfolk and Portsmouth Belt Line and the Commonwealth Railway. Virginia's intermodal rail connections allow the port to reach customers in the Ohio Valley and the upper Midwest with scheduled daily service. The VIP facility helps to quickly move containerized cargo from the marine terminals to its location 220 miles inland, and closer to port customer's distribution centers.

Partnerships

Virginia International Terminals

Through a cooperative agreement with the port, VIT provides terminal management services for the port. The company manages, operates and conducts business for each of the port's terminals. It also offers electronic data interchange services. The company was founded in 1982 and is headquartered in Norfolk, Virginia.

Tidewater Motor Truck Association

The Tidewater Motor Truck Association (TMTA) is Hampton Roads' key trucking advocacy group. TMTA's purpose is to promote safe, efficient and responsible truck commerce in Virginia and to significantly contribute to the region's supply chain.

Virginia Maritime Association

The Virginia Maritime Association (VMA) has a membership of more than 450 companies which employ more than 70,000 Virginians. The VMA's role is to promote, protect and encourage international and domestic commerce through Virginia's ports. The VMA works collaboratively with its members and the port to develop effective and efficient solutions to improve opportunities.

City of Norfolk, Virginia

The City of Norfolk is a key stakeholder in this project. One of the four deep-water marine terminals, NIT, is located in the City of Norfolk. Norfolk's primary interest in this project is to reduce congestion on several surface street arterials in the vicinity of the terminal, address associated safety concerns of trucks and improve the quality of life for neighboring residential areas.

City of Portsmouth

The City of Portsmouth also is a major stakeholder in this project and has two of the four deep-water marine terminals located in the city boundaries, VIG and PMT. Similar to the City of Norfolk's interest, the City of Portsmouth endorses this project to reduce congestion of several corridors in the city, address associated safety concerns of trucks waiting to enter the port facilities and improve the quality of life for its citizens.

Section 1.3 – Description of Geographic Area

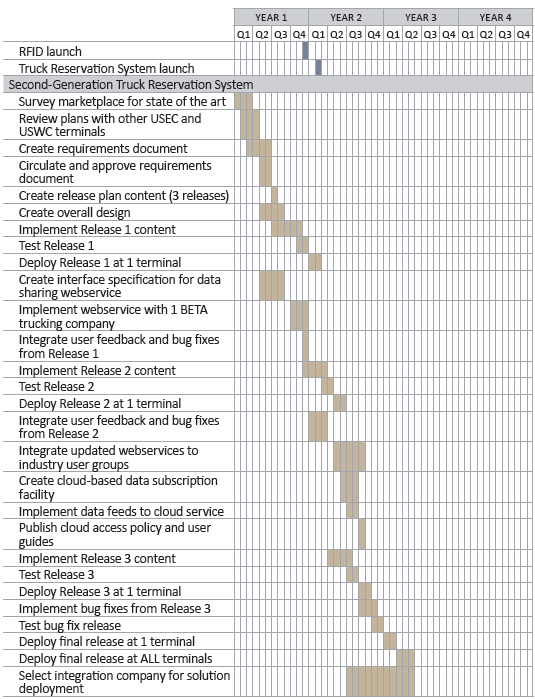

The port owns four terminals and leases two terminals throughout the Commonwealth. Through a master services agreement with VIT, the port oversees operations at six terminals, five of which are included in this project. The five terminals and their geographic area are described below.

Norfolk International Terminals

NIT is a 567-acre container terminal located in the City of Norfolk along the Elizabeth and Lafayette Rivers. It is located adjacent to Interstates 64 and 564 and Hampton Boulevard, with additional easy access to US Route 17 and US Route 58. NIT is the port's largest terminal which has six 50-feet deep berths and 14 Super Post Panamax ship-to-shore cranes. Thousands of daily truck moves are processed through 17 interchange lanes and two on-terminal transfer zones. In June 2017, NIT will expand its operations by adding 26 interchange lanes increasing the facility's truck throughput capacity.

Portsmouth Marine Terminals

PMT is a 285-acre mixed use terminal located on the west bank of the Elizabeth River in the City of Portsmouth. PMT has three deep-water berths and six Post Panamax ship-to-shore cranes that are currently allocated to container operations. PMT serves primarily as an over-the-road truck terminal with infrequent intermodal rail operations. The terminal has the capability of handling containers, break-bulk and roll-on/roll-off cargo. PMT also has a 44-acre empty container yard that is used as overflow for NIT and VIG.

Virginia International Gateway

VIG is a 231-acre container terminal located along the Elizabeth River in the City of Portsmouth. It is located just off VA-164W in Portsmouth with easy access to Interstate 64, U.S. Route 17 and U.S. Route 58. VIG has three 50-foot deep berths and eight Super Post Panamax ship-to-shore cranes. Container operations make use of semi‑automated rail-mounted stacking cranes, with waterside transfers to vessels via shuttle carriers. VIG includes an on-dock rail yard with 13,200 feet of working track. The facility was commissioned in July 2007, and is the largest privately-owned container terminal in the United States. VIG is one of the only functional automated container terminals in the Western Hemisphere. The facility is a U.S. Customsdesignated port of entry, and the full range of customs functions is available to customers.

VIG is situated on a total footprint of 576 acres. Phase I of VIG's development, at 231 acres, can process more than one million TEUs annually. Phase II will add approximately 60 acres in additional space and another one million-plus TEUs in capacity. The terminal has been designed to serve super post-Panamax class vessels, and is accessible by a 50-feet navigation channel, direct interchange to the interstate highway system and double-stack intermodal service. The terminal is constructed as a semi-automated operation, with a mix of manual and automated container handling equipment. Its design is unique in that many of the terminal's operations are performed remotely from a

centralized terminal operations center promoting efficiency, accuracy and employee safety.

