| Skip

to content |

|

FHWA Operations Support - Port Peak Pricing Program Evaluation2.0 Analysis of the PierPASS OffPeak ProgramThis section presents the results from the work conducted as part of Task 1 of the study, which involved a detailed review of the PierPASS Off-Peak program at the Ports of Los Angeles and Long Beach (San Pedro Bay ports). The work conducted under Task 1 and presented in this section was specifically intended to answer the following key questions about the PierPASS Off-Peak program, which guided the work conducted under the subsequent tasks of the project:

In order to obtain answers to the above questions, this section presents a discussion of the following specific issues related to the Off-Peak program:

2.1 Factors Leading to the Development of the PierPASS OffPeak ProgramA recent study conducted by the METRANS Transportation Center (METRANS) (a joint research center at the University of Southern California and California State University Long Beach) and an evaluation conducted by Cambridge Systematics, Inc. (CS) for the Riverside County Transportation Commission (RCTC) looked at some key operational, community and regulatory issues that set the stage for the development of the PierPASS OffPeak program (Extended Gate Operations at the Ports of Los Angeles and Long Beach, A Preliminary Assessment, April 2007). These issues include the following, and are discussed in detail in the forthcoming sections:

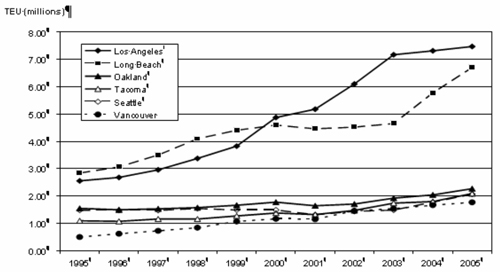

Sustained and Rapid Growth of International TradeAs shown in Figure 2.1, growth in containerized traffic (which accounts for majority of the cargo movements) at the San Pedro Bay ports have exceeded that of any other west coast port in the U.S. This growth can be attributed to many factors, including economies of scale in international shipping through the ports, the large local consumer market in the region, good intermodal rail connections to the U.S. national market, and the availability of large warehousing and distribution facilities and other supporting logistics industries and facilities. It is estimated that warehousing, distribution, and intermodal facilities occupy more than 1.5 billion square feet of space in Southern California currently, with more than 32 million square feet currently in development. Services provided by these facilities account for 15 percent of the total U.S. market and 60 percent on the west coast. The rapid growth in international trade activity has resulted in its increasing visibility within the region. The San Pedro Bay ports together handled 14.2 million Twenty-Foot Equivalent Units (TEU) in 2005, and 15.8 million TEUs in 2006, a growth rate of more than 11 percent in a single year. The ports are projected to continue to maintain their strong position in the future in accounting for a large share of the containerized trade moving through the west coast. The current forecasts predict containerized trade volumes through the ports to triple to 42.5 million TEUs in 2030. The ability of the ports to handle this unprecedented growth in containerized cargo volumes is critical to the continued health of the local, regional, and the national economy. Table 2.1 shows the container traffic forecasts through the ports for 2010, 2020, and 2030. Figure 2.1 Growth in West Coast Port Container Traffic

figure 2.1 - chart - this chart is showing the historic growth in container traffic, from 1995 to 2005, at major west-coast ports in North America, including Los Angeles, Long Beach, Oakland, Tacoma, Seattle, and Vancouver. Along the x-axis are the years from 1995 to 2005. Along the y-axis are the annual container traffic volumes represented in millions of TEUs. The graph shows that the Ports of Los Angeles and Long Beach have experienced significant growth in container traffic from 1995 to 2005, while the growth at other ports has only been relatively marginal. This indicates that the Ports of Los Angeles and Long Beach have experienced significant growth in west-coast container market shares relative to other major ports.