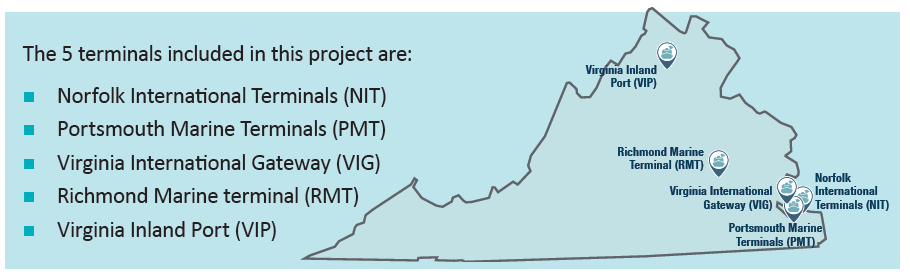

Richmond Marine Terminal

RMT is a 121-acre general cargo terminal on the James River in the City of Richmond. It is located just off Interstate 95 and provides easy access to Interstate 64, Interstate 85, U.S. Route 17 and U.S. Route 58. RMT supports a container barge service to the Hampton Roads marine facilities as well as bulk agriculture exports, transloading, warehouse and break-bulk operations. RMT also includes on-dock rail service. The facility is owned by the City of Richmond and leased by the VPA, under an agreement that began in late 2010. RMT has 300,105 square feet of warehouse space. The facility is a U.S. Customs-designated port of entry, and the full range of customs functions is available to customers.

Virginia Inland Port

VIP is a 161-acre intermodal container transfer facility in Front Royal (Warren County, approximately 60 miles west of Washington D.C.) with container rail service to and from NIT and VIG. VIP is located off Interstate 66 and provides easy access to Interstate 81. The terminal brings the port 220 miles closer to inland markets and enhances service to the Washington D.C./Baltimore Metro region by providing rail service to the terminals in Hampton Roads. VIP also consolidates and containerizes local cargo for export. The terminal is serviced by 17,820 feet of rail track that runs adjacent to Norfolk Southern‘s Crescent Corridor.

The facility is a U.S. Customs-designated port of entry, and the full range of customs functions is available to customers. Well-known companies such as Home Depot, Kohl's, Rite Aid and Red Bull have opened new distribution centers in the Front Royal area to utilize VIP. VIP serves a crucial role as an outlet for container cargo from the marine terminals to points along the East Coast and westward via truck and rail.

Section 1.4 – Challenges Addressed and Goals of the Initiative

The three terminals in the Hampton Roads area have experienced a variety of challenges that include unacceptably slow truck turnaround times, inefficient terminal operations regarding container storage and on-site management as well as a large volume of trouble tickets (which require prolonged on-terminal special assistance) for truckers attempting to gain access to the terminals. The challenges have been recognized throughout the trucking community to the level that resulted in a few disgruntled truckers contacting local news outlets to complain in 2015. The complaints created several news stories and articles on the excessive delays and associated truck queuing and inefficiencies at the various terminals. Our local news provider, WAVY TV 10, published the following statement:

Truck drivers have called WAVY.com about this problem before, and we went to the port, and we did find problems. The pictures emailed to us from frustrated truckers show them backed up onto the Western Freeway (Highway 164.)

"This is a mess. It is killing us. I mean, we are trying to survive, and it's taking us down," truck driver Blake Nixon said.

Nixon and many other truckers claim it takes hours to get into the Virginia International Gateway terminal (VIG), which is one the port's two primary container terminals. The other is Norfolk International Terminal (NIT).

"It's every day. Four … five hours every time you come in here … it's terrible. This is supposed to be the most efficient port. There's no efficiency here," Nixon said.

A link to the full reports can be found here: http://wavy.com/2015/03/11/truck-drivers-complainof-long-wait-times-at-port-of-virginia/

http://wavy.com/2015/04/30/uncontained-chaos-at-the-ports/

Terminal Operations

Due to not having a truck reservation system deployed at each of the terminals, there is inefficiency from having to move containers multiple times before they get picked up. As the terminal currently operates, a trucker has a five-day window to pick up their container. The trucker can come with no notification within that five-day window. This results in containers being moved multiple times to allow for other containers to be picked up and creates significant delays for drivers on the terminal due to the multiple container movements to uncover their desired container. This causes serious inefficiencies with terminal operations, especially during peak period demands. Having a truck reservation system will allow each terminal to know when a container is to be picked up and to pre-position it prior to the pick-up reservation. This problem is compounded by the surge in demand for trucker access when a particular container gets to the end of its five-day window. Failure to pick up a container within the windows results in extra charges. Finally, the demand for service is very inconsistent. There is no predictability to know days there will be more trucks, or if most trucks will come in the morning or afternoon on any given day. The containers are split into 15 (soon to be 28) distinct "piles". A piece of equipment serves each pile. That equipment can nominally handle 15 containers per hour. If 20 truckers show up for containers in the same pile in the same hour, there is going to be a delay.

Trouble Tickets

Trouble tickets are generated by the gate attendant and are the result of issues that range from truck drivers going to the wrong terminal facility, freight that has not been released by the line operator (usually because the freight charges have not been paid by the shipper), uncommunicated Customs holds and early arrival times (containers not ready for pickup – perhaps still on the ship). This lack of communication results in more truckers on-site than necessary, trucks needing to be redirected to other terminal facilities, truckers waiting for holds to be removed from the cargo or the trucker being sent away—frustrated. In addition, paper tickets are issued to each truck that enters the terminals and it is the responsibility of the gate attendant to ensure each ticket is complete with all the truck's information and the cargo container they are picking up or dropping off. If any information is missing, the gate attendant must fill in the missing data manually adding time to the gate transaction and increasing the resulting delay and queues for trucks entering the terminal.

Having the Truck Reservation System Expansion and Automated Work Flow Data Model extended to all of Virginia's terminals will allow for trucking dispatchers to know when trucks should be scheduled, if the area they must access (which pile) is available (e.g. no over booking the specific piles), which facility to be directed to and when. The system also provides real-time updates of the release status of the containers. Last minute Customs holds will be communicated well in advance. The RFID technology will increase the accuracy and completeness of the information of the truck and the cargo to allow for the automation of gate operations. This will further reduce the time to enter the terminal facilities and the resulting queues.

Section 1.5 – Transportation Systems and Services

The port has a long history involving state of the art truck management systems and the application of technology to improve the effectiveness of cargo logistics. The VIG Terminal opened in 2007 and is considered a pioneer in the application of automated technology to container terminals. This terminal also introduced a first-generation truck reservation system to streamline access to the new facility. That reservation system has been in use since 2007. In 2014, the reservation system was expanded to the NIT. Both of these early systems have remained in continued use. The truck reservation system recently deployed in the Port of New York derived many lessons learned from the early Virginia system.