Source: American Association of Port Authorities (AAPA). Table 2.1 San Pedro Bay Ports Containerized Cargo Forecasts

Source: Growth of California Ports – Opportunities and Challenges, A Report to the Legislature, April 2007. Increased Awareness of Port-related Trade ImpactsAs noted earlier, the rapid growth in international trade activity through the San Pedro Bay ports has led to its increasing visibility in the region, in terms of both positive and negative impacts of trade activity to the region as well as other parts of the nation. On the positive side, a recent economic impact study conducted for the ports estimates that the ports are major economic engines supporting more than 886,000 jobs in California directly or indirectly, and generating more than $6.7 billion in state and local tax revenue benefits in 2005 (http://www.acta.org/Releases/018%20REL%20ACTA-Port%20California%20Press%20Release.pdf). Additionally, the economic impacts of international trade through the ports are also felt in other parts of the nation in terms of indirect and induced job impacts and associated tax revenue benefits. However, these positive economic impacts of trade activity come with large external costs that are disproportionately affecting the region, which include congestion (highway, terminal), environmental pollution (air, noise), and other impacts on local quality of life (such as lack of green space, etc.). CongestionInternational containerized trade through the ports generates significant local truck traffic associated with pick-up and drop-off of import and export containers, as well as empty container, bobtail, and chassis truck traffic. It is estimated that the ports currently generate about 35,000 daily container (loaded + empty) truck trips, more than 30 percent of which are loaded container movements. In addition, the ports generate around 20,000 bobtail and 6,000 chassis truck trips daily. An analysis of the time of day distribution of truck trips generated at the ports indicates that the majority of the trips occur in the midday (9:00 a.m. to 3:00 p.m.) time period (58 percent). Morning peak commute-period (6:00 a.m. to 9:00 a.m.) accounts for 13 percent of the trips, while evening peak commute (3:00 p.m. to 6:00 p.m.) and night (6:00 p.m. to 6:00 a.m.) time periods account for 19 percent and 10 percent of the total daily truck trips, respectively. The Multi-County Goods Movement Action Plan (MCGMAP) analyzed the impact of port truck traffic on the I‑710 freeway, which is one of the most important trade corridors in the region. Table 2.2 shows the share of port truck traffic of total truck traffic, as well as share of truck traffic of total traffic on the I‑710 corridor, for 2003. Clearly, port truck traffic accounts for more than 85 percent to 90 percent of total truck traffic on some sections of the freeway. Also, most of the sections of the freeway have truck traffic volumes that are between 14 percent to 17 percent of total traffic volumes, which indicates that truck traffic volumes on the I‑710 might be causing congestion problems and contributing disproportionately to incident related delays compared to other highways in the region with lower shares of truck volumes. Environmental PollutionPerhaps the most serious impact of increased trade through the San Pedro Bay ports is air pollution. A study conducted in 2000 by the South Coast Air Quality Management District (SCAQMD) titled Multiple Air Toxics Exposure Study (MATES-II) identified the emissions from port-related sources as being of major concern for public health in the region (http://www.aqmd.gov/matesiidf/matestoc.htm). This is an important issue in Southern California because the South Coast Air Basin (SCAB), where the San Pedro Bay Ports are located, has some of the worst air quality in the nation. The U.S. Environmental Protection Agency (EPA) has designated the SCAB region as being in nonattainment of the National Ambient Air Quality Standards (NAAQS) for Ozone and Particulate Matter less than 2.5 microns (PM2.5). The concentration of Diesel Particulate Matter (DPM), in particular, which is a primary pollutant from port-related sources due to their reliance on diesel fuel, has become a major public health concern in the region, since more than 70 percent of the potential cancer risk from toxic air contaminants, according to the California Air Resources Board (CARB), can be attributed to DPM.

It was determined that a key solution to addressing truck idling problems at marine terminal gates (and consequently, reducing air pollution from truck idling) was to allow for better utilization of gates through extended hours of gate operations. There is a general agreement in the perceptions of key industry stakeholders on the air quality benefits accruing from the PierPASS extended gate operations program at the ports, particularly resulting from reduced truck idling at terminal gates and within terminal areas. In a survey conducted as part of the METRANS study (the results of which are discussed in more detail in subsequent sections), marine terminal operators (MTO) reported notable reductions in midday congestion (and truck idling) at marine terminal gates and inside the terminals due to the PierPASS OffPeak program. Though they reported exacerbation of gate congestion at specific time periods (such as 5:00 p.m. to 6:00 p.m.), there is perceived to be a net reduction in truck idle times at terminal gates and inside the terminals due to the program, leading to a net reduction in emissions. The results of a December 2006 survey of truck drivers were consistent with this perception, in which drivers reported experiencing reduced congestion at marine terminal gates as a result of the program. An ensuing section provides a discussion on congestion impacts on the I‑710 corridor due to the PierPASS OffPeak program. However, additional analysis is needed to shed light on air quality benefits (if any) accruing to the region from net reductions in truck idle times on the I‑710 corridor due to the PierPASS OffPeak program. Table 2.2 Share of Total and Port Truck Traffic on the I‑710 Corridor