The port is currently deploying an enhanced truck reservation system at two of its Hampton Roads terminals—NIT and VIG— as part of a pilot deployment.

Building from the base pilot system at NIT and VIG, the port is proposing to expand the system to three of its four remaining Virginia terminals; RMT, PMT and VIP. The Newport New Marine Terminal facility will not be included in the project due to the type of cargo operations. The proposed transportation system and services to be included in the project include:

- Expansion of a cloud-based truck reservation software platform integrated with the back-end inventory management system and RFID readers at each facility

- Use of data model

- Expansion of RFID (PRO-PASS) to the remaining entry/exit gates at RMT, PMT and VIP

The base scheduling system will be expanded to cover the additional terminals, including annual software/system maintenance during the four-year design, development and installation time frame along with software integration to the inventory management systems at each facility. RFID tag readers will be included for the entry and exit gates at the RMT, PMT and VIP terminals for ubiquitous coverage of all Virginia terminals.

The initial pilot system deployment focused on a truck scheduling system for external truck dispatching entities to manually request a time slot for picking up or dropping off containers which only allowed for limited data flow to/from the port's reservation system. Status updates are not presently available for the dispatchers/truckers, nor can the truckers use the data with their Truck Management Systems. The proposed upgrades will expand the software coverage to the other container terminals in the port and create a two-way data flow with other systems (truckers, railroads and beneficial cargo owners). Establishing a data flow with the trucking industry will require collaboration to design standard data sets for types and quantities of information to be shared. As a result, an open, standardized data model would be published to allow the other terminals and supply chain stakeholders the opportunity to immediately leverage the new functionality for their systems.

Traffic flow into each facility is highly variable based on time-of-day. Due to the unique nature of each terminal facility, modeling and simulation support from the Old Dominion University VMASC will be used to evaluate the size of scheduling windows. This data driven approach will assist in the optimization of the scheduling window and the effects traffic congestion may have on traveltime reliability to various terminal facilities. These models will also contribute to the creation of operating policy related to reservation time slot flexibility (early arrival cases, late arrival cases, etc.).

RFID tag readers will be integrated with the back-end scheduling system to automate work flow of arriving trucks to increase the efficiency of clearing them to enter the terminal, execute their mission and exit the facility, thereby reducing the associated turnaround time. The objective of this project is to minimize/eliminate the wait time at the terminal to reduce truck idling time, fuel consumption and emissions while increasing trucking productivity and the terminals' throughput. Based on the defined data model, dispatchers can be notified of status changes when containers have been released from hold (e.g., Customs, payment hold), when trucks have arrived to pick up the container as well as when the truck left the facility with the container. In addition, the two-way data flow will be provided to shippers, brokers and freight forwarders so that each entity can be apprised of the shipment status in real time.

Section 1.6 – Deployment Plan

This project will involve a number of sub-projects that can be executed in parallel. Broadly speaking, there are four separate tracks.

Ongoing Maintenance and Annual Support

The ongoing annual maintenance and support of the existing Truck Reservation System (TRS) will happen in parallel. This is not developmental in nature; rather, it ensures the existing TRS continues to operate during the next four years. This grant line item provides funding during the period of the grant. The port currently pays for maintenance of the existing systems. These are strategic systems and will be maintained for the foreseeable future. The plans to deploy the first generation system throughout the port while simultaneously developing a replacement system are evidence of the critical nature of this technology in the operation of the port. The impacts of the densification project must be mitigated by some form of truck access management system. The current products are lacking in some advanced features, but even as they are, the impact of their balancing of truck access are significant. For this reason, the operations staff is fully engaged in the use of the systems.

Technology Upgrade to Other Port Terminals

This effort will be considered high priority. By the time the project starts, the TRS will have been deployed to both VIG and NIT. The construction at those sites makes the timing of deployment critical. Once we begin regulating truck flow at the two main terminals, it's likely that all unplanned access will swamp the smaller terminals. Within the scope of upgrades, the PMT will be given the highest priority because of its proximity to both VIG and NIT.

The upgrade project will consist of a series of work packages that are implemented for each terminal.

- The first task will involve conducting a wireless network and RFID site survey at each terminal. This will provide critical details related to network channel utilization as well as on-terminal mounting logistics for the sensors that make up the RFID solution. The common elements of the systems as well as site-specific issues are important inputs to the plans to create a common design package.

- The survey results will be used to create a standard design concept. This concept will describe

computer hardware and software requirements as well as the strategy for deploying the RFID

sensors in the in-gate and out-gate complexes at each site. - The standard design will then be adapted as necessary to create a site-specific design for the RFID system at each terminal. This will support the creation of accurate equipment order lists as well as the budget process for installation and debugging costs.

- The equipment lists will be consolidated into a single procurement document. The equipment order will be placed with the intent of buying everything at one time. This will provide maximum volume discounts while ensuring that all the items purchased are at the same revision levels to simplify ongoing maintenance. It also will allow the equipment for the lower priority terminals to be used as spare parts for the higher-priority terminal. This will improve schedule adherence.

At this point, the schedule will diverge for each terminal based on the priority for implementation. The timeline lists the terminals in order of priority.

The equipment will be installed in the gate complex and an installation acceptance test will be performed prior to linking the equipment to the upstream software systems.

The terminal operating system will be upgraded to include the new functionality related to the RFID system. This will include adding RFID signatures to all gate transactions. The gate point-of-use hardware will be upgraded at this point to provide feedback about RFID equipment details for specific trucks. RFID tag number, license plate number and TRS status (initially this will be void).

At this point, the specific terminal will be considered ready to deploy the RFID portion of the technology. The operational users will be trained on using the system.

When operations are comfortable with the level of training and the functionality of the new RFID subsystem, a launch date will be set. The RFID system will then be live at the specific site.