Source: Multi-County Goods Movement Action Plan (MCGMAP). Capacity ConstraintsCapacity constraints at the marine terminals, as seen during the 2004 peak shipping season, were another key factor contributing to the PierPASS OffPeak program. An increase in container volumes of 12 percent in the peak season (contrary to expected growth of around 5 percent) overwhelmed the ports in 2004, and resulted in widespread gridlocks in the international supply chains operating through the ports. The inability of the ports to handle the unexpected growth in container cargo demand clearly pointed to the lack of capacity associated, in particular, with insufficient productivity at the marine terminals. This was seen through the delays in unloading of ships at the terminals, which led to increasing queuing of ships at the harbor, as well as delays associated with processing of containers out of the terminals to the customer locations. According to a Waterfront Coalition report in 2005, the gridlock resulted in an average delay of six to eight days for U.S. shippers, and a diversion of more than 100 vessels to other ports resulting in a major loss of peak season container market share (National Marine Container Transportation System - A Call to Action, Waterfront Coalition, May 2005). Extended gate hours would have a significant impact on terminal productivity, typically under the conditions experienced in the 2004 peak season, by allowing additional capacity to be available per day to process containers out of the terminals. U.S. west coast ports operate at a productivity of around 5,000 TEUs per acre per year, which is significantly less than the productivity of Asian ports that handle more than 16,000 TEUs per acre per year. Operation of single shifts per day at U.S. terminals compared to all day shifts at Asian terminals is a major factor impacting the productivity of U.S. terminals. Also, terminal productivity is expected to be a critical issue in the future as more megaships are deployed in international container trade that can carry more than 10,000 TEUs. Legislative PressuresRegulatory pressures to extending gate operating hours at port marine terminals had been growing for several years. In February 2004, Assembly Bill (AB) 2041 was introduced by Assemblyman Alan Lowenthal requiring extended gate operations, which would also establish a regional governing body, the Port Congestion Management District, as an entity of local government, and authorize a charge for cargo moved at the Ports of LA and Long Beach between the peak hours of 8:00 a.m. and 5:00 p.m. intended to shift truck traffic from day to night-time periods. AB 2041 was opposed by the MTOs, particularly because of the management and control of the fee revenue in the hands of a public authority. The MTOs knew that they will incur additional operating costs associated with extended gate operations (on weeknights and weekends), and realized that if the control of the fee revenue from an extended gate operations program were to be in the hands of a public authority (as was proposed under AB2041), they will have no way of defraying these additional costs. Some other factors that also contributed to the strong opposition from the MTOs towards AB 2041 included the following:

Though factors like rapid growth in container traffic volumes, a growing awareness of the adverse local impacts of trade activity, and the capacity constraints experienced in the 2004 peak season were generating interest in strategies such as extended gate hours at marine terminals to improve productivity and capacity, legislative pressure through AB 2041 was the single most important factor that provided the political cover and impetus for the development and implementation of the PierPASS OffPeak program. As revealed in the survey conducted as part of the METRANS study, the MTOs unanimously believe that the OffPeak program was implemented primarily because of legislative pressure, and not because of concerns (of the MTOs) regarding congestion at the terminals. In the absence of political pressure, competitive conditions between MTOs would have made it difficult for them to come together cooperatively to develop such a program structured primarily on changing their existing business models. The MTOs were able to use antitrust immunity, granted under the Shipping Act of 1984 as amended by the Ocean Shipping Reform Act (OSRA) in 1998, to engage in cooperative discussions (through the West Coast MTO Discussion Agreement) regarding pricing and extended gate operations, and establish the PierPASS OffPeak program as a private sector solution to meet the public policy objectives of AB 2041. Without the provision under the OSRA for antitrust immunity for ports and MTOs, the U.S. antitrust laws would have prevented the MTOs, who are competitors, from coming together to form an agreement to implement a joint port pricing and extended gate operations program at the San Pedro Bay ports. With the agreement that AB 2041 would be dropped if a private sector solution was developed, the MTOs at the ports worked together to come up with an unprecedented approach to develop the PierPASS OffPeak program, more information on which is presented in the following sections. 2.2 Background on the PierPASS OffPeak ProgramThe PierPASS OffPeak program is the off-peak (night and weekend) gate operating hours program created by MTOs at the ports to alleviate truck traffic congestion, and improve air quality in the region. The OffPeak program was launched at the San Pedro Bay ports in July of 2005. The program provides an incentive for cargo owners and their carriers to move cargo at night-time periods and on weekends, as a way of reducing truck traffic during peak day time periods on major highways around the Ports, alleviating Port congestion (for example, at truck gates at marine terminals), and reducing air quality impacts from high peak-period truck traffic volumes. The program is based on a market incentive approach, where all loaded containers entering or exiting the marine terminals at the ports by truck during the day time shifts (Monday through Friday, 3:00 am to 6:00 p.m.) are charged a Traffic Mitigation Fee (TMF). (The original TMF of $40 per TEU was increased to $50 per TEU in April 2006 to cover the higher than expected costs of sustaining the OffPeak program). The Beneficial Cargo Owners (shippers, consignees, or their agents) are responsible for the payment of the fee. Neither the trucking community nor the ocean carriers is assessed a fee under this program. In addition to providing an incentive for the shippers to divert cargo to off-peak time periods, the TMF also serves to defray the additional costs incurred by the MTOs to keep terminal gates open at night and on weekends. Before the implementation of the OffPeak program in July 2005, marine container terminal gates at the San Pedro Bay ports were operating mainly during the day time shift (Monday through Friday between 8:00 a.m. and 5:00 p.m.). Some terminals, however, offered extended gate hours on an “as needed” basis, based on the demands of some high-volume shippers for night or weekend pick-up and/or delivery of containers. Under the OffPeak program, all the marine container terminals at the two ports established off-peak gate shifts, which include four new night shifts per week (Monday through Thursday 6:00 p.m. to 3:00 a.m.) and one new weekend shift (Saturday 8:00 a.m. to 6:00 p.m.). The marine terminal gate operating shifts are dictated by the labor work shifts stipulated under the longshore labor contract between the International Longshore and Warehouse Union (ILWU) and the Pacific Maritime Association (PMA) (The PMA is an association whose member companies include cargo carriers, MTOs and stevedores. The primary business of the PMA is to “negotiate and administer maritime labor agreements with the ILWU”)(http://www.pmanet.org/). Existing longshore labor work shifts (in the current contract that expires July 2008), applicable to longshore labor at all the west coast marine terminals, include a day shift (8:00 a.m. to 5:00 p.m.), a night shift (6:00 p.m. to 3:00 a.m.), and a hoot-owl shift (3:00 a.m. to 8:00 a.m.). Cargo entering or exiting by truck during the off-peak shifts is exempt from the TMF, thus providing incentive for truck drayage operations during these time periods. The program exempts all intermodal containers departing or arriving via the Alameda Corridor from the TMF. Also, there is no fee for empty containers, chassis, or bobtails moving through the terminal gates, since the program assesses the TMF only on the beneficial cargo owners. Bobtails and chassis trucks account for more than 40 percent of the daily truck traffic at the Ports. However, the shifting of loaded truck trips to the off-peak time period due to the program also causes a shift in bobtail and chassis truck trips to the off-peak period because of the direct trip chain linkages between these trips. All the marine terminals at the ports have adopted the same night and weekend operations for improved operational efficiency as part of the program, and the services rendered by the MTOs at the gates during the off-peak shifts are exactly the same as during the day time shifts. The existing longshore labor work shifts at the west coast terminals have had an impact on extended gate operations as part of the OffPeak program. As discussed earlier, current longshore labor work shifts include a day time shift (8:00 a.m. to 5:00 p.m.), a night-time shift (6:00 p.m. to 3:00 a.m.), and a hoot owl shift (3:00 a.m. to 8:00 a.m.). As a result, there is a one-hour window between the close of the day time gate shift, and the opening of the off-peak night shifts. The discussion of the impacts of this on truck operational efficiency is included in a subsequent section. The OffPeak program is administered and managed by PierPASS Inc. PierPASS Inc. is a nonprofit organization created by the MTOs at the ports to collect the TMFs and disburse them to the MTOs. For better management and implementation of the OffPeak program, PierPASS Inc. is subject to an external audit, the results of which are published for the trade community. 2.3 Impacts on Truck Traffic and CongestionThis section presents the impacts of the PierPASS OffPeak program on time-of-day distribution of port gate traffic, as well as on time-of-day patterns of truck traffic on the I‑710 corridor (which is the major highway corridor providing access to the port terminals) before and after the implementation of the OffPeak program. Impacts on Port Gate TrafficThe PierPASS OffPeak program has been a success in terms of exceeding objectives of diverting truck traffic from day time to off-peak (night and weekend) time periods. On its first day of operations, more than 1,000 port users registered for the program, and over 7,500 containers were shipped during nighttime rather than daytime periods. The program was aimed at diverting 15 percent to 20 percent of all cargo movements to off-peak shifts by the end of the first full year of operation, but far exceeded expectations by realizing off-peak diversions of the order of 30 percent to 35 percent at the end of the first full year. More than 2.5 million truck trips had been diverted to the off-peak shifts at the end of the first year of the program, amounting to an average of 11,000 truck moves per day. According to a Journal of Commerce (JoC) article dated May 07, 2007, around 5 million trucks had been diverted to off-peak hours (from the start of the program – July 2005 – to the date of the article), and around 60,000 truck trips in a normal week moved during the off-peak hours. According to data available from the Port of Long Beach for 2005, the OffPeak program led to significant changes in the distribution of port truck traffic moving through the terminal gates during the day, night and weekend time periods. These trends for 2005, before and after the implementation of the program, are shown in Table 2.3. As seen from Table 2.3, the OffPeak program clearly led to an increase in share of truck traffic in the off-peak (night and weekend) periods relative to the day time period. A notable impact of the program was to increase the share of gate truck traffic in the night-time period compared to truck traffic during weekends. Table 2.3 Port of Long Beach Truck Traffic Trends – 2005