The common TRS system will then be updated to allow reservations to be made for the site. The operating policy will be adjusted to contemplate specific needs related to truck access. This will include parameters related to number of trucks per hour, the areas of the facility where quotas will be established, the policy for early/late arrival windows and the options related to handling trucks without reservations. Once these are configured the TRS will be launched at the site. This will be preceded by appropriate communications with all truckers and other terminal users.

Miscellaneous Support Tasks

Marine terminals employ a layered architecture when it comes to the software systems that support their business. The very top layer involves typical financial support systems that most businesses use. There are some special needs related to invoicing, but for the most part these systems are very normal. The next layer involves special execution software that is highly process aware. The software at this layer is called a Terminal Operating System (TOS). The TOS is highly focused on the processes that generate revenue on the terminal which includes truck in gate, out gate, vessel load, unload, train loading, unloading and the various EDI streams that support U.S. Customs and export ship slot bookings. The third layer involves specialty and off-the-shelf systems—like gate systems, reservation systems, RFID systems, GPS systems, etc. This project deals with the second and third layer of this hierarchy. Automated terminals have an advantage when it comes to optimizing the benefits of a TRS. The technology allows the equipment to be employed during idle times in a role to move containers to better positions at virtually no cost. That means once the reservations are made, it's possible for the TOS to move the containers to better positions to support the delivery demands of the known reservation list related to the next day. The TOS logic for improving the after-hours optimization (housekeeping) must be advanced beyond its current level of capability to improve its effectiveness. This will entail a co-development sub-project working with the TOS supplier (Navis).

One of the biggest concerns related to broad deployment of mandatory truck reservations is the lack of certainty in planning the second or third visit a truck makes to the terminal in a given day. The current deployment in NY/NJ, for instance, covers the first four hours of the day. This is easier to make work properly because a truck driver has all night to make sure he/she is at the terminal for that first time slot. Once the driver leaves the terminal having completed the first move of the day, there are a number of factors that can impact the reliability of predicting the proper time for a second, third or fourth move. Very short moves to a local warehouse or container storage lot are pretty easy. In fact, there are NY/NJ truckers who are managing to do three moves in four hours with the current level of TRS deployment (first four hours of the day). But it's much harder for a mission that may involve 70 miles of travel to predict the time slot for the second (or beyond) move. We have started discussions with the Old Dominion University VMASC in an attempt to create a scientific approach to the policy-making related to TRS time slot flexibility. The traffic and simulation modeling will allow us to develop the right flexibility in the rule set. This will take effect immediately but also will be an input to the second-generation system design described below.

The goal of this effort is to create a sharable, scalable solution that is suitable for broad industry use. A point solution limited to Virginia might suit our needs but would be less impactful and beneficial than one that could be used as a model for the entire country, or at least the USEC. The database model development will be best implemented if it involves a community outreach component. We intend to confer with the terminal operators along the USEC to solicit input to the model and architecture we create as part of our project. This would include at a minimum the Port of NY/NJ and Georgia Ports Authority. The needs of different terminal operators will vary based on local requirements. But we are confident that a core set of functions can be identified and shared. At a minimum, we feel our work will serve as a launch point for further development and cooperation. A Federal Maritime Commission (FMC)-approved agreement was signed earlier this year between the port and Georgia Ports Authority to facilitate this type of technology development. The past relationship our team has with the Port of NY/NJ also will help make this cooperation more achievable.

Finally, the lessons learned and progress we make during the project will be of interest to a number of industry groups. We have planned to conduct briefings twice a year related to lessons learned. These will include forums like the Journal of Commerce Port Productivity Conference (held in December in NY/NJ), and the Port Technology Integration Forum (held in the spring in London) or similar conferences. The conference organizers have long sought participation by the project team in their events, so we are confident these avenues of communication will remain available.

Second-Generation Truck Reservation System

Truck reservations are currently a very popular topic in the container terminal literature. There is a growing acceptance for the need to regulate truck access to container terminals. The benefits are numerous and a great many revolve around quality of life (for truckers and people who live near terminals) as well as the environment (less idling truck hours). As with any new technology, the starting point for systems that support truck reservations has been very modest. The focus has been on reliability, ease of use and managing expectations. The needs of the end users are unclear because the users have not been in a position to state their needs. To maintain momentum in the adoption of this new technology, it's necessary for the functionality to advance and serve a broader set of needs. From the outset, when the current system was being deployed in NY/NJ, a shopping list of future functionality items was created. Once the system was implemented, a new set of features has been growing. These relate to usage, accessibility, flexibility and system data sharing to name a few. This portion of the grant request is aimed at funding the effort to capture all or some of these new features and create a solution that extends the state of the art to help maintain the momentum of adoption. We have already discussed engaging with other stakeholders, both to obtain and provide information related to truck reservation systems. The second generation will take that feedback and, through a series of well-defined phases, create a solution that addresses the selected items on the list.

The first step will be to survey the state of the art. That will involve collecting marketplace details on products that are focused on truck flow management technology. There are a number of small businesses that are attempting to provide services and products in this area. Most are doing this without the support of the data sources. There is a tendency to employ big data, random-access techniques to provide systems with inherent accuracy limitations. The data model will address this aspect of the development cycle. As the needs are collected, we plan on conducting a series of reviews with USEC (and some USWC) marine terminals. We will solicit input to help rank the various needs we identify. The needs will be summarized and the ranking shared.

What follows will be a design document that defines the proposed solution to address the needs. The design document will provide the tangible vision of how the next-generation software will run. Included will be a plan to do three releases during the lifecycle of the grant. The number of releases may be adjusted based on experience, but given the plan's development methodology, this number seems reasonable.

Each release cycle will be the same series of steps. Implementation of planned functionality is the primary driver. Fixes related to a previous release is an obvious secondary factor. Once the coding and unit testing are completed the project team will formally test the new release. As that wraps up, it will be deployed to a single terminal to allow users hands-on access. The scope of the installation will be adjusted as we gain more experience. For example, we may well allow the existing system to be used by the majority of users, while a select set use the new feature set. The bugs and issues associated with the release as well as feedback from the test users will be collected and fed into the next release cycle.

As part of the first release, we will create the interface specification for the web service interface and implement the first version. This will be provided to a select group of third-party integrators for evaluation. We anticipate having a BETA trucking company customer lined up to provide real usage feedback on the data-sharing interface.

Part of release two will be the rollout of the cloud-based data subscription concept. The exact details are still to be determined as part of the overall requirements definition phase. But we feel this will be a scalable software-as-a-service facility that will initially hold the port data feeds, but which could be expanded to service other ports as well. This is a pretty ambitious undertaking that requires more analysis and planning.

Finally, as an ongoing task, we will be evaluating the commercialization of the technology developed in the project. This will include determining whether existing service providers can support the new software, or possibly selecting a new company that could continue the development and support. This is a very important step since, by the time the project ends, the port will be heavily invested in the TRS concept. We fully plan to budget for ongoing support but hope to defray ongoing feature development to the commercial marketplace.

Section 1.7 – Challenges to Deployment

There are no anticipated regulatory or legislative challenges associated with the deployment of this project. Of note, there are three potential institutional challenges that are in the process of being mitigated. These challenges will not prevent the implementation of the project.

- International Longshoremen's Association (ILA) — The port is working collaboratively with the ILA to introduce the truck reservations system and the resulting automation of inbound and outbound gates. The concern from ILA is the potential displacement of the gate clerks who are responsible for interfacing with truck drivers and completing missing information. The new technology improves the flow of trucks but there is no anticipated change in manning related to the gate area. In any case, the port is committed to working with ILA to avoid the displacement of these individuals and to reassign them to other positions within the port.

- Acceptance of Truck Reservation System by Private Sector Trucking Companies — The port has a long history of working with the various trucking associations, including TMTA, to develop win-win solutions. The port has held numerous outreach efforts with the TMTA to educate the users on the first-generation reservations system, how to create a reservation and the benefits associated with such a system. The port is committed to continuing the comprehensive outreach program in the Hampton Roads area and expanding it to include the trucking companies and associations servicing RMT and VIP. The concept of Truck Reservations has become more visible across the entire industry during the past 24 months. The successful deployment in New York will significantly contribute to the acceptance in Virginia.

- Industry Acceptance of a Standardized Data Model — This is a somewhat ambitious role and the size and diversity of the logistics chain are the main reason we have identified this as the "initial version". The risk in this area will be mitigated by reaching out to various initiatives that are in underway by various special action groups across the country. We anticipate participating in discussion groups and special interest organizations. The plan is to create a flexible, extensible solution and demonstrate feasibility and efficacy in a real-world setting (i.e. the third largest port on the U.S. East Coast). The success of our project should help drive adoption, even if the final model changes somewhat during that process.

Section 1.8 – System Performance Improvements

System Efficiency

Throughout the country, various TRSs and RFID tag reader systems have been implemented. These systems allow truckers to conduct most administrative tasks online prior to arriving at the terminal, saving significant time. In addition to performing administrative tasks, trucking companies and shippers also can check on container availability, observe vessel schedules, identify any holds that may exist on their containers or schedule truck arrival appointments. Conducting these tasks prior to arriving at the terminal allows for more efficient and balanced truck arrival patterns throughout the day, reduced queue lengths and time spent waiting to enter the terminal—resulting in reduced idling time—and more efficient processing of trucks and containers on-terminal.

Average daily processing time data, on a per-truck basis, was obtained from 2016 at VIG, NIT and PMT, and is summarized in Table 1.8.1. Processing time data is currently not collected at VIP and RMT; therefore, processing times at these two terminals is depicted as "Data Not Available." Lastly, turn time data is the only time data that is collected and available at PMT.

| Trip Step | Step Description | VIG | NIT (minutes/vehicle) | PMT (minutes/vehicle) | VIP (minutes/vehicle) | RMT (minutes/vehicle) |

|---|---|---|---|---|---|---|

| 1 | Time spent at inbound portal and waiting in queue at the gate | 13.8 | 19.7 | Data Not Available | Data Not Available | Data Not Available |

| 2 | Time spent at the gate arm waiting to be dispatched | 4.6 | 4.6 | Data Not Available | Data Not Available | Data Not Available |

| 3 | Time spent being processed inside the terminal |

52.1 | 42.5 | 50.2 | Data Not Available | Data Not Available |

| 4 | Time spent at outbound portal and waiting in queue at the exit gate | 2.9 | 5.1 | Data Not Available | Data Not Available | Data Not Available |

| 5 | Time spent at the exit gate arm waiting to exit | 3.8 | 1.7 | Data Not Available | Data Not Available | Data Not Available |

| TOTAL TRIP TIME | 77.2 | 73.6 | N/A | N/A | N/A | |

After implementing a TRS and RFID technology, time savings are expected during each step of a typical truck trip. Entering the terminal, truck trips incur time checking in at the inbound portal, waiting in queue at the terminal gate and being served/dispatched when it is their turn at the terminal gate (i.e., Trip Step 1 and Trip Step 2 from Table 1.8.1). After implementing a Truck Reservation System and RFID technology, total time for these events is only expected to require approximately 1.5 minutes per truck, which reflects more than a 92 percent time savings per truck at both VIG and NIT.

Within the terminal, conventional turn times (i.e., time required for a truck entering the terminal from the inbound gate to be processed and then arrive at the exiting portal) are expected to decrease to approximately 20 minutes per truck after implementing a TRS and RFID technology. This reflects an approximate 50–60 percent time savings per truck at VIG, NIT and PMT. This time savings is recognized since trucks are made aware of the location of their container in advance of their arrival and containers are prepositioned in the storage area such that minimal container movements are needed once the trucks arrive.

Time savings also are expected during Trip Step 4 and Trip Step 5, but for different reasons. Time incurred during Trip Step 4 at NIT will be reduced when a new gate complex comes online in late June 2017, approximately doubling the existing processing capacity. Additionally, at VIG and NIT, the balancing of truck access on terminal will reduce times incurred during the exit process. After implementing a TRS and RFID technology, it is anticipated that Trip Step 4 will only require 0.5 minutes per truck at each facility. Lastly, during Trip Step 5, it is anticipated that software upgrades at the VIG exit gate will result in similar processing times as those currently being observed at NIT (i.e., approximately 1.7 minutes per truck). This reflects an approximate 55 percent reduction in time that is currently being incurred during Trip Step 5 at VIG.