Source: Port of Long Beach Transportation Planning. Impacts on Terminal CongestionThis section discusses impacts of the OffPeak program on terminal congestion focusing on the following two issues:

According to interviews of MTOs conducted as part of the METRANS study, the OffPeak program has had a notable impact on truck traffic congestion at the terminal gates. A significant diversion of truck traffic from the day time to the night-time periods has relieved congestion at the gates during the day time. Daytime truck traffic at the gates in 2005 (Table 2.3) reduced from 90 percent to 66 percent due to the implementation of the program, which had a significant impact on reducing day time truck traffic congestion at the gates. However, the effect of this diversion has been an exacerbation of congestion at the gates for certain specific time-periods. MTOs reported occurrence of queuing of trucks at the gates before the start of the night-time gate shift at 6:00 p.m., because of the one hour lag between the end of the daytime shift when the TMF is enforced (5:00 p.m.) and the start of the night-time shift (6:00 p.m.). It was also observed that most of the night-time gate truck traffic occurs during the 6:00 p.m. to 10:00 p.m. off-peak time period in order to avoid delays associated with longshore labor lunch breaks occurring from 10:00 p.m. to 11:00 p.m. As a downside of the concentration of truck traffic before 10:00 p.m., terminal gates see very little truck activity during the 11:00 p.m. to 3:00 a.m. time period, leading to poor utilization of gate capacity and longshore labor after 11:00 p.m. Since the MTOs must staff the gates for the full night-time labor shift, this represents a cost with limited return on investment. There is a general agreement that the OffPeak program has reduced truck traffic congestion within the terminal area. Truck drivers surveyed in December 2006 reported experiencing reduced congestion within the gates of the terminals as a result of the program. This can be attributed to the effect of the program in achieving more even distribution of truck traffic within the terminal and improved utilization of terminal capacity during different times of the day. However, there is also an agreement that there is room for further improvement in terminal capacity utilization and productivity, by achieving more even distribution of truck traffic, especially during the night-time periods, through the use of innovative approaches such as appointment systems, and potential changes in longshore labor work shifts. Impacts on I‑710 Truck TrafficChanges in truck traffic at the terminal gates at the ports are linked with changes in time-of-day distribution of trucking activity on the I‑710 freeway, which is the major highway corridor providing access for trucks moving to and from the marine terminals. This section discusses the impacts of the OffPeak program on time-of-day distribution of truck traffic on the I‑710 corridor using data from the Caltrans vehicle classification count station on the I‑710 freeway north of the Pacific Coast Highway (PCH), a location within a few miles north of most of the terminals. Truck traffic data from this count station by hour-of-day and by truck classes for representative days in February and September 2007 were analyzed and summarized by time of day (6:00 a.m. to 9:00 a.m., 9:00 a.m. to 3:00 p.m., 3:00 p.m. to 7:00 p.m., and 7:00 p.m. to 6:00 a.m.), and compared with truck traffic data for February 2006 and May 2005, to assess changes in time-of-day truck traffic distributions that could be attributed to the OffPeak program, and if there have been any notable trends in these distributions since the implementation of the program. Table 2.4 shows the comparisons of average weekday truck traffic volumes for 5–or-more-axle trucks by time-of-day between May 2005, February 2006, February 2007, and September 2007. The average daily truck traffic volumes at this location in 2005, 2006, and 2007 based on data available from Caltrans, were observed to be 22,390, 23,023, and 24,411 trucks, respectively.Table 2.4a Time-of-Day Truck Traffic Distribution Trends on I‑710 – North of PCH – Northbound