The proposed project will assist in balancing and improving truck arrival patterns, primarily by reducing the number of peak hour arrivals and spreading them to other periods of the day where terminal capacity is available. This improvement will reduce the potential number of trucks dwelling within the terminal and, therefore, the number of potential conflicts where a crash can occur.

Pedestrian safety is another area that is of concern within the Landside Transfer Zone. VIG proactively addresses pedestrian safety by using a Risk Score system. The Risk Score system provides a numeric score for existing pedestrian safety concerns based on the potential frequency of the event (e.g., event happens once per day, once per month, several times per day, etc.), the number of pedestrians potentially exposed (e.g., less than five people, 100 or more people, etc.), and potential severity that could result during an incident. Any resulting Risk Score greater than 400 is identified as "intolerable" and must be addressed.

Because of truck drivers leaving their cab while dwelling within the Landside Transfer Zone, VIG has a Risk Score of 900. VIG considers four separate categories of potential countermeasures to address high Risk Scores, such as the example of truck drivers leaving their cab within the Landside Transfer Zone:

- PPE Control: This category includes implementing personal protective measures such as high-visibility vests (10 percent reduction in Risk Score)

- Administrative Control: This category includes developing policy and enforcing the policy by issuing citations to violators (40 percent reduction in Risk Score)

- Engineering Control: This category includes engineered infrastructure or programs which can be constructed and/or implemented on terminal (70 percent reduction in Risk Score)

- Elimination/Substitution: This category includes eliminating the event from occurring, resulting in a 100 percent reduction in Risk Score

To address safety concerns associated with dwelling truck drivers leaving their trucks, VIG developed a policy that is enforced by issuing citations to violating drivers:

"Drivers may not walk in traffic and must stay in their truck while waiting to back into a slot and may not stand/walk within 25 feet behind vehicle moving in reverse."

Several citations have been issued since implementation. The proposed truck reservation system will provide an additional countermeasure for reducing the risk of an incident from occurring. The proposed project will efficiently manage truck arrivals throughout the day such that a significant number of trucks would not dwell on the terminal. With trucks not having to wait extended periods of time to be served, the opportunity for a driver to leave their truck is greatly reduced.

Section 1.9 – Safety, Mobility and Environmental Benefit Projections

The following section summarizes safety, traffic operations and air quality improvements that are anticipated to result from the implementation of the Truck Reservation System Expansion and Automated Work Flow Data Model.

Safety Benefits on Terminal

The proposed project will reduce the likelihood of trucks needing to dwell on-terminal waiting to be served. Prior to implementing a truck driver safety policy, the Risk Score system had a Risk Score of 900 assigned at VIG when dwelling truck drivers were leaving their trucks in the Landside Transfer Zone. To address truck drivers leaving their trucks, VIG developed a policy that is enforced through issuing citations to violating drivers. This countermeasure was an example of an "Administrative Control" countermeasure, which resulted in a revised Risk Score of 560 (a 40 percent reduction of 900). However, the Risk Score remains above 400, requiring additional attention. The proposed TRS would be considered an "Engineering Control" countermeasure, and would further reduce the 560 Risk Score by 70 percent, resulting in a new Risk Score of 168. The revised Risk Score would no longer be "intolerable" and would not require additional immediate attention.

Traffic Operation Benefits to Surrounding Roadway Networks

Operating capacity of the processing gates and truck arrival patterns are the two critical factors that determine the magnitude of operational impacts to roadway networks surrounding each terminal. During daily peak truck arrival periods, truck demand exceeds processing gate capacity, resulting in queue lengths that extend onto surrounding roadway networks. Currently, peak truck arrival times occur from approximately 9:00 AM to 12:00 PM. During this period, truck arrivals exceed both gate processing and internal terminal capacity by up to 50 trucks per hour per terminal. It is not until approximately 2:00 PM that gate processing capacity exceeds truck arrival demand, meaning that queuing along the surrounding roadway networks could be sustained for up to two hours.

To regulate the number of trucks dwelling internally at VIG, the facility currently restricts the number of trucks processed at the inbound gate. While this strategy helps to ensure that terminal operations are not over capacity, this strategy results in increased delay and greater queue lengths at the processing gate, which in turn exacerbates operational impacts along the surrounding roadway networks during peak truck arrival periods. In 2015, queue lengths at VIG consistently extended onto an adjacent limited access facility during peak truck arrival times, as illustrated in the photo below.

As a short-term solution, a truck storage area was constructed to contain peak period queue lengths to the surface street network, and reducing the potential for queuing to extend onto the adjacent limited access facility. After 2:00 PM, there is typically available capacity at both the terminal processing gates and internally at the Landside Transfer Zone within each VPA terminal. With the proposed project, scheduled appointments will balance arrivals throughout the day, reducing peak period truck demand that is currently negatively impacting the surface street networks surrounding each of the terminals.

Idling Time Benefits

Other facilities that have implemented a similar truck reservation system have reduced overall truck idling times. As summarized in Section 1.8, the most significant idling time savings are recognized during Trip Step 1 and Trip Step 2 (referred to as "queue time" in this section). Turn time (Trip Step 3) and exit time (Trip Step 4 and Trip Step 5) savings also have been recognized at facilities with similar truck reservation systems implemented and are referred to as "turn time" and "exit time" in this section, respectively.