Source: Caltrans. Table 2.4b Time-of-Day Truck Traffic Distribution Trends on I‑710 – North of PCH – Southbound

Source: Caltrans. Some notable trends in time-of-day truck traffic distribution on the I‑710 corridor before and after the implementation of the OffPeak program are discussed below:

Tables 2.5 and 2.6 show the trends in hourly shares of truck traffic on the I‑710 corridor for the day time period between 6:00 a.m. and 8:00 p.m., for the northbound and southbound directions. Table 2.5 Trends in Hourly Truck Volume Shares on I‑710, North of PCH – Southbound

Source: Caltrans. Some notable trends in hourly distribution of southbound truck traffic on the I‑710 corridor are discussed below:

Table 2.6 Trends in Hourly Truck Volume Shares on I‑710, North of PCH – Northbound

Source: Caltrans. The trends in hourly distribution of northbound truck traffic on I‑710 for the 6:00 a.m. to 8:00 p.m. time period are also worth noting, a discussion of which is presented below:

Impacts on I‑710 CongestionA survey conducted by PierPASS Inc. of drayage truck drivers in May 2006 obtained information on truck driver perceptions of reduced congestion during the day time on I‑710. In this survey, drivers perceived reduced congestion during the day time on the I‑710 corridor by a ratio of 10:1. Consistent with the results from this survey, in an earlier survey organized by the California Trucking Association (CTA) in September 2005, 73 percent of drayage truck drivers indicated experiencing an improvement in highway traffic conditions since the launch of the program, and 58 percent being able to accommodate more drayage trips in their work shifts. However, these perceptions do not reflect recent trends in time-of-day truck traffic patterns, especially in the evening peak commute time period, as observed in the data from February and September 2007, which show an increase in truck traffic shares in the evening peak commute time period (5:00 p.m. to 6:00 p.m. from February 2006 to February 2007; and 4:00 p.m. to 5:00 p.m. and 5:00 p.m. to 6:00 p.m. from February 2007 to September 2007). These trends, coupled with the observation that the majority of the truck traffic diversion is occurring from the midday (9:00 a.m. to 3:00 p.m.) time period, indicate that the program could actually be exacerbating congestion on the I‑710 corridor by shifting some of the truck traffic from midday (which is less congested) to the congested evening peak commute time period. The trends for the morning peak commute time period (6:00 a.m. to 9:00 a.m.) look more promising, with the Caltrans count data showing some reduction in truck traffic shares for this time period in September 2007. However, the magnitude of this diversion will need to be higher in order to realize significant congestion reduction benefits in the morning peak period from the OffPeak program (which could be potentially achieved through innovative approaches such as variable pricing). 2.4 Stakeholder Perceptions about PierPASSThe recently completed METRANS study conducted interviews of key industry stakeholders on their perceptions on the PierPASS OffPeak program, which included 11 of the 14 MTOs at the two ports, representatives from PierPASS Inc., the San Pedro Bay ports, representatives of distribution centers/warehouses and governmental officials. The following sections present a summary of the results obtained from these interviews, as well as information obtained from on-line news and journal articles.

2.5 Summary of FindingsThis section summarizes the findings from the work conducted in Task 1 in terms of providing answers to some of the key questions about the PierPASS OffPeak program raised at the outset of this section. These findings are discussed below:

Previous Section | Next Section | Top | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

United States Department of Transportation - Federal Highway Administration |

||