Anticipated queue, turn and exit time reductions were assumed to be times during which trucks would otherwise remain delayed and therefore idling. As previously summarized in Section 1.8, facilities with similar truck reservation systems have observed significant reductions in queue, turn and exit times. These reductions allow for shorter overall trips and the ability for the VPA terminals to accommodate anticipated future growth. Table 1.9.1 summarizes existing 2016 and projected 2023 annual truck trips at VIG, NIT and PMT. Truck trip data is not provided for VIP or RMT since truck trip data is not available. The forecasted year of 2023 was identified since it was consistent with VPA's Comprehensive Air Emissions Inventory Update, which was used in the air emissions analysis later in this section. Additionally, 2023 occurs after the anticipated opening year for the proposed project (2021).

| VIG (Trucks/Year) | NIT (Trucks/Year) | PMT (Trucks/Year) | TOTAL VIG + NIT + PMT (Trucks/Year) | |

|---|---|---|---|---|

| 2016 Existing Truck Trips | 377,470 | 367,046 | 66,608 | 811,124 |

| 2023 Forecasted Truck Trips | 549,869 | 765,234 | 45,822 | 1,360,925 |

| Change in Trips (Trucks) | +172,399 | +398,188 | (-20,786) | +549,801 |

| Change in Trips (percent) | +45.67 percent | +108.48 percent | (-31.21 percent) | +67.78 percent |

As summarized in Table 1.9.1, it is anticipated that PMT is forecasting approximately 31 percent fewer truck trips in 2023. This is due to PMT being phased out as an active terminal primarily handling containers in the future. PMT will transition into a multipurpose facility for non-containerized and roll-on/roll-off cargo as well as being used as an overflow yard and an empty container storage facility. Across the three facilities, an increase of approximately 550,000 annual truck trips is anticipated in 2023 when compared to 2016.

When estimating potential idling time benefits at VIG, NIT and PMT under 2023 conditions with the proposed project, idling times without the proposed project were conservatively held constant from 2016. Anticipated idling time reductions at VIG, NIT and PMT under 2023 conditions are presented in Table 1.9.2.

| Location | Scenario | Average Processing Time (min/truck) | Total Time Saved** (min/truck) | Forecasted 2023 Truck Volume | ||

|---|---|---|---|---|---|---|

| Queue Time | Turn Time | Exit Time | ||||

| VIG | 2023 without TRS | 18.4 | 52.1 | 6.7 | 53.5 | 549,869 |

| 2023 with TRS* | 1.5 | 20.0 | 2.2 | |||

| Time Savings | 16.9 | 32.1 | 4.5 | |||

| NIT | 2023 without TRS | 24.3 | 42.5 | 6.8 | 49.9 | 765,234 |

| 2023 with TRS* | 1.5 | 20.0 | 2.2 | |||

| Time Savings | 22.8 | 22.5 | 4.6 | |||

| PMT | 2023 without TRS | Data Not Available | 50.2 | Data Not Available | 30.2 | 45,822 |

| 2023 with TRS* | 20.0 | |||||

| 30.2 | ||||||

| Total Time Savings Weighted Average (min/truck) | 50.7 | 1,360,925 | ||||

* Total Time Saved = Queue Time + Turn Time + Exit Time

** Assumes proposed processing times included in Section 1.8

With the proposed project, overall average trip time is expected to decrease by approximately 51 minutes per truck. Conservatively assuming that the overall average trip time of approximately 77 minutes in 2016 is held constant in 2023, the proposed project will reduce overall trip time by approximately 66 percent, more than doubling the number of trucks that can be processed within a typical day. Therefore, the idling time reduction benefit associated with the proposed project will provide additional capacity to the terminals to process the significant increase in forecasted throughput.

Additional idling time reduction benefits will be recognized through fuel cost savings for the trucking companies. A typical truck burns approximately one gallon of diesel fuel for every 60 minutes of time spent idling. Assuming an average idling time savings of 50.7 minutes per trip with the proposed project, an estimated 1,360,925 truck trips forecasted in 2023, and a national average price for diesel fuel of $2.365 per gallon, the proposed truck reservation system could save trucking companies approximately $2.72 million per year in fuel costs.

Air Quality Benefits

Based on the Port of Virginia's 2014 Comprehensive Air Emissions Inventory Update, a reduction in 10 minutes of idling time per truck equates to an approximate 12 percent reduction in total emissions. This means that with the proposed truck reservation system, a weighted average idling time savings of 50.7 minutes per truck would equal up to an approximate 61 percent reduction in total air emissions. Table 1.9.3 summarizes anticipated 2023 air emission forecasts, as obtained from the 2014 Comprehensive Air Emissions Inventory Update, with anticipated emission reductions (in tons per year) resulting from the proposed project. Also included in Table 1.9.3 is the monetized value of the emissions reductions based on USDOT guidance.

| Pollutant | Forecasted 2023 Annual Tons of Emissions from On-Road Trucks | Anticipated Annual Reduction in Pollutant (tons) | Cost per Ton of Pollutant | TOTAL VIG + NIT + PMT (Trucks/Year) | |

|---|---|---|---|---|---|

| 2023 without TRS | 2023 with TRS | ||||

| NOX | 157.3 | 61.3 | 96.0 | $2,000 | $192,000 |

| CO | 40.4 | 15.8 | 24.6 | $21,000 | $516,600 |

| HC | 6.9 | 2.7 | 4.2 | $123,000 | $516,600 |

With the proposed project, it is estimated that up to approximately $1.225 million per year will be

saved in air emission reductions with reduced truck idling times at VIG, NIT and PMT.

Section 1.10 – Vision, Goals and Objectives

The port is a major player in freight delivery on the East Coast, with direct impacts to the regional

and the national economy. With the port moving approximately 60 percent of its containerized

volume via over-the-road trucks, optimizing the efficiency of the turnaround time is paramount to

the port's ability to manage the approximate 68 percent growth in anticipated truck volume during

the next six years alone.

Improving the turnaround time through automation provides direct benefits to the shipping/broker/trucking community and, in turn, the economy as well as providing the port with the ability to keep up with increasing demands. A secondary benefit of reducing turnaround times is improved safety. The port strives for a goal of zero accidents, and the reduced turnaround time will greatly diminish the need for truck drivers to leave their vehicles while on terminal.

Standardization and scalability are two other key objectives for the port. Experiencing a seamless/consistent experience across all of the ports terminals will improve the adoption of the automation by the trucking community in Virginia and neighboring regions. Truck scheduling will not only smooth out the peak demands on the port's facilities, but the neighboring arterials and interstates. To that end, the port intends to reduce truck idling time and air emissions by approximately 61 percent with the associated improvements, and to reduce queuing onto adjacent surface roads by implementing the proposed truck scheduling and RFID automation systems.

The project we are proposing will be a key factor in the realization of a data visibility goal that has been expressed by numerous industry stakeholders including the FMC and BTS Port Performance Working Group. The logistics chain must become better connected. The benefits of just-in-time inventory control and improved logistics management will have a significant impact on the costs U.S. consumers pay for goods. Companies like Amazon and Uber have set the bar high in terms of consumer expectations. It is critical that we take the steps to keep pace with these expectations. Marine terminals are the key factor in the crossroads for global trade all over the world. Our goal is to help the industry take the next vital step. We feel we are unique in our ability to deliver on this promise. We have the motivation (due to our $700 million investment portfolio), the ideas (based on our past experience) and the team to deliver on our promises.

Section 1.11 – Plan for Partnerships

Section 1.2 identified a number of key partnerships that will be required to support the deployment of the TRS Expansion and Automated Work Flow Data Model. The port is committed to working collaboratively with the broad range of stakeholders that use the port and will benefit from this project. These stakeholders include shippers (Walmart, Target and other large volume exporters), customs brokers, VMA, TMTA and the Virginia Trucking Association, railroads serving the port, localities surrounding each of the terminals and the Virginia Department of Transportation (VDOT). Supplier partners will also make a key contribution to this effort. We have the cooperation of Navis (the largest supplier of TOS systems in the world) and Advent Intermodal (the current mark leader in TRS).

As expansion of the RFID and TRS occurs, the port will continue to conduct outreach and training for trucking firms, dispatchers and truckers to educate them on how to use the system and make a reservation. The port has already held webinars and half-day training seminars educating the trucking community in the Hampton Roads area on PRO-PASS and the RFID technology. This outreach effort will be expanded to Richmond and the Front Royal area. In addition to training, the port will seek to gain stakeholder input, through the use of focus groups, on the information to be contained in the Automated Work Flow Data Model. This will allow for the data model to be developed that will provide the needed information in real time to each stakeholder such that informed decisions can be made in a more efficient and timely manner.

The port will continue to foster partnerships through the Hampton Roads Transportation Planning Organization's (HRTPO) Freight Technical Advisory Committee (FTAC), of which its an active member. FTAC will be routinely apprised of the project's progress and its implementation schedule.

Appendix B provides letters of support from key stakeholders.

Section 1.12 – Existing Local and Regional Advanced Transportation Investments

VDOT has made significant statewide investments in its intelligent transportation systems through the deployment of sensors, cameras, changeable message signs and real-time traveler information systems (511 Virginia). In the Hampton Roads Region, the area roadways are monitored 24/7 to detect and respond to incidents and to provide real-time information to motorists. In addition, VDOT and a number of localities have traffic management centers that have entered into cooperative agreements to integrate cameras feeds and sensor data into each other's traffic centers to create a situational awareness of the overall transportation system. VDOT also has recently established data sharing agreements with Google to improve travel information to the motoring public using both entities' user interfaces.

The TRS Expansion project will have access to VDOT's Statewide 511 System that allows truck dispatchers and truck drivers to have real-time travel information to assist with making travel/routing decisions. Using this existing resource will assist truck drivers in making sure they can maintain their appointed reservations and providing advanced notifications of traffic incidents or congestion on primary and backup routes to the ports.

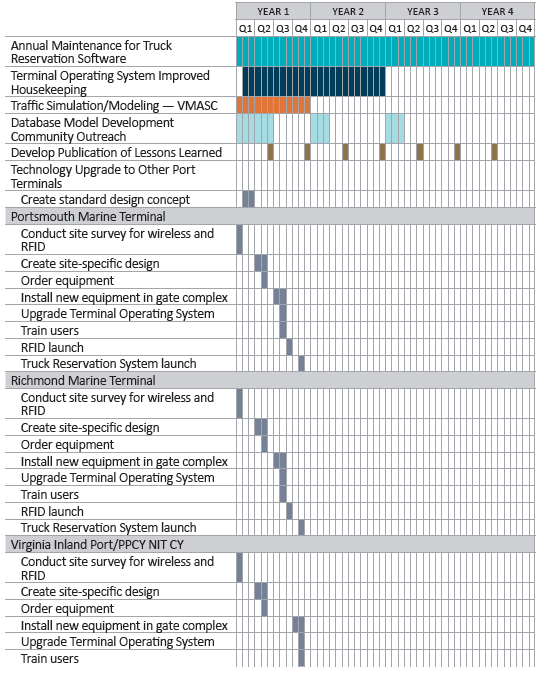

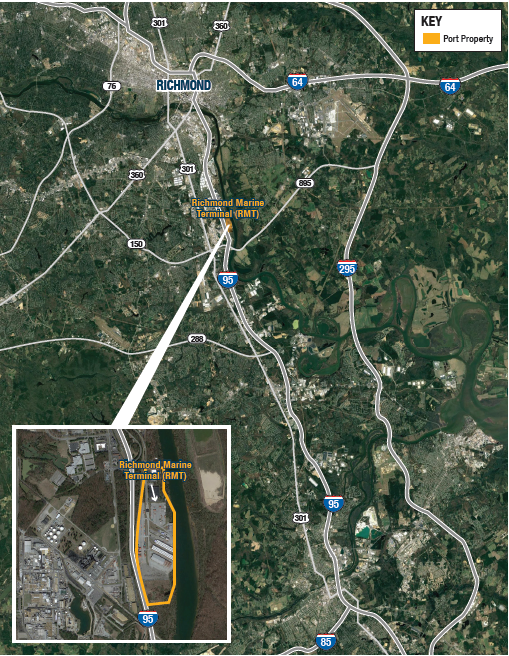

1.13 – Deployment Schedule

Section 1.14 – Supporting USDOT ITS and Technology Programs

USDOT has three key areas that can be leveraged for further benefits under this project: Automation, Enterprise Data and Interoperability. The establishment of a standardized truck reservation system coupled with RFID automation at entry/exit gates across VPA terminals will improve the efficiency of the transfer of containers with the trucking companies and the individual terminals. With the deployment of the RFID technology, the gate terminal operations will be capable of becoming fully automated and paperless. Establishing a standardized data model for real-time status information is consistent with the USDOT's Enterprise Data initiatives by creating efficiencies for extracting available data and data gathered from the RFID automation to quickly distribute to the trucking community and other supply chain stakeholders. Further, by establishing an open standard data model, USDOT can leverage the findings from this project for supporting scalability at other ports across the country